Your Deposit Account Agreement

&

General Terms & Conditions

Electronic Transfers

Funds Availability

Effective February 10, 2025

Member FDIC

TERMS APPLICABLE TO ALL ACCOUNTS

THIS IS AN AGREEMENT

Welcome to U.S. Bank and thank you for opening an account with us. This Agreement provides the general rules that apply to the account(s) you have with U.S. Bank (“us”) described herein. Additional rules will be provided in:

- disclosures we give you when you open your account for example our Consumer Pricing Information, Business Pricing Information and U.S. Bank Business Essentials® Pricing Information disclosure(s) and other fee disclosures (All disclosures can be obtained by stopping in a U.S. Bank branch or for the Consumer Pricing Information only, call 800-872-2657 to request a copy);

- disclosures that are applicable to additional products and services (for example the Digital Services Agreement);

- periodic statements;

- user guides;

- Consumer Privacy Pledge disclosure;

- any appropriate means such as direct mail and notices on or with your statement, including any statements or notices delivered electronically; and

- disclosures we give you about ATM and Debit Card Overdraft Coverage (applicable to certain consumer accounts, refer to the Insufficient Funds and Overdrafts section on page 7 for details).

These things, together, are an agreement between you and U.S. Bank.

Please read this carefully and retain it for future reference. This disclosure is revised periodically, so it may include changes from earlier versions.

By providing a written or electronic signature on a signature card or other agreement or contract, opening, or continuing to hold an account with us, you agree to the most recent version of this Agreement, which is available to you at your local U.S. Bank branch, at www.usbank.com, or by calling U.S. Bank 24-Hour Banking at a number listed on the last page of this disclosure.

This Agreement represents the sole and exclusive agreement between you and us regarding the subject matter described herein and supersedes all previous and contemporaneous oral agreements and understandings. If any terms of your signature card, resolution, or certificate of authority are inconsistent with the terms of this Agreement, the terms of this Agreement will control. Any other variations to this Agreement must be acknowledged by us in writing.

If you have any questions, please call us. Our most commonly used phone numbers are printed on the back of this disclosure.

DEFINITIONS

The following definitions apply in this Agreement except to the extent any term is separately defined for purposes of a specific section.

- The words “we,” “our,” and “us” mean U.S. Bank National Association (“U.S. Bank”). We are a national bank. We are owned by U.S. Bancorp.

- U.S. Bancorp and U.S. Bank own or control other companies, directly and indirectly. The members of this family of companies are our “affiliates.” The words “you” and “your” mean each account owner and anyone else with authority to deposit, withdraw, or exercise control over an account. If there is more than one owner, then these words mean each account owner separately, and all account owners jointly.

- The term “account” means any savings, transaction (for example, checking, NOW Account), and time deposit (for example, certificate of deposit or CD) account or other type of account you have with us, wherever held or maintained.

- An “owner” is one who has the power to deal with an account in his, her or its own name. An “agent,” in contrast, is one whose power to withdraw from an account comes from, or is on behalf of, the owners. Authorized signers, designated corporate officers, trustees, attorneys-in-fact, and convenience signers are examples of agents.

- Entities such as corporations, limited liability companies, partnerships, estates, conservatorships, and trusts are not natural persons, and can only act through agents. In such cases, it is the “entity” that is the owner.

- “Personal accounts” are consumer accounts in the names of natural persons (individuals). They are to be distinguished from “non- personal accounts” which are accounts in the name of businesses, partnerships, trusts and other entities.

- An “account cycle” or “statement cycle” represents the period of time when your statement starts and ends. It’s approximately 30 days long but doesn’t necessarily align with the beginning and end of the month and won’t end on a weekend or holiday.

Except where it is clearly inappropriate, words and phrases used in this document should be interpreted so the singular includes the plural and the plural includes the singular.

PRIVACY

Protecting your privacy is important to us. All information gathered from you in connection with your account relationship will be governed by the provisions of our privacy policies which are available online, within our mobile app(s), or by calling us.

You authorize your wireless carrier to use or disclose information about your wireless account and your wireless device, if available, to us or our service provider for the duration of our relationship, solely to help us identify you or your wireless device and to prevent fraud. See our privacy policies to see how we treat your data.

CELLULAR PHONE CONTACT POLICY

By providing us with a telephone number for a cellular phone or other wireless device, including a number that you later convert to a cellular number, you are expressly consenting to receiving communications—including but not limited to prerecorded or artificial voice message calls, text messages, and calls made by an automatic telephone dialing system—from us and our affiliates and agents at that number. This express consent applies to each such telephone number that you provide to us now or in the future and permits such calls for non- marketing purposes. Calls and messages may incur access fees from your cellular provider.

MONITORING AND RECORDING COMMUNICATIONS

You acknowledge and agree that we, or anyone acting on our behalf, may monitor and/or record any communication between you and us, or anyone acting on our behalf, for quality control and other purposes. You also acknowledge and agree that this monitoring or recording may be done without any further notice to you. The communication that may be monitored or recorded includes telephone calls, cellular or mobile phone calls, electronic mail messages, text messages, instant or live chat, or any other communications in any form.

DEFINITIONS

The following definitions apply in this Agreement except to the extent any term is separately defined for purposes of a specific section.

- The words “we,” “our,” and “us” mean U.S. Bank National Association (“U.S. Bank”). We are a national bank. We are owned by U.S. Bancorp.

- U.S. Bancorp and U.S. Bank own or control other companies, directly and indirectly. The members of this family of companies are our “affiliates.” The words “you” and “your” mean each account owner and anyone else with authority to deposit, withdraw, or exercise control over an account. If there is more than one owner, then these words mean each account owner separately, and all account owners jointly.

- The term “account” means any savings, transaction (for example, checking, NOW Account), and time deposit (for example, certificate of deposit or CD) account or other type of account you have with us, wherever held or maintained.

- An “owner” is one who has the power to deal with an account in his, her or its own name. An “agent,” in contrast, is one whose power to withdraw from an account comes from, or is on behalf of, the owners. Authorized signers, designated corporate officers, trustees, attorneys-in-fact, and convenience signers are examples of agents.

- Entities such as corporations, limited liability companies, partnerships, estates, conservatorships, and trusts are not natural persons, and can only act through agents. In such cases, it is the “entity” that is the owner.

- “Personal accounts” are consumer accounts in the names of natural persons (individuals). They are to be distinguished from “non- personal accounts” which are accounts in the name of businesses, partnerships, trusts and other entities.

- An “account cycle” or “statement cycle” represents the period of time when your statement starts and ends. It’s approximately 30 days long but doesn’t necessarily align with the beginning and end of the month and won’t end on a weekend or holiday.

Except where it is clearly inappropriate, words and phrases used in this document should be interpreted so the singular includes the plural and the plural includes the singular.

PRIVACY

Protecting your privacy is important to us. All information gathered from you in connection with your account relationship will be governed by the provisions of our privacy policies which are available online, within our mobile app(s), or by calling us.

You authorize your wireless carrier to use or disclose information about your wireless account and your wireless device, if available, to us or our service provider for the duration of our relationship, solely to help us identify you or your wireless device and to prevent fraud. See our privacy policies to see how we treat your data.

CELLULAR PHONE CONTACT POLICY

By providing us with a telephone number for a cellular phone or other wireless device, including a number that you later convert to a cellular number, you are expressly consenting to receiving communications—including but not limited to prerecorded or artificial voice message calls, text messages, and calls made by an automatic telephone dialing system—from us and our affiliates and agents at that number. This express consent applies to each such telephone number that you provide to us now or in the future and permits such calls for non- marketing purposes. Calls and messages may incur access fees from your cellular provider.

MONITORING AND RECORDING COMMUNICATIONS

You acknowledge and agree that we, or anyone acting on our behalf, may monitor and/or record any communication between you and us, or anyone acting on our behalf, for quality control and other purposes. You also acknowledge and agree that this monitoring or recording may be done without any further notice to you. The communication that may be monitored or recorded includes telephone calls, cellular or mobile phone calls, electronic mail messages, text messages, instant or live chat, or any other communications in any form.

WAIVERS AND PRECEDENTS

Our Agreement with you gives us rights and duties. If we don’t take advantage of all our rights all the time that does not mean we lose them. For example:

- If we make funds available to you for withdrawal ahead of schedule, that does not mean we have to do it again.

- If we pay a check that is more than your account balance, that does not mean we have to do it again.

APPLICABLE LAW

Unless otherwise stated herein, your account and this Agreement will be governed by federal law and, unless superseded by federal law, by the law of the state in which your account is located. If you opened your account in person, it is located in the state in which you opened it. If you opened your account online, in the U.S. Bank Mobile App or by telephone and you reside in a state in which we have a branch at that time (or reside within 50 miles of a branch), it is located in the state in which the branch is located. If you reside anywhere else, then your Account is located in Minnesota.

CUSTOMER IDENTIFICATION PROGRAM NOTICE (USA PATRIOT ACT)

To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

What this means for you

When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see other identifying documents like a driver’s license or documents showing your existence as a legal entity.

Existing customers

Even if you have been a customer of ours for many years, we may ask you to provide this kind of information and documentation because we may not have collected it from you in the past or we may need to update our records.

Failure to Provide Information

If, for any reason, any owner is unable to provide the information necessary to verify their identity, their account(s) may be blocked or closed, which may result in additional fees assessed to the account(s).

OWNER’S AUTHORITY

Each owner of a personal account, or an agent for a non-personal account, acting alone, has the power to perform all the transactions available to the account. For example, each owner or agent can:

- make withdrawals by whatever means are available for the account;

- make deposits by whatever means are allowed for the account;

- obtain and release information about the account;

- sign or authenticate any document in connection with the account (for example, an owner can endorse a check payable to a co-owner for deposit to a joint account);

- give rights to others to access the account (for example, any owner could grant a power of attorney to have access to the account); and

- close the account.

In addition, if you share ownership of an account with someone else (for example, you have a joint or multi-party account), then each of you can endorse items for deposit to the account on behalf of another owner. If there is shared ownership of an account, it is the intention of all owners that each of you has complete and separate access and withdrawal rights to all the funds in the account irrespective of who had deposited the funds in the account.

U.S. Bank makes no warranty or representation as to the suitability of any deposit product outside the United States of America.

AUTHORIZED ACCESS AND POWER OF ATTORNEY

Each owner of your account is independently permitted to authorize someone else to access your account. For example, the following persons will have access to your account:

- Any person listed on a signature card, resolution, or certificate of authority as being authorized to make withdrawals or transfers, by check or otherwise, from your account;

- Any person that you authorize to make withdrawals or transfers from the account by whatever means the account allows (for example, pre-authorized withdrawals, wire transfers, ATM card, or debit card transactions);

- Any person you give rights to act on your behalf, such as a power of attorney;

- Any person to whom you make your checkbook or your checking account number available for purposes of transacting business on the account. We discourage this type of “authorization” because it is possible that we will detect such transactions and treat them as unauthorized. If you give any such person “authority,” we are not responsible whether we honor the transactions or dishonor them; and

- Any person to whom you make your ATM card or debit card personal identification number (PIN) available. Although we discourage this practice, by allowing this type of “authorization,” the person to whom you make your personal identification number (PIN) available may be able to access all of your accounts held with us by using the telephone, ATM, online or other banking access channels. If you give any person such “authority,” we are not responsible for actions they take with respect to your accounts.

We will use the word “agent” to mean any person who you authorize to act on your behalf, whether by following the process we require (for example, by designating an authorized signer on a signature card), or on your own (for example, by creating a power of attorney). If you name such an agent:

- we may require that you use forms we approve and require each owner to sign the form to be effective;

- the powers you give to your agent, and any limitations on those powers, are between you and your agent, even if we have express written notice of those powers. You understand and agree that we have no duty or responsibility to monitor the acts of your agent or ensure that the acts of your agent are for your benefit. For example, if you only give your agent authority to pay your bills and your agent exceeds that authority, we are not responsible for that breach of authority;

- you agree not to hold us responsible for any loss or damage you incur as a result of us following instructions given to us by your agent;

- the owners of the account are responsible to us for any actions of your agent, regardless of whether those actions exceed the authority given or whether the agent is appointed by all the owners or less than all the owners;

- the agency will end if the owner dies and we have actual knowledge of that death, or if there is more than one owner, the agency will end after the death of the last owner and we have actual knowledge of that death and, in either case, once we’ve had reasonable opportunity to act on it;

- the agency will end after the owner notifies us in writing to end the agency and we have had a reasonable opportunity to act on it; and

- if you authorize any third person, such as a bookkeeping service, an employee, or agent of yours to retain possession of or prepare items, you agree to assume full responsibility for any errors or wrongdoing performed or caused by such third person or any of its agents or employees if we should pay any such item.

YOU CANNOT TRANSFER AN ACCOUNT

You may not transfer an account to someone else without our express written permission. This does not limit your right to access your account by any permissible means.

CHANGE IN AUTHORIZED SIGNERS

Any owner, including one of the owners of a joint account, may add owners or authorized signers to an account; however, we have the right to require the signature of all owners to make the change. Only under special circumstances and subject to prior approval by us may an owner remove another owner or authorized signer from an account.

No change in owners or authorized signers is effective until we have received written notice of the change and have had adequate time to approve and act on it.

ADJUSTMENTS

If we (or you, or you and us together) make an error on your account, we can fix the error without first notifying you. For example, if:

- the dollar amount of your check is paid for the incorrect amount;

- a deposit is added incorrectly;

- we apply a deposit to the wrong account;

we can fix the error without any special notice to you, though such a correction will normally appear on your statement if the error and the correction occur on different business days.

For accounts coded as Consumer and Business accounts, we may not adjust for insignificant errors unless you request it. For all other account types including Corporate and Commercial accounts, we may not adjust for deposit errors of $50.00 or less unless we have agreed with you to a lower adjustment amount.

RETENTION OF DOCUMENTS

You should retain your copy of deposit receipts and other documents associated with your deposit(s). Should you claim that a deposit was incorrectly credited, we may request a copy of your receipt or other documents associated with your deposits.

LIABILITY FOR CHARGES AND OVERDRAFTS

All account owner(s) are responsible to repay to us any overdraft amount and any overdraft fees charged to an account, no matter which owner caused it or why, subject to rights under the Electronic Fund Transfers Act. That repayment is due immediately, and we will take it from your next deposit or whenever funds become available in your account. If there is more than one owner, each owner is separately, and all owners are jointly, responsible for an overdraft and any account fees. (This means we can collect the total from any owner(s), on any of the owner(s) accounts, but we won’t collect it more than once). For more information on overdrafts please refer to the section titled Insufficient Funds and Overdrafts.

We list the charges that you may incur on your account in separate pricing information disclosures or agreements for your account.

TRANSACTION POSTING ORDER

We reserve the right to decide the order of the items we will pay and which items will be returned (if any). Our posting order may not be the same as the order in which you conducted a transaction and could result in overdraft fees, if you do not have available funds at the time the item is paid. Generally, we post the following three transaction types after the close of each business day in the following order:

- Deposits we receive before the daily cutoff time will be posted before any withdrawals. (Refer to our Cutoff Time and/or Funds Availability section for cutoff time description.)

- Your non-check withdrawals will be posted in date/time order, based on the date and time associated with each transaction. A date and time (if one is available) will be assigned to each transaction based on one of the following: (1) when the transaction was preauthorized (for example a debit card or ATM transaction was approved); or (2) when the transaction was processed by U.S. Bank (for example an ACH, or bill pay transaction for which there is no pre-authorization). If a date and time is not available, these transactions are posted to your account after all transactions with a valid date and time or check number are complete, and posted to your account in order of amount, starting with the lowest transaction amount first (frequently referred to as low-to-high).

- Your checks will be posted in check number order, starting with the lowest number. (For example: on Monday we may receive and post check # 107; on Tuesday we may receive check # 102 and # 105, and those would be posted on Tuesday in the order of lowest check number (e.g., # 102) posting first).

DEPOSITS

When you make a non-cash deposit to your account, we give you credit for that deposit, but that credit is provisional (temporary). If the deposit needs to be collected from another financial institution, we must be paid before the credit becomes final. After a credit is final it may still be reversed if the funds cannot be collected. See the sections titled Returned Deposited Items and Funds Availability. All deposit receipts are issued subject to our count and verification of the items deposited. You should retain your copy of deposit receipts and other documents associated with your deposit(s). Should you claim that a deposit was incorrectly credited, we may request a copy of your receipt or other documents associated with your deposit.

Foreign Currency: Deposits received in a foreign currency, whether by check, foreign currency notes, wire-transfer, or otherwise, must be converted to U.S. dollars prior to being deposited into your account. U.S. Bank will convert your funds at an exchange rate established by U.S. Bank and/or our foreign currency vendor on the business day when such exchange is processed. Currency exchange rates are determined in our sole discretion based on factors such as market conditions and risk, economic and business factors. The exchange rate is an all-in rate which includes our profit, fees, costs, and charges. Currency exchange rates will be applied to these deposits without notice to you. You agree to this procedure and accept our determination of the currency exchange rates.

Foreign currency conversions and verification of foreign currency notes can take time and exchange rates fluctuate at times significantly. Foreign currency notes that are determined to be counterfeit, outdated, or out of circulation will be rejected for conversion and returned to U.S. Bank as unacceptable, and U.S. Bank may reverse any provisional credit made to your account when you deposited such items. You acknowledge and accept all risk that may result from such fluctuations, rejections and returns. Your transaction is a retail transaction. Retail foreign exchange conversion rates are different from the wholesale exchange rates for large transactions between two banks as may be reported in The Wall Street Journal or elsewhere. Exchange rates offered by other banks or shown at other sources (including online sources) may be different from our exchange rates. The exchange rate you are offered may be different from, and likely inferior to, the rate paid by U.S. Bank to acquire the underlying currency. The exchange rate may also be different from a rate offered by U.S. Bank to a different customer, at a different time, for a different transaction amount, or in a different payment channel (checks, wire-transfers, etc.).

U.S. Bank sometimes relies on other financial institutions or vendors in the conversion process. In this event, the conversion and acceptance of notes will be in accordance with the policies and procedures of that bank or vendor and the funds will be converted at the exchange rate determined by that bank or vendor. Any fees or charges assessed by that bank or vendor will be passed on to you. Your final credit will be adjusted to reflect that final exchange rate and acceptance of notes less all fees or charges.

Foreign Checks: Checks and other items drawn off a foreign financial institution, whether negotiable in a foreign currency or in U.S. dollars may require special funds collection processing by us. As a result, funds availability may be delayed. If you deposit such an item, you agree that we may delay funds availability at our discretion until we are satisfied that we have received final payment of the item.

Deposits by Mail: Deposits you send by mail are considered deposited on the business day it arrives at the bank. (See our Funds Availability section.)

Cutoff Time: A deposit made after our daily cutoff time on a business day, or on a day we are not open for all forms of business, will be considered deposited on the next full business day. (Refer to our Funds Availability section for cutoff time description.) The cutoff time applies to all accounts (savings, certificate of deposits, payments, etc.), not just checking accounts.

Endorsement: If you make a deposit to an account and you fail to endorse the item, we may add an endorsement on any item and you will be responsible for the item as if you endorsed it yourself.

We can refuse to accept any item or other type of deposit, for any reason, or no reason, or impose conditions on a deposit. For example, we can treat a deposit as an “inquiry” or take an item for “collection” instead of deposit. We may also decline to accept a large cash deposit or require you to make such a deposit at a location and time of our choosing.

RETURNED DEPOSITED ITEMS

The funds you deposit to your account are subject to normal collection processes even after we make the funds available to you for withdrawal (i.e., the check has “cleared”). If we do not collect the funds, or we need to return the funds, your deposit will be reversed and become your responsibility. Returned items are charged back to your account and a Return Item Advice notice is mailed to the primary account address on file.

For example:

- The deposit amount of the check is recorded incorrectly to your account. The person who wrote the check catches the error, and reports it to their bank, who in turn reports it to us. We would reverse the incorrect portion of the deposit and correct the mistake.

- A check you deposit has a forged endorsement. The person who wrote the check notices the forgery and reports it to their bank, who reports it to us. We would reverse the deposit and collection of the check would become your responsibility.

For business accounts only, there will be one fee posted for the sum of all Returned Deposited Item fees returned within a single transaction as well as applicable overdraft fees if sufficient funds are not in your account to cover your items.

We may withhold the availability of funds represented by a returned deposited check.

CHECK 21

Check processing is getting faster as banks begin to process checks “electronically.” We are required by law to provide the notice in the following section (SUBSTITUTE CHECKS AND YOUR RIGHTS), which explains the differences between your original check (which might not be returned) and a substitute check, and your rights in the event the substitute check causes a loss that would have been avoided if the original check was still available.

SUBSTITUTE CHECKS AND YOUR RIGHTS

What is a substitute check?

To make check processing faster, federal law permits banks to replace original checks with “substitute checks”. These checks are similar in size to original checks with a slightly reduced image of the front and back of the original check. The front of the substitute check states: “This is a legal copy of your check. You can use it the same way you would use the original check.” You may use the substitute check as proof of payment just like the original check.

Some or all of the checks that are returned to you from us may be substitute checks. This notice describes your rights you have when you receive substitute checks from us. The rights in this notice do not apply to original checks, photocopies of original checks, or to electronic debits to your account. However, you have rights under other laws with respect to those transactions.

What are my rights regarding substitute checks?

In certain cases, federal law provides a special procedure that allows you to request a refund for losses you suffer if a substitute check is posted to your account (for example, if you think that we withdrew the wrong amount from your account or that we withdrew money from your account more than once for the same check). The losses you may attempt to recover under this procedure may include the amount that was withdrawn from your account and fees that were charged as a result of the withdrawal (for example, overdraft fees).

The amount of your refund under this procedure is limited to the amount of your loss or the amount of the substitute check, whichever is less. You are also entitled to interest on the amount of your refund if your account is an interest-bearing account. If your loss exceeds the amount of the substitute check, you may be able to recover additional amounts under other law.

If you use this procedure, you may receive up to $2,500.00 of your refund (plus interest, if your account earns interest) within ten business days after we received your claim and the remainder of your refund (plus interest, if your account earns interest) not later than 45 calendar days after we received your claim.

We may reverse the refund (including any interest on the refund) if we later are able to demonstrate that the substitute check was correctly posted to your account.

How do I make a claim for a refund?

If you believe that you have suffered a loss relating to a substitute check that you received and that was posted to your account, please call U.S. Bank 24-Hour Banking (see last page for phone numbers) or write to us at U.S. Bank, 60 Livingston Ave, EP-MN-WS5D, St. Paul, MN 55107. You must contact us within 40 calendar days of the date that we mailed (or otherwise delivered by a means to which you agreed) the substitute check in question or the account statement showing that the substitute check was posted to your account, whichever is later. We will extend this time period if you were not able to make a timely claim because of extenuating circumstances.

Your claim must include:

- a description of why you have suffered a loss (for example, you think the amount withdrawn was incorrect);

- an estimate of the amount of your loss;

- an explanation of why the substitute check you received is insufficient to confirm that you suffered a loss; and

- a copy of the substitute check or identifying information such as the check number and the name of the person to whom you wrote the check.

COPIES OF DOCUMENTS

We do not typically keep the original paper documents (like deposit slips) associated with your account for a long time. We image most of the documents that end up with us and destroy the paper originals. Electronic images is one type of media that is used, but as technology changes, there are and will be other imaging techniques. You agree that such images will be sufficient for all purposes.

See the section titled CHECK 21. To facilitate check imaging and electronic check collection, it is important that you take care with the transactions you create on paper. When completing a check, you must:

- write clearly;

- use black or dark blue ink in the date, pay to, amount, and signature fields; and

- use only the space provided for your part of a transaction. (See the section on ENDORSEMENT STANDARDS.)

You agree to reimburse us for any losses and costs we incur as a result of a poor check image caused by a deficiency in the written check, whether due to your failure to follow these guidelines or otherwise. You also agree to reimburse us for any losses and costs we incur as a result of a poor check image caused by a deficiency in the written check that you accepted and deposited as the payee.

NIGHT DEPOSITORY

If you arrange for night depository services, you must comply with the following two rules and also comply with the rules in any separate night depository agreement.

- Use of Containers. Each deposit placed in the depository must be contained in a sealed envelope, or in a bag or pouch that has been approved or supplied by us. Deposits are only processed to accounts held at U.S. Bank.

- Care. You must take appropriate care when you put the container in our night depository or other facility to make sure the container is received by us.

Our responsibility for the security of the container and the drawer or facility is to use reasonable care. This means we are not automatically liable for just any loss, only for losses that result from our own negligence, only to the extent we caused a loss, and reduced by your contribution to any loss. In legal terms, we are a “bailee” until the point:

- when we open the container and inventory its contents (if that is what we are asked to do); or

- when you sign the receipt for or take custody of the container (if we do not open the container).

CHECKS

Post-Dated Checks. We are not responsible to you if we pay a check before its date, even if we have noticed that it is post-dated. If we, at our option, refuse to pay a check because it is presented before its date, you will have to pay, if applicable, the fee we charge for an overdraft. If you want to be sure we do not cash it before its date, you must stop its payment by following our rules for stop payments in the STOP PAYMENTS section of this Agreement and follow our procedures for revoking a stop payment request.

Stale-Dated Checks. A “stale-dated” check is one that is brought to us for payment more than six months after its date. We may pay, or refuse to pay, a check brought to us (“presented”) more than six months after its date. The general rule is we will pay the check, however we may return the check for insufficient funds. In addition, the check would be subject to an overdraft. If you do not want us to pay a stale-dated check, you must place a stop payment order on the check.

Check Legends. We are not required to honor any legends or memos you put on your checks, even if we are aware of them. By a “legend” or “memo” we mean a message, such as “not valid for more than $50.00” or “do not pay more than ten days after date” or “paid in full”.

Check Forms. Checks are sorted and copied by high speed equipment. If you don’t buy your checks through us, you must get them approved by us or we will not be responsible if your checks do not process correctly. See the section titled COPIES OF DOCUMENTS for additional information on inks and related issues.

Deposits of Checks at ATMs

We reserve the right to refuse to credit your account for ATM deposits of the following items. If an item is refused the item or a substitute check may be returned via mail to the primary account address.

- All the check payees are not listed on the account;

- Checks payable to a business and the business name is not listed on the account. (Checks payable to a business must be deposited into an account that includes the name of the business on the associated account);

- Improperly endorsed (for example, different endorser than payee);

- Restrictive wording (on the deposited item);

- Post-dated (greater than one day after the ATM network business day);

- No date or incomplete date;

- Altered in any way;

- Photocopy of item;

- Not signed by maker;

- Traveler’s check with different counter signature;

- Drawn on a foreign bank;

- Missing the numeric amount and/or the written amount;

- Numeric amount and written amount do not match;

- No payee listed;

- Federal tax refund checks not endorsed by payee or payees; and

- Any other instrument which is not a check or negotiable instrument.

ENDORSEMENT STANDARDS

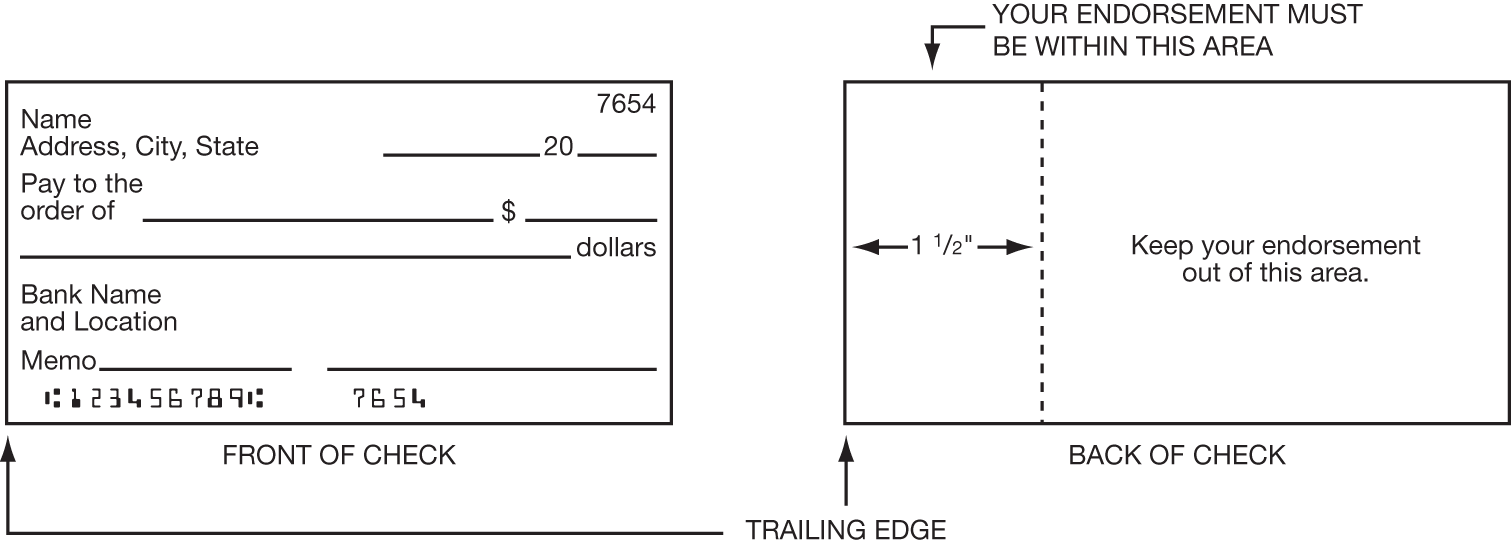

The payee of a check (the person to whom a check is payable) must sign (endorse) the check on the back in the space shown in the picture. If a check is transferred to someone else before it gets deposited or cashed, that person (the transferee) may also be required to sign the check.

Every bank that handles a check on its way to the bank that is asked to pay it also has to identify itself on the back of the check. The space for those banks is to the right of the space shown for the payee and other “holders” (see picture below).

When you endorse a check, you must:

- clearly sign your name;

- use black or dark blue ink if possible;

- never use a faint color, like red, pink or any pastel, or a gel ink (these do not copy well);

- sign near the top of the space provided, or just below any other signature in that space;

- stay out of the area below the space for endorsers (most check forms have a line separating the endorsement area); and

- keep any stamp within the area set aside for handwritten signatures.

The picture on this page shows you the correct endorsement area.

TRAILING EDGE

Why is this important?

If your endorsement of a check, or the endorsement of someone from whom you took the check, either:

- causes a delay in a necessary notice to someone else, or

- prevents someone from being identified quickly enough (and therefore cannot get notice or cannot get it in time).

You will be responsible for the check and the loss that occurs because it is not paid. It will then be up to you to try and recover from someone else who might be liable.

INSUFFICIENT FUNDS AND OVERDRAFTS

“Account Balance” means the funds in your account, including deposits and withdrawals made to date. Not all your transactions will be immediately reflected. As a result, only part of this balance may be available for withdrawal.

“Available Balance” means the amount of money that can be withdrawn at a point in time. The Available Balance will be less than the Account Balance when there are pending transactions such as:

- Funds held from deposits: These funds have been deposited but are not yet fully available for withdrawal or transfer. Once these funds are available, they will be reflected in the Available Balance.

- Funds held for debit card authorizations: This reflects merchant- authorized requests for payment, when the final charge has not been submitted by the merchant. Debit card authorizations will be reflected as pending transactions and/or will reduce your Available Balance from the time we receive the authorization until the merchant presents the item for payment. If the debit card transaction has not been presented for payment within seven business days, it may be removed from your pending transactions and your Available Balance may no longer be reduced by the authorization amount. Once the final charges have been received and processed, they will be reflected in the Available Balance.

- Any other holds on funds in your account.

Note: The Available Balance does not reflect every transaction you have initiated or previously authorized. Items that may not be reflected in your Available Balance include, but are not limited to:

- Outstanding checks and authorized automatic withdrawals (such as recurring debit card transactions, transfers, and ACH transactions that we have not received for payment or processing).

- The final amount of a debit card purchase. For example, we may authorize a purchase amount from a restaurant or a gas station, but the authorized amount may be different from the final charge. Once a final charge has been received and processed, it will be reflected in the Available Balance. (Please refer to “Debit Card Transactions” subsection for more information about how these situations are handled.)

- Scheduled bill payments that have not yet been processed.

- Debit card transactions that have been previously authorized but not sent to us for payment from your account where we have released the transaction authorization hold and the transaction is sent for payment from your account at a later date.

“Insufficient funds” means your Available Balance is insufficient to pay the transactions you are attempting from that account.

Having insufficient funds in your account could lead to returned items, which refers to any withdrawal or transfer that we return because it exceeds your Available Balance on a given day. Examples of withdrawals that could be returned may include any checks, ACH transactions, online or mobile bill payments, or any other debit from your account where we return it because it is for more than the Available Balance you have in your account at the time the transaction is presented to your account. We reserve the right to pay an insufficient funds withdrawal and overdraw your account, which may result in an Overdraft Paid Fee. If we’ve paid insufficient funds items before, we are not required to do it in the future.

“Overdraft” means a transaction has caused the Available Balance on an account to become a negative number. An overdraft can happen, for example:

- by writing a check without enough money in your checking account to pay the check, and we pay the item;

- by making a withdrawal from your account that exceeds your Available Balance;

- by using your U.S. Bank Debit Card for payment without enough money in your checking account to cover the amount authorized or the amount paid to the merchant. If any debit card transaction results in a negative Available Balance at the time it is presented for payment;

- by making a deposit, withdrawing money based on the credit received from that deposit, and then having that deposit reversed because the deposited item is later returned to us unpaid;

- by withdrawing money from your account and not having enough money left to pay any related charges posted to the account;

- when funds are credited to your account in error and you use the funds, and the reversal of the credit results in an overdraft; or

- when fees such as monthly maintenance fees are charged, and you do not have sufficient funds to cover.

Our Options: You do not have the right to withdraw funds that exceed the Available Balance on your account. When an item of yours overdraws an account, we can either pay or return the item. You cannot choose which items we pay or return, except as identified in your selection of “Overdraft Handling” (as identified later).

If we get a batch, or multiple batches, of such items in a day (for example, checks, ATM purchase transactions, and debit card purchase transactions typically come in batches), and if one, some or all of them would overdraw the account if paid, we will post items in accordance with the “Transaction Posting Order” section listed within this Agreement. This may result in processing larger dollar items before smaller dollar items, even though this would have the effect of reducing your Available Balance more quickly.

Our Fees: We charge an Overdraft Paid Fee for each item or transaction we pay that causes the Available Balance to become negative or occurs while the Available Balance is negative on the account. Any Overdraft Paid Fees are deducted from your account on the next business day. See the current pricing information disclosure for information on fees and how fees will be assessed. If you want to avoid the inconvenience and extra expense of overdraft fees, refer to the sections titled “Overdraft Handling” on page 7 and “Overdraft Protection Plans” on page 8 for information.

There are some circumstances that can take your account into a negative balance where we will not charge a fee, for example:

- If certain fees such as your monthly maintenance fee are the only items that resulted in the negative balance.

- If the negative Available Balance is less than our threshold. See your Consumer Pricing Information, Business Pricing Information or U.S. Bank Business Essentials® Pricing Information disclosure(s) for specific information. (All disclosures can be obtained by stopping in a U.S. Bank branch or for the Consumer Pricing Information only, call 800-872-2657 to request a copy.)

Your responsibilities for overdrafts: If you have an overdraft on your account (excluding consumer checking accounts), you must deposit enough money into your account to pay both the overdraft amount and the fees we charge. If you have an overdraft on your consumer checking account only (excluding Safe Debit accounts), please refer to the section titled “U.S. Bank Overdraft Fee Forgiven” on page 8 for more information. If you share ownership of your account with someone else, you are responsible for the overdraft, whether or not you personally caused the overdraft or benefited from it.

OVERDRAFT HANDLING

Consumer Checking and Money Market Accounts:

Most U.S. Bank Consumer checking and money market accounts come with Standard Overdraft Coverage. Under Standard Overdraft Coverage we will authorize and pay overdrafts for these types of transactions at our discretion:

- Checks and other transactions using your checking account number

- Automatic bill payments

- Recurring debit card transactions, for example setting up your debit card to automatically pay a monthly gym membership. We rely on the merchant to inform us if a debit card transaction is a one-time or a recurring transaction.

If we pay these transactions into overdraft, we may charge an Overdraft Paid Fee. See the Consumer Pricing Information disclosure for additional details.

In addition to Standard Overdraft Coverage, you have the following options outlined below.

ATM and Debit Card Overdraft Coverage:

Upon opening your U.S. Bank consumer checking or money market account, or after your account is opened, you have the option to say ‘Yes’ or ‘No’ to ATM and Debit Card Overdraft Coverage.

If you say ‘Yes’

If you choose to say ‘Yes’, you allow U.S. Bank to authorize and pay ATM and everyday debit card transactions (purchases made with your debit card on a day-to-day basis) that may cause the Available Balance in your account to become negative. If this happens and the negative Available Balance is $50.01 or more, we may charge an Overdraft Paid Fee for each item paid greater than $5.00.

If you say ‘No’

If you choose to say ‘No’, you do not allow U.S. Bank to authorize and pay ATM and everyday debit card transactions into a negative Available Balance. If we do not authorize and pay an overdraft your transaction will be declined and you will not be charged a fee.

In limited circumstances, your ATM or everyday debit card transaction may be processed, resulting in your Available Balance becoming negative. These situations may include, but are not limited to:

- A debit card transaction is processed for more than the preauthorized amount. For example, we may authorize a purchase amount from a restaurant or a gas station, but the authorized amount may differ from the final charge (Please refer to “Debit Card Transactions” subsection for more information about how these situations are handled.);

- A debit card transaction that obtained an authorization based on a sufficient Available Balance in your account, but is sent to us for payment later when your Available Balance is no longer sufficient to cover the item;

In these situations, you will not be charged an Overdraft Paid Fee.

If you wish to discuss your options or change your account election at any time, contact a local U.S. Bank branch, call U.S. Bank 24-Hour Banking or visit usbank.com. Please be aware it may take up to three business days to implement your request.

U.S. Bank Overdraft Fee Forgiven

All consumer checking accounts (excluding Safe Debit Accounts) are eligible to have Overdraft Paid Fee(s) waived with qualifying deposits (see below). The Overdraft Fee Forgiven period starts the first day your Available Balance becomes negative and you were charged an Overdraft Paid Fee(s). U.S. Bank will review your account for a fee waiver at 11p.m. ET on the day we charged the Overdraft Paid Fee(s). In the event your Available Balance at the end of the business day is or would be overdrawn by $50.00 or less, we will not charge an Overdraft Paid Fee. If your Available Balance* at 11 p.m. ET is $0 or more, the Overdraft Paid Fee(s) charged will be waived.

*Excluding the Overdraft Paid Fee(s) and including immediate and same day deposits.

If you have Overdraft Protection and your account becomes overdrawn Overdraft Protection funds will be accessed (and applicable fees charged) before the account is eligible for Overdraft Fee Forgiven.

Deposits that generally will qualify for Overdraft Fee Forgiven include:

- ACH and electronic deposits;

- Cash deposits;

- Wire transfers;

- ATM deposits at U.S. Bank ATM;

- Check deposits in branch;

- Internal transfers from another U.S. Bank account.

Deposits that generally will not qualify for Overdraft Fee Forgiven include:

- Mobile check deposit;

- Extended hold placed on a deposit;

- Deposits into new accounts opened less than 30 days where funds are generally made available the fifth business day after the day of your deposit.

Requested Return:

You may ask us to place your account in Requested Return status. When you select this option, you are automatically choosing to say ‘No’ to ATM and Debit Card Overdraft Coverage (refer to If you say ‘No’ for more details). In addition, we will attempt to return items which would result in an overdraft to your account such as checks, and automatic bill pay transactions.

- Note that when you select Requested Return, you may be charged fees by the merchant or service provider.

- Please understand we will not be able to return all items. If we pay an item, for any reason, you will be charged the applicable Overdraft Paid Fee (with the exception of ATM and everyday debit card transactions). These situations include, but are not limited to: recurring debit card transactions when a merchant had obtained an authorization for the first instance, but did not obtain a new authorization for subsequent occurrences (for example, a monthly gym membership); or other transactions/adjustments that may be processed in accordance with our Transaction Posting Order resulting in an insufficient Available Balance (Refer to “Transaction Posting Order” section listed within this Agreement). We rely on the merchant to inform us if a debit card transaction is a one-time or a recurring transaction.

If you wish to select Requested Return, contact a local U.S. Bank branch or call U.S. Bank 24-Hour Banking (see last page for phone numbers). Please be aware it may take up to three business days to implement your request and items may or may not be returned during that time.

Business Options for Checking and Money Market Accounts

For Business Checking and Business Money Market accounts, we will authorize and pay overdrafts for all types of transactions at our discretion. If we pay these transactions into overdraft, we may charge an Overdraft Paid Fee.

Requested Return

You may ask us to place your account in Requested Return status. When choosing this option, we will attempt to return and/or decline items which would result in an overdraft to your account.

- Note that when you select Requested Return, you may be charged fees by the merchant or service provider.

- Please understand we will not be able to return all items. If we pay an item, for any reason, you may be charged an Overdraft Paid Fee.

If you wish to request Requested Return, contact a local U.S. Bank branch or call U.S. Bank 24-Hour Banking (see last page for phone numbers). Please be aware it may take up to three business days to implement your request and items may or may not be returned during that time.

Other sections: While many other sections of this Agreement relate to these issues, these sections are particularly appropriate:

- Setoff (page 16)

- Security Interest in Accounts (page 16)

- Funds Availability: Your Ability to Withdraw Funds - All Accounts (page 18)

- Electronic Fund Transfers for Consumer Customers (page 20)

- Limits on Transfers (page 21)

- Electronic Fund Transfers for Business Customers (page 23)

OVERDRAFT PROTECTION PLANS

Consumer Overdraft Protection

U.S. Bank offers Overdraft Protection Plans to help you avoid the inconvenience of having a check returned, and/or a debit card purchase rejected, resulting in the expense of overdraft fees. These Overdraft Protection Plans allow an eligible account to be linked to a U.S. Bank Personal Checking Account(s) (“checking account(s)”) to cover overdraft situations when the Available Balance is insufficient to cover checks presented for payment and/or Available Balance has been reduced due to pending authorized debit card transactions, as specified in subsection “Debit Card Transactions”.

U.S. Bank lets you choose which eligible accounts are linked to your checking account for Overdraft Protection, and the order in which those accounts are accessed to transfer funds to your checking account. Some eligible accounts (e.g. depository accounts) do not have Overdraft Protection Transfer fees, and if you have deposit and credit accounts linked for Overdraft Protection, the first Overdraft Protection Account determines whether a fee is charged (if any).

You can choose to link up to three eligible U.S. Bank accounts to your personal checking account for Overdraft Protection. Owner(s) who are signers on the checking account must also be signers on the account(s) linked for Overdraft Protection.

Eligible accounts include:

- U.S. Bank Savings Account or Money Market Account

- U.S. Bank Reserve Line of Credit

- U.S. Bank Credit Card

- A secondary U.S. Bank Personal Checking Account

- U.S. Bank Personal Line of Credit

- U.S. Bank Home Equity Line of Credit

- Other U.S. Bank Lines of Credit

If you have linked eligible accounts, and the negative Available Balance in your checking account is or would be overdrawn by $5.01 or more, the advance amount will transfer in multiples of $50.00. If the negative Available Balance is or would be $5.00 or less, the amount advanced will be $5.00. The Overdraft Protection Transfer Fee is waived if the transfer is made from a deposit account or the negative Available Balance in your checking account is $50.00 or less.

If the negative Available Balance in your checking account is caused by monthly fees, such as a maintenance fee or statement/image fee only, overdraft protection will not advance and no Overdraft Protection Transfer Fees will apply. (For example, the account is overdrawn due to a Monthly Maintenance Fee, overdraft protection will not advance. If additional transactions post, overdraft protection will advance to cover the negative Available Balance amount and an Overdraft Protection Transfer Fee may be charged.) If the account linked for Overdraft Protection does not have enough funds to cover the overdrawn amount, the current Available Balance will still be transferred to reduce the overdrawn amount.

If there is more than one account linked for Overdraft Protection and the Available Balance of the first linked account is not enough to cover the overdrawn balance, the next linked account will transfer funds in multiples of $50.00 to cover the remaining overdrawn balance. When multiple accounts are linked as Overdraft Protection, the first account funds are transferred from determines the amount of the Overdraft Protection Transfer Fee (if any).

For each day an Overdraft Protection transfer occurs, a Bank fee will be charged to the checking account that received the transfer. (Refer to the Consumer Pricing Information disclosure Overdraft Protection Transfer Fee for fee amount. This disclosure can be obtained by contacting a U.S. Bank branch or calling 800-872-2657.) While no fee will be charged to your U.S. Bank savings account or secondary checking account, U.S. Bank Reserve Line of Credit, U.S. Bank Credit Card, U.S. Bank Personal Line of Credit, or U.S. Bank Home Equity Line of Credit, for any automated advance to cover an overdraft to your associated deposit account, you will incur an interest charge according to the terms of your agreement governing your credit account. Advances on a U.S. Bank Credit Card Overdraft Protection Plan account are subject to the standard cash advance interest rate, as well as the current cash advance fee. Please refer to your U.S. Bank Reserve Line of Credit, U.S. Bank Credit Card, U.S. Bank Personal Line of Credit or U.S. Bank Home Equity Line of Credit for information regarding interest charges.

When the Bank accesses funds from an eligible line of credit or credit card, these types of transfers may be subject to additional charges such as annual fees. In addition, you may be subject to interest that will accrue on the amounts advanced in accordance with your line of credit or cardmember agreement.

Business Banking Overdraft Protection

U.S. Bank offers Overdraft Protection Plans to help you avoid the inconvenience of having a check returned, and/or a debit card purchase rejected, resulting in the expense of overdraft fees. These Overdraft Protection Plans allow an eligible account to be linked to a U.S. Bank Business Checking Account(s) (“checking account(s)”) to cover overdraft situations when the Available Balance is insufficient to cover checks presented for payment and/or Available Balance has been reduced due to pending authorized debit card transactions, as specified in subsection “Debit Card Transactions”.

U.S. Bank lets you choose which eligible accounts are linked to your checking account for overdraft protection. Only one deposit product and one credit product may link to a business checking account. When the checking account has a linked Business Reserve Line of Credit, the system will automatically draw from that account first, which may incur a fee. If the checking account does not have a linked Business Reserve Line of Credit and has both a credit product and a deposit product linked as overdraft protection, the system will draw from the deposit product first, which will not incur a fee. Funds only draw from the credit product (excluding Business Reserve Line of Credit) if the deposit product has insufficient available funds.

The name of the business on the business checking account must match the name of the business on the business credit overdraft protection plan account. The name(s) of the account signer(s) on the business checking account may also be required to match the account signer(s) on the business Overdraft Protection Plan account.

Eligible accounts include:

- U.S. Bank Business Savings or Money Market Account

- A secondary U.S. Bank Business Checking Account

- U.S. Bank Business Reserve Line of Credit

- U.S. Bank Business Credit Cards

- U.S. Bank Cash Flow Manager or Advantage Line

If you have a U.S. Bank Business Savings, Business Money Market account, or secondary U.S. Bank Business Checking account linked as Overdraft Protection, any automatic advances will be in $200.00 increments made to cover the overdraft. Automated transfers from a U.S. Bank deposit account are not assessed Overdraft Protection Transfer Fees.

If you have a U.S. Bank Business Reserve Line of Credit linked as overdraft protection, any automatic advances will be in $200.00 increments made to cover the overdraft. Please refer to your U.S. Bank Business Reserve Line Agreement for information regarding interest charges.

U.S. Bank Business Credit Card linked as overdraft protection, any automatic advances will be in $25.00 increments made to cover the overdraft. Advances on a U.S. Bank Business Credit Card Overdraft Protection Plan account are subject to the standard cash advance interest rate, as well as the current cash advance fee.

When the Bank accesses funds from an eligible line of credit or credit card, these types of transfers may be subject to additional charges such as annual fees. In addition, you may be subject to interest that will accrue on the amounts advanced in accordance with your line of credit or Cardmember Agreement. Please refer to your Cardmember Agreement for information regarding charges and fees.

Each time an overdraft protection transfer from a Business Reserve Line or a U.S. Bank Business Credit Card automatically transfers funds to the checking account, an Overdraft Protection Transfer Fee (daily fee) applies. The transfer fee amount posts as a separate transaction to the checking account.

Refer to the Business Pricing Information or U.S. Bank Business Essentials® Pricing Information disclosure(s) for current fees. This disclosure can be obtained by stopping in a U.S. Bank branch.

If you have a U.S. Bank Cash Flow Manager linked as overdraft protection, any automatic advances will be in $100.00 increments made to cover the overdraft. While no Overdraft Protection Transfer Fee is charged to the Cash Flow Manager account for any automated advance to cover an overdraft to your associated deposit account, you will incur an interest charge according to the terms of your agreement governing your credit account. Please refer to your U.S. Bank Cash Flow Manager agreement for information regarding interest charges.

If the negative Available Balance is caused by a monthly maintenance fee, service fee or statement/image fee only, overdraft protection will not advance and no Overdraft Protection Transfer Fees will apply. (For example, the account is overdrawn due to a Monthly Maintenance fee, overdraft protection will not advance. If additional transactions post, overdraft protection will advance to cover the negative Available Balance amount and an Overdraft Protection Transfer Fee may be charged.) If the account linked for Overdraft Protection does not have enough funds to cover the incremental amounts listed above, the current Available Balance will still be transferred to reduce the overdrawn amount. If there is more than one account linked for Overdraft Protection and the Available Balance of the first linked account is not enough to cover the overdrawn balance, the next linked account will transfer funds in the increments listed in this section. In the event the Available Balance in the second linked account does not have enough funds to cover the incremental amount, the Available Balance will be transferred.

Business Overdraft Protection Agreements

U.S. Bank also offers certain business customers overdraft protection through separate written agreement. The terms of such agreement shall govern those Business Overdraft Protection Plans.

REFUSING PAYMENT ON YOUR CHECKS

You must fill in an amount (in words and numbers) correctly and clearly, and sign your name on checks you write. You should fill in the date and name a payee on your checks. If you don’t name a payee, anyone can cash the check. If you fail to follow these rules, we may refuse to honor your checks.

When a check you write is presented to us by another bank for payment, we will generally accept the endorsements on the check, because if an endorsement is missing or forged, we have rights against the other bank that protect us. When a check of yours comes to us other than through another bank, we might not cash it if we are not comfortable with the endorsements on it or the identity of the person who presents it. This is especially true with an endorsement in the name of a business entity.

We may require anyone who presents a check for payment in person (other than an account owner presenting a check on his or her own account) to:

- pay a fee to cash the check if applicable; and

- give a fingerprint or thumbprint, and identification, as a condition of cashing a check.

If the presenter of the check refuses to comply with these requirements, or complies but later asserts that these requirements infringed on their legal rights, you understand and agree that imposing these requirements will not be considered a “wrongful dishonor” of your checks.

FUNDS TRANSFERS

Unless we have entered into a specific written agreement with you that provides otherwise, payment orders you give to us for the transfer of funds out of the account by wire transfer or otherwise, and payment orders we receive for the transfer of funds into the account, will be governed by this section, subject to rights under the Electronic Fund Transfers Act. In addition, your rights and obligations with respect to a payment order, and our rights and obligations, will be governed by (a) any separate written agreement with us; then (b) this section; and then, to the extent not specified in a separate written agreement or this Agreement; (c) by Article 4A of the Uniform Commercial Code (“UCC4A”) as enacted in the state in which you have your account with us.

We reserve the right to refuse to accept any payment order. Payment orders are accepted when they are executed by us. We may process any payment order request (as well as any amendment or cancellation request concerning a payment order) that we believe is transmitted or authorized by you if we act in compliance with a security procedure agreed upon by you and us. Such payment orders will be deemed effective as if made by you, and you will be obligated to pay the amount of such orders, even though they are not transmitted or authorized by you. Unless we agree on another security procedure, you agree that we may confirm the authenticity and content of a payment order (among other ways) by placing a telephone call to you. If we cannot reach you, or if the payment order is not confirmed or approved in the manner we require, we may refuse to execute the payment order.

YOU AGREE THAT IF A PAYMENT ORDER OR CANCELLATION THEREOF IDENTIFIES THE BENEFICIARY BY BOTH NAME AND AN IDENTIFYING NUMBER, AND THE NAME AND NUMBER IDENTIFY DIFFERENT PERSONS OR ACCOUNT HOLDERS, EXECUTION AND PAYMENT TO THE BENEFICIARY OR CANCELLATION MAY BE MADE SOLELY ON THE BASIS OF THE IDENTIFYING NUMBER. YOU ALSO AGREE THAT IF A PAYMENT ORDER IDENTIFIES AN INTERMEDIARY BANK OR THE BENEFICIARY’S BANK BY BOTH NAME AND AN IDENTIFYING NUMBER AND THE NAME AND NUMBER IDENTIFY DIFFERENT PERSONS, EXECUTION OF THE PAYMENT ORDER BY ANY BANK MAY BE MADE SOLELY ON THE BASIS OF THE IDENTIFYING NUMBER.

If we receive a funds transfer into any account you have with us, we are not required to give you any notice of the receipt of the funds transfer. The funds transfer will appear on your next periodic statement. To confirm the completion of funds transfers, please contact us through U.S. Bank 24-Hour Banking (see last page for phone numbers), usbank.com or the U.S. Bank Mobile App. Prior to the acceptance of an outgoing payment order, the outgoing payment order may be cancelled, but may not be amended or modified, if the beneficiary’s bank is located within the United States of America and the outgoing payment order is to be paid in U.S. dollars. Other outgoing payment orders may not be cancelled, amended or modified. We must receive your cancellation in a reasonable time prior to the time we execute the outgoing payment order. Payment orders sent by Fedwire will be subject to the Federal Reserve’s Regulation J, and payment orders sent via other payment systems will be subject to the rules of those systems. You agree that we may record all telephone conversations and data transmissions received from, made for or made on behalf of you pursuant to or in connection with a payment order.

SUBJECT TO RIGHTS UNDER THE ELECTRONIC FUNDS TRANSFER ACT YOU AGREE THAT ALL ACTIONS AND DISPUTES CONCERNING ANY PAYMENT ORDER, INCLUDING CANCELLATION OR AUTHORIZATION RELATING THERETO, SHALL BE GOVERNED BY UCC4A AND THIS AGREEMENT TO THE FULL EXTENT PERMITTED BY LAW. FOR INFORMATION ON SUBMITTING A DISPUTE REGARDING A PAYMENT ORDER, SEE THE STATEMENTS AND NOTICES SECTION OF THIS AGREEMENT.

If an outgoing payment order in a foreign currency cannot be completed, the exchange rate that will apply to any refund due you will be the exchange rate in effect at the time on the day the refund is made. Additional fees may be deducted from a payment order amount by other banks involved in the funds transfer process.

We may route payment at our own discretion for each outgoing wire transfer. A wire transfer is irrevocable once payment has been transmitted to the beneficiary’s bank. At your request, we may request that the beneficiary’s bank return funds previously transferred. However, you acknowledge that the beneficiary’s bank is under no obligation to comply with this request.

WITHDRAWAL RIGHTS, OWNERSHIP OF ACCOUNT, AND BENEFICIARY DESIGNATION

The following rules govern the ownership and withdrawal rights of deposit accounts with the various titles given to them.

There are two primary issues that these rules control. The first is “withdrawal rights” and the second is “ownership.”

By “withdrawal rights” we mean who has access to the funds in the account for all purposes. These withdrawal rights will control, for example, whose instructions we must follow, whose checks we must pay, and whose withdrawal requests we must honor. These withdrawal rights do not control who actually owns the funds, as between multiple parties to an account.

By “ownership” we generally mean who owns the funds in the account. In particular, by selecting a particular ownership, you are expressing your intention of how and to whom your interest in the funds in the account should pass in the event of your death.

If you create a type of account, you retain the right to change or close the account to the extent of the withdrawal rights you retain in your own name.

We make no representations as to the appropriateness or effectiveness of any particular ownership or beneficiary designations. Our only responsibility is to permit access to the account as provided by the withdrawal rights. You must consult with your own attorney or financial advisor as to whether and how to effect any change in actual ownership of funds in the account.

Individual Account. This is an account in the name of one person. Such an account is also referred to as a “single ownership” account.

Withdrawal Rights. The holder of such an account is the only person who has the right to withdraw from the account, unless we permit the holder to designate an agent or attorney-in-fact to the account.

Ownership. The holder of such an account is presumed to be the owner. Holding such an account, by itself, creates no additional ownership rights nor survivorship rights (nor does such type of ownership create or extinguish any community property rights). In almost all instances this type of account will pass, on the death of the owner, through the estate of the owner. (You must consult your own estate planner to be sure.)

Agents and “Attorneys-in-Fact.” The owner of this type of account can nominate an authorized signer or attorney-in-fact.

Joint Account - With Survivorship. If your account is opened as a joint account, we will treat it as a joint account with right of survivorship unless our account records demonstrate a different type of ownership. This is an account in the names of two or more natural persons, with the following features:

Withdrawal Rights. Each joint tenant has complete and separate access to the funds and withdrawal rights, and each authorizes the other(s) to endorse for deposit any item payable to the joint tenant. Upon the death of any joint tenant, any surviving joint tenant will have complete withdrawal rights to the balance of the account. If there is more than one surviving joint tenant, such survivors remain as joint tenants with right of survivorship with the same withdrawal rights provided in this section.

Each joint tenant reserves the right to change the ownership of the account to the extent of that owner’s withdrawal rights.

Ownership. Each joint tenant is presumed to “own” the funds in proportion to that person’s net contribution to the account. Each joint tenant intends upon his or her death that the funds owned by such person will be owned by the survivor. If there is more than one survivor, the “ownership” of the decedent’s funds will be shared equally with such survivors.

Other Titles. In some states, it is advisable to add either “not as tenancy in common” or “not as a tenancy by the entirety” or both to insure the intention described above.

Agents and “Attorneys-in-Fact.” Any joint tenant can nominate an authorized signer or attorney-in-fact who can hold all the same withdrawal and deposit rights as the authorizing owner, except the authorized signer or attorney-in-fact will not be an owner (a joint tenant).

Joint Account with Survivorship - Arizona. A Joint Account with Survivorship in Arizona has a unique feature that will change the “ownership” rights on the death of one of the joint owners if there is more than one surviving joint tenant and one of the surviving joint tenants is the surviving spouse of the deceased joint tenant.

Withdrawal Rights. This rule will not change the withdrawal rights to the account on the death of a joint tenant; it only affects the actual ownership of the account balance, which will only affect the survivors, and will not affect our responsibilities under the account.

Ownership. If two or more parties survive and one is the surviving spouse of the deceased party, the amount to which the deceased party, immediately before death, was beneficially entitled by law belongs to the surviving spouse. If two or more parties survive and none is the spouse of the decedent, the amount to which the deceased party, immediately before death, was beneficially entitled by law belongs to the surviving parties in equal shares, and augments the proportion to which each surviving party, immediately before the deceased party’s death, was beneficially entitled under law, and the right of survivorship continues between the surviving parties.

Tenancy in Common Accounts. A Tenancy in Common account is another form of joint account without the survivorship feature. A Tenancy in Common account is also in the name of two or more individual owners.

Withdrawal Rights. Each joint tenant has complete and separate access to the funds and withdrawal rights, and each authorizes the other(s) to endorse for deposit any item payable to the joint tenant. Until we receive notice of the death of any joint tenant, any tenant in common will have complete withdrawal rights to the entire account balance.

If more than one tenant in common survives the death of another tenant in common, such survivors remain as tenants in common between them.

Each tenant in common reserves the right to change the ownership of the account to the extent of that owner’s withdrawal rights.

Ownership. Each tenant in common is presumed to “own” the funds in proportion to that person’s net contribution to the account. However, because of the extreme difficulty in determining such proportions over time, you agree that upon the death of one tenant in common, the balance in the account at the time immediately before the death of the tenant in common will be deemed to be owned in equal shares between all tenants in common. After death and our receipt of notice of such death, the decedent’s share will be set aside for the estate of the decedent, and the survivor’s share in the account balance will be at the disposal of the surviving tenant in common.

Other Titles. In some states this account is referred to as Joint Tenancy WITHOUT Right of Survivorship.

Agents and “Attorneys-in-Fact.” Any tenant in common can nominate an authorized signer or attorney-in-fact who can hold all the same withdrawal and deposit rights as the authorizing owner, except the authorized signer or attorney-in-fact will not be an owner (a tenant in common).

Marital Account (Wisconsin). This account is an account established by two persons in Wisconsin who claim to be husband and wife. This account is, for such persons, the same as the Tenancy in Common account described above.

Marital Account with P.O.D. Beneficiaries (Wisconsin). This account is, first, the same as a Wisconsin Marital Account (which is, in turn, the same as a Tenancy in Common account described above).

Withdrawal Rights. During the lives of both parties to the marriage, the withdrawal rights will be the same as for the Marital Account. The beneficiaries have no withdrawal rights until the death of one of the marriage partners.

Ownership. Upon the death of one of the spouses, the surviving spouse owns 50% of the funds on deposit, and the P.O.D. beneficiary named by the deceased party (if that beneficiary is then surviving) owns the other 50%. Each spouse can name his or her own beneficiary.

If there is more than one beneficiary who is named by a party who survives, the shares of those beneficiaries will be equal.

On the death of one of the marriage partners, the account will have to be retitled and beneficiary shares will have to be redeposited or withdrawn.