Enjoy nationwide fleet card acceptance, as well as in Canada and Mexico.

Acceptance with complete, detailed, accurate data for fuel and maintenance services as well as for unexpected expenses such as tolls, parking and repairs.

The Voyager Mastercard works for all fuel-related expenses, so you can rest assured your fleet cards will cover surprises, including repairs and unexpected hotel stays.

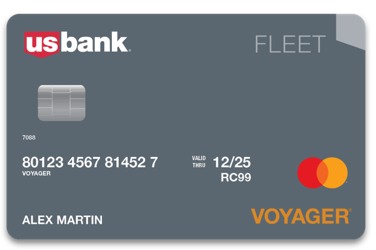

U.S. Bank senior fleet product manager, Michelle Erickson, highlights the U.S. Bank Voyager Mastercard and the many benefits it affords companies with U.S.-based fleets. From dual-network acceptance and cross-border payments to driver and fleet manager peace of mind, all managed on a single platform, the U.S. Bank Voyager Mastercard is an exciting game-changer.

The Voyager Mastercard enables drivers to pay for all fleet-related expenses. And while they are on the road, fleet managers have the visibility to control purchases and minimize risk with advanced fleet management and reporting tools.

Plus, the Voyager Mastercard provides the flexibility needed for your fleet to:

Take charge of fleet costs and enhance productivity with the right card solution for your fleet.

Integrate fuel and maintenance on a single platform to better manage total costs.

Experience the reliability of a nationwide network that works for you and your drivers.

Our secure program management tool gives you unprecedented visibility into your fleet operations.

Accepted on both the Voyager and Mastercard networks, the Voyager Mastercard can be used for approved fleet-related expenses including tolls, parking, repairs, hotel stays and restaurants.

Drivers may either need to go inside the store to complete their transaction or contact Voyager Customer Service at 800-987-6591 for assistance.

The embedded chip stores information required to verify, authorize and process transactions. This is the same type of information that is stored today on the magnetic stripe. Chip cards and chip terminals work together to ensure a highly secure transaction.

Chip cards can help reduce certain types of fraud. The primary benefit of a chip card is a dramatic reduction in counterfeit fraud at chip-enabled point-of-sale systems (also known as “card present fraud”). For drivers, the chip card provides enhanced security for in-person (“card present”) transactions when used with chip card-compatible terminals and a stronger verification method that helps protect account information.

As more gas pumps are being updated to accept EMV chip cards, you may have varying card usage experiences at different fueling locations, even within the same brand. Some will be chip-enabled and others will still rely on magnetic stripes. You should continue to follow pump prompts to begin and complete your fuel purchases.