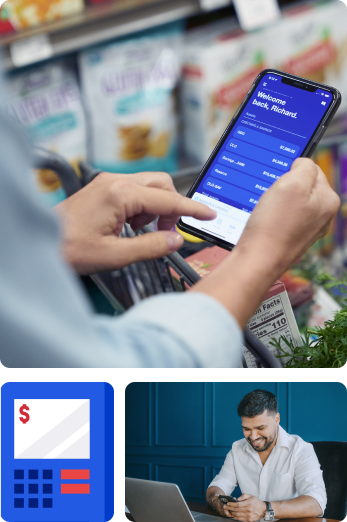

Use the U.S. Bank Mobile App to track your spending categories and set up alerts to monitor your balances.

Take advantage of free credit reporting4 tools to:

- Access the TransUnion® CreditView™ Dashboard.

- See your VantageScore® 3.0 credit score and ranking.

- Use Score Simulator to see what affects your credit score and ways to fix it.

- Find helpful credit education information and resources.

Use our goal planner to help you estimate how much you’ll need for your next passion project, special trip, down payment on a home, or new addition to the family.

Use the Money Tracker tool, along with personalized insights, to monitor your spending across all your accounts as you save for the future.