Limited time offer

Get $100 when you invest in yourself with an IRA from Automated Investor.1

Whether you're just starting out or well on your way, Automated Investor can help you work toward your goals, such as growing your wealth, getting ready for a major purchase or saving for retirement. With automatic rebalancing and human help when you need it, you can stay on track and in control.

Automated Investor is currently only available to existing clients of U.S. Bancorp Investments and its affiliate U.S. Bank. Not a customer yet? We can help you get started - just call 866-758-8655.

To get started with Automated Investor, answer a few simple questions to tell us about your goals, investment preferences and time frame. We'll use this information to select a diversified mix of investments that fits your needs best.

Your portfolio is then put to work, automatically adjusting for market conditions and implementing tax-efficient strategies, such as tax-loss harvesting, with the objective to maximize returns, minimize risk and help you save on taxes.

A tailored approach to your investment mix

Experiment by moving the risk selection slider left or right to see how the investment mix chart changes.

We are experiencing technical difficulties. Please try again later.

You're not alone on your investing journey. We have online resources and human support to help you along the way.

When you want offline help, we're here for you. Wealth professionals are available to provide you with insight and answer any questions you may have about Automated Investor. Call 866-758-8655 to talk with one of our knowledgeable financial professionals.

Start investing toward a financial goal without adding to your to-do list. If you're ready, use one of the buttons here to either begin investing with Automated Investor or explore the other types of investment options we offer.

Get answers to your Automated Investor questions. Start here or view all FAQ.

Consider using Automated Investor if you:

Asset allocation – Based on your goal and risk profile, the robo-advisor will invest your money across a variety of asset classes with various levels of risk and potential return to keep your portfolio diversified.

Automatic portfolio rebalancing – Your account is reviewed by our robo-advisor daily, when U.S. markets are open, to help keep your portfolio in balance with your goal and target date.

Low-cost investments - We invest your money in exchange-traded funds (ETFs), whose fees are typically lower than those for mutual funds. Source: Investopedia, September 2022, “Why are ETF fees lower than mutual funds?”

Tax-loss harvesting - For taxable accounts, we automatically seek to offset taxes on capital gains by selling other investments at a loss. The cash from the sell transactions will be reinvested across your portfolio to help keep your portfolio in balance and on track with your goal.

See our Methodology & Assumptions page for more information on automated investments.

Peace of mind

We invest and manage your money for you. As a fiduciary, it’s our responsibility to make automated investment decisions that are in your best interest.

The strategies behind the smart technology of Automated Investor come from our affiliate U.S. Bank Asset Management Group, that has more than 40 years of experience managing money.

Our always-on automated trading system monitors your investments every business day when U.S. markets are open.

Ease and convenience

Automated Investor is an easy robo-advisor tool to use. You don’t need to have any investing experience or knowledge.

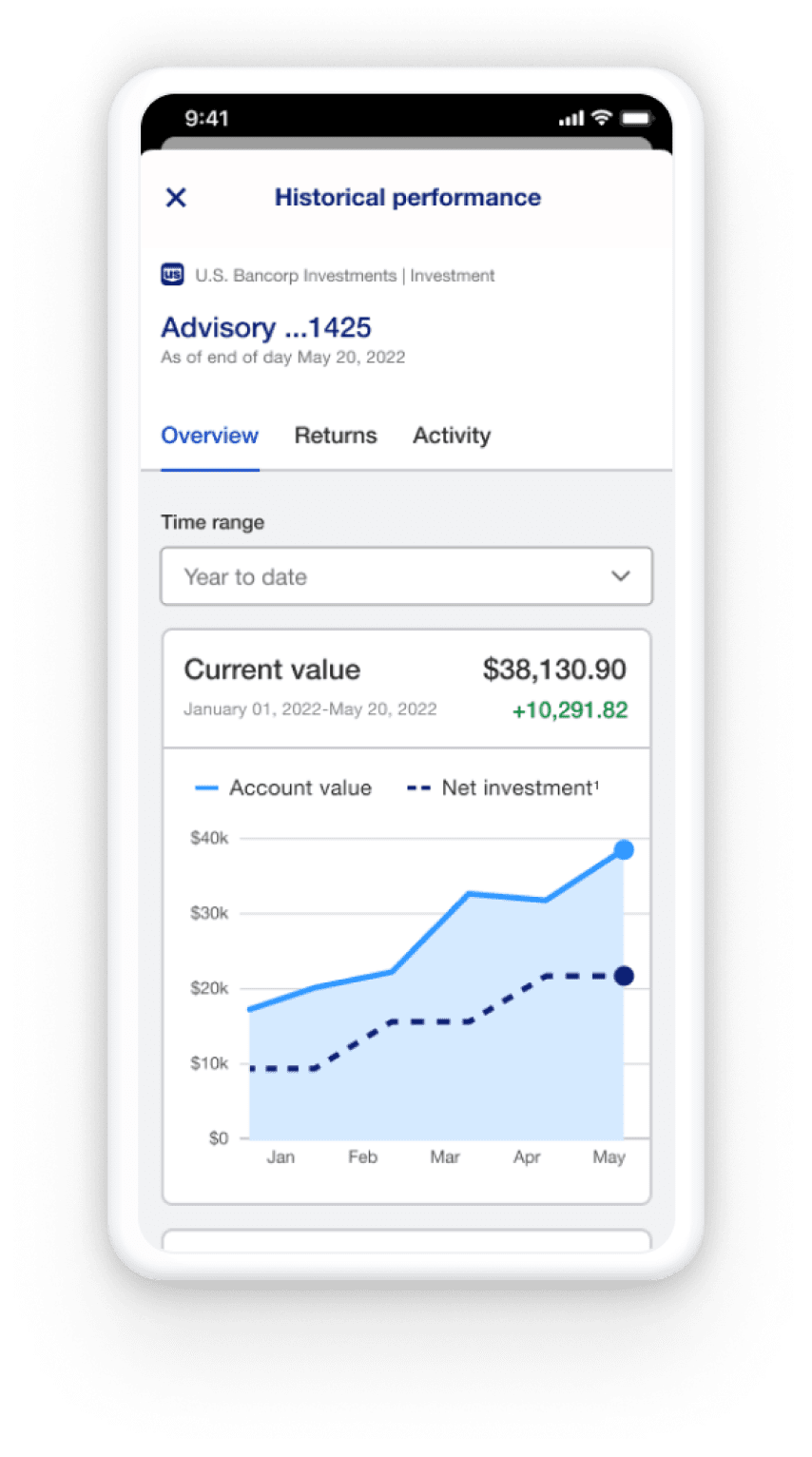

You can track progress toward your goal right on your account dashboard and easily move money between accounts. Access all your accounts together at usbank.com or on any mobile device.

Value and service

Our always-on automated trading system monitors your investments every business day when U.S. markets are open.

Historical gains and losses

Here are examples of the best and worst market returns based on market indices for the past 20 years4

Stocks

Best

Worst

1 month

(4/2020)

(10/2008)

3 months

(ending 5/2009)

(ending 11/2008)

1 year

(ending 3/2021)

(ending 2/2009)

3 years

(ending 2/2012)

(ending 3/2003)

5 years

(ending 2/2014)

(ending 2/2009)

10 years

(ending 2/2019)

(3/2012)

Bonds

Best

Worst

1 month

(12/2008)

(9/2022)

3 months

(ending 1/2009)

(ending 10/2022)

1 year

(ending 10/2001)

(ending 10/2022)

3 years

(ending 5/2003)

(ending 10/2022)

5 years

(ending 7/2012)

(ending 10/2022)

10 years

(ending 6/2016)

(ending 10/2022)

We invest in exchange-traded funds (ETFs). ETFs are SEC-registered and offer investors a way to pool their money in a fund that makes investments in stocks, bonds, other assets or some combination of these investments.

You can learn more about ETFs from the Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA).

You can apply for an Automated Investor account in about 10 minutes.

You’ll answer a few questions about your goal and your comfort with risk. We’ll use this information to show you an investment mix tailored to your goal. Then, complete our brief application and transfer money into your new investment account.

Fund your account from your checking, savings, or brokerage account. If you’re opening an Automated Investor IRA and want to rollover funds from a previous employer, call us and we’ll walk you through the steps.

Once you transfer money to your new automated investment account, we’ll start investing for you, usually on the next business day. You’ll receive a welcome email and you can check your progress on your mobile app or online.

If at any point along the way you have questions or need help, call us at 866-758-8655.

Your Automated Investor account is automatically monitored by our robo-advisor daily when U.S. markets are open.

If you are an existing customer of U.S. Bancorp Investments or our affiliate U.S. Bank who is exploring investment opportunities, there are several different types of robo-advisor accounts that can be opened, including:

Individual accounts

Joint accounts

Traditional IRAs

SEP IRAs

Roth IRAs

Automated investing is a type of investing that is handled by a robo-advisor based on the information provided by an investor. Automated Investor is U.S. Bancorp Investments’ robo-advisor. Like many other robo-advisors, it uses a set of investing rules run by advanced computer software to manage your investments automatically in an investment advisory account.

You provide the robo-advisor information about your investment goals, your comfort with financial risk and when you would like to reach your goal. The robo-advisor will monitor your mix of investments to make trades for you to help keep you on track to your goal.