You can do this at any time during your draw period – that’s the time between opening the HELOC up until your repayment begins.

What’s a fixed-rate option for a HELOC?

Once you close on a HELOC, you have the option to lock in a fixed interest rate for up to 20 years on some or all of the money you borrow. That way, if interest rates rise in the future, your fixed-rate option(s) won’t.

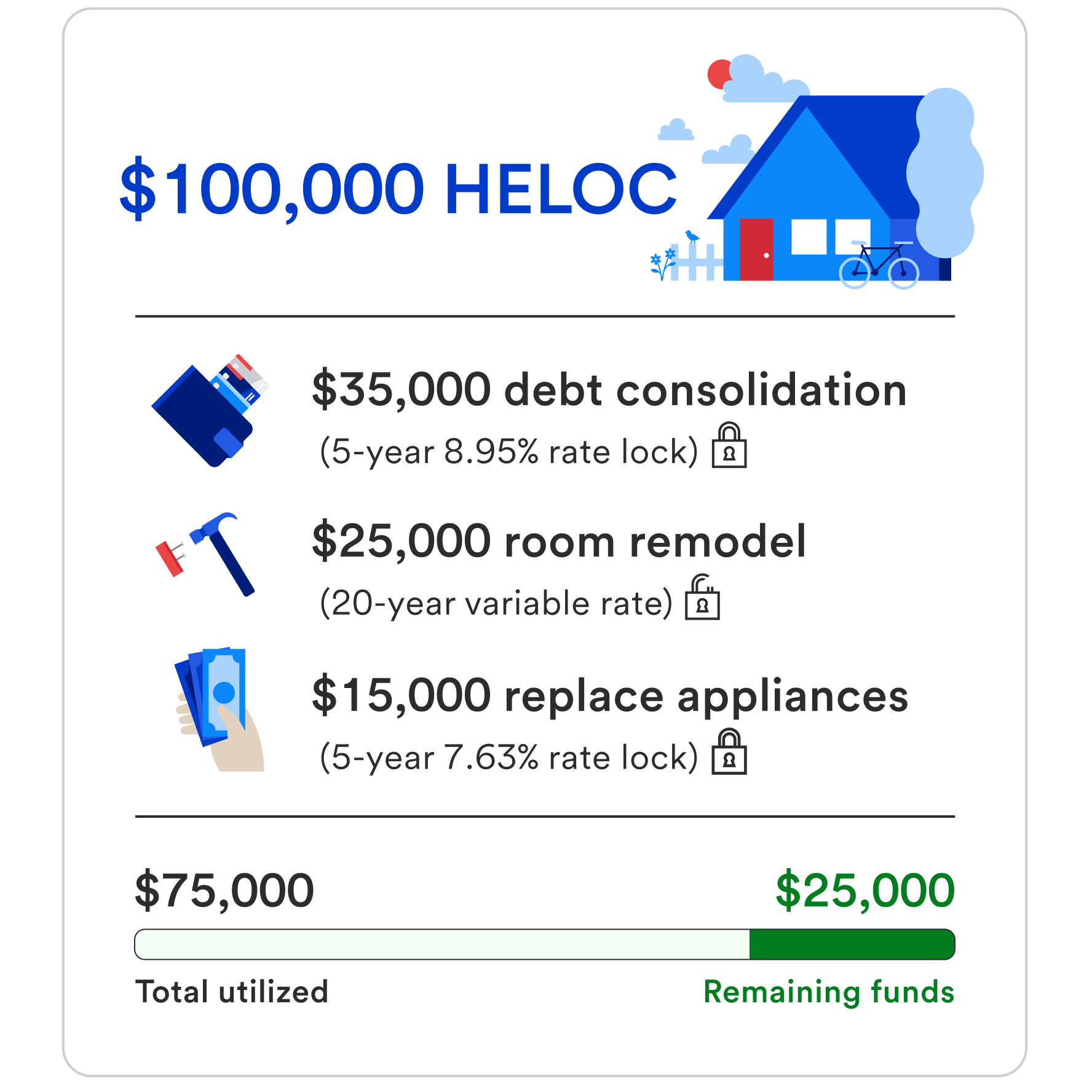

An example of a HELOC with fixed-rate options

- Open a $100,000 HELOC.

- To consolidate your debt, you draw $35,000 and you’re able to lock in a 8.95% APR.

- Next, you choose to remodel a room. Since you aren’t sure how much money you’ll need for the total project, you can’t lock in a rate. You end up drawing $25,000 over time at a variable (or unlocked) rate.

- To finish the room, you need new appliances. Since you know the total will be $15,000, you draw that much from your HELOC and lock in a 7.63% APR.

- You have now utilized $75,000 from your HELOC and have $25,000 available.

All rates shown are for example only.

Don’t have a HELOC yet? Start your application.

The process for getting a HELOC is simple. You’ll need to complete a basic application, submit any requested documentation and, if approved, close at a branch.

Ready to lock in a rate on your existing HELOC?

View our step-by-step guide to lock a fixed rate.

Our U.S. Bank self-service tool makes it even easier to manage your HELOC and lock or unlock rates on your own. Check out this video to learn how.

Step 1

Log in to mobile or online banking.

Step 2

Select your HELOC account.

Step 3

Choose to lock or unlock a fixed rate.

Step 4

Select the amount you want to lock in, along with the term and rate.

Get answers to frequently asked questions about fixed-rate options for a HELOC.

Once your application is approved, you’ll have the option to automatically lock in a portion or the entire balance upon account opening.

No, you can only lock in a fixed-rate option during the 10-year draw period.

Rates will vary based on when you lock in your fixed-rate option. If you have multiple fixed-rate options, it’s possible that they will all have a different rate.

Any portion of the balance that is not converted into a fixed-rate option will continue to have a variable rate and minimum payment in addition to the fixed-rate option payment.

Yes. You can choose to lock in rates for all or part or your balance.

You can select any term between 12 and 240 months.

Yes. As principal is paid down, it becomes available again within the HELOC during the 10-year draw period.

You can make additional principal payments at any time by visiting a branch or contacting 888-664-5200. Making additional principal payments during the draw period increases your available credit.

Fixed-rate option payments are fully amortized over the selected term and include principal and interest, unless otherwise stated at the time of locking the fixed-rate option. Your HELOC monthly statement will breakdown your variable rate payment along with any fixed-rate option payments.

Yes. You can unlock a fixed-rate option and relock at any time during the 10-year draw period.

Yes. You can pay off your fixed-rate option by visiting a branch or contacting 888-664-5200.