Your gateway to organizational growth

Explore related insights or solutions.

Key takeaways

Companies now have a billing option that enables billing, payment and settlement within a matter of minutes.

They can reach consumers by sending a Request for Payment (RfP) through the RTP® network.

RfP becomes the next step toward immediate bill payment and a simplified customer experience.

Consumer bill pay has come a long way since the days when most bills were sent and paid by mail, often taking days or weeks to complete. Since then, technology has improved the billing process to include a number of nearly instant options, like online bill pay, pay-by-text and voice payments – all are delivered through convenient, streamlined payment portals.

Yet while these transactions appear to happen instantly, the money movement is still delayed. Settlement can still take hours or even days to complete.

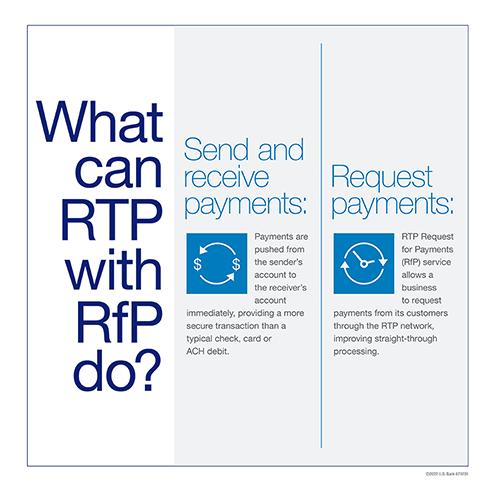

But billers now have an option that enables billing, payment and settlement within a matter of minutes. They can reach consumers by sending a Request for Payment (RfP) through the RTP® network, which allows 24/7/365 access and immediate settlement of funds for bill pay. This creates two-way communication and the ability to send a bill and receive a payment on one payment rail.

New payment rails and new acronyms can be confusing – especially now that The Clearing House (TCH) is enabling something called RfP, which could be easy to confuse with the more commonly used RFP.

This one isn’t a “request for proposal.” It’s a “request for payment,” and it might be the key ingredient that allows businesses to truly leverage the same kind of immediate money movement in consumer-to-business (C2B) bill pay that people have come to expect when transferring money to their friends on easy-to-use apps.

RfP becomes the next step toward immediate payment and a simplified customer experience. C2B payments become easier to manage for businesses and less stressful for customers.

With an immediate bill delivery system, people can act quickly on both sides of a bill. As soon as the biller initiates the request to pay, the consumer can view it through their bank’s bill payment experience. Within seconds, the consumer can take care of the payment and get back to what they’re doing. Or they can future date to pay on the due date.

The settlement is also immediate on both sides. Consumers can make last minute or emergency payments to avoid late charges or service disruptions. Sometimes in online bill pay systems, even though the payment seems instant, the settlement can take time and include paper processes.

A real-time payment is a completely closed loop transaction, which means there are no third parties involved. On this network, a payment is good funds and irrevocable, which can eliminate returned items and overdrafts related to bill payments.

From a childcare payment to a utility bill, a lot of customers are choosing to enable reoccurring ACH payments. This option increases the risk of returned items if the consumer account doesn’t have the funds to cover the transaction. If an ACH payment returns, you can send a second request as an RfP through the RTP network using the information you already have, and the customer can make sure to have funds in the account before they send the payment back.

The real-time payment network is trusted and secure. All the information related to a bill and the resulting payment is available on the network with data-rich messaging. This allows visibility into where the payment is in the process, and it’s backed by a trusted financial institution.

The elephant in the room for payments is all the data. RfP standardizes the information, so the payment details are normalized, applied and transparent in real-time, without relying on the customer to input remittance detail. If ‘matching’ is a recognizable part of a business’s strategy, this process eliminates that need, saving time, energy and resources.

RfP ensures a simplified customer experience, something everyone expects as the world goes more instant. Imagine the impact for customers used to receiving paper bills, then mailing a paper check or calling a company with a credit card number. Instead, the customer can receive notification of a bill in their online banking app and simply click a button to immediately complete the payment.

The enablement of RfP within consumer banking applications provides a different user experience than current online bank bill pay. The biggest advantage for a consumer is they know when the banking application will apply the payment, so they know the real state of the payment. RfP gives speed and certainty.

Financial institutions are also creating unique ways to connect customers to digital payments, which allows consumers to choose how they pay and offers a whole new level of convenience because there’s the ability to choose what works in that moment. The way someone pays might not always be the same based on the circumstances of the transaction.

“The enablement of RfP within consumer banking applications provides a different user experience than current online bank bill pay.”

This bill pay revolution is in the early stages, but there are already several scenarios where billers are seeing the value of RfP. For example, RfP works well for late or urgent payments. It also works well for returned items and is a great alternative to a collection scenario. Overall, RfP could replace current online bank bill pay methods that might seem instant but actually still involve ACH or checks.

Deploying cloud-based ERP or treasury workstation solutions can connect cash flow planning tools with your company’s CRM and sales management systems. And dashboards are a powerful visual tool that provide leaders across the organization with meaningful cash flow metrics that reflect the strategic drivers of diligent cash flow management.

It's not hard to see that receiving payments faster is better. But there’s also a whole other element of time. What about the time it takes to match all the payment information, reconcile data and resolve exceptions?

With RfP and real-time payments, there’s no guessing. The payment happens in real-time. The communication happens in real-time. The settlement happens in real-time.

To learn how real-time payments are changing the way companies do business, visit our instant payments resource page or schedule a call with a treasury management expert.

As faster payment technologies have evolved, businesses continue to identify new ways that instant payments can make a real-time impact.

Send, receive and request immediate payments with an end-to-end payment solution that streamlines the experience for customers, vendors and employees.