Key takeaways

A hedge fund is an investment vehicle that pools money from many individuals and organizations.

Hedge funds invest in a wide range of liquid and illiquid securities and utilize different trading approaches across the various hedge fund strategies.

Since hedge funds are managed differently than traditional investment vehicles, there are unique advantages and risks eligible investors should consider before investing

Hedge funds originated in the 1940s when wealthy investors were looking for ways to generate performance in their portfolios that did not closely correlate with the performance of more traditional investments. And until recently, hedge fund clients were limited to pension plans, large institutions that manage money for individuals or organizations, and clients with millions of dollars to invest.

Today, interest and participation in hedge funds has broadened to include a wider group of individual investors. If you’re considering adding hedge funds to your investment portfolio, it’s important to fully understand hedge funds’ specific structure, risks and potential benefits, as well as the range of available investment strategies.

How hedge funds work

Hedge funds fall under the category of “alternative investments,” as they’re managed in a way that’s different from more traditional types of investment vehicles such as stocks, bonds or mutual funds.1

Hedge fund managers have significant flexibility in how they allocate investment dollars. They can choose to take “long” positions (with expectations that prices will rise) as well as “short” positions (anticipating a decline in value). The flexibility for managers to play “both sides” of a given market, asset category or security allows them to “hedge” their positions in an effort to limit the risk of an investment portfolio.

Along with strategies like purchasing or short-selling securities, hedge fund managers also make use of derivatives, such as options contracts, and can use leverage to expand their investments into particular securities. Leverage involves borrowing money to put additional dollars to work beyond the assets already accumulated in the fund. This is another feature that differentiates hedge funds from many traditional mutual funds.2

Potential benefits of hedge funds

Because hedge funds are managed differently, they have the potential to provide unique features for investors, such as:

- Attractive risk-adjusted returns. Many hedge funds emphasize their ability to generate competitive returns while effectively managing market volatility.

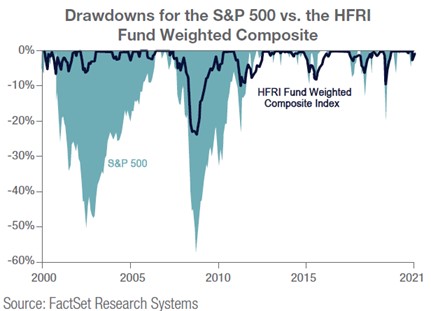

- Diversification benefits in down markets. The HFRI Fund Weighted Composite, a measure of hedge fund performance, shows that as a group over the past 20 years, hedge funds exhibited less declines in periods when the broader stock market, as measured by the S&P 500, experienced more significant declines.

Past performance does not guarantee future results. Returns shown represent results of market indices, are not from actual investments, are not available for direct investment and are shown for ILLUSTRATIVE PURPOSES ONLY.

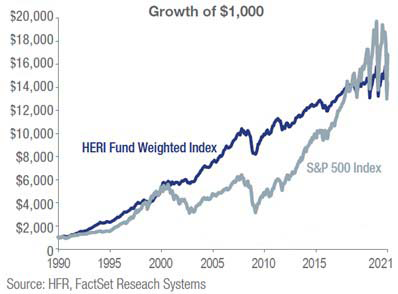

Meanwhile, from 1990 to 2022, a period when traditional stock indices experienced substantial appreciation, hedge funds demonstrated an ability to keep pace with equity markets by managing portfolio risk that mitigated losses, when markets fell precipitously during the dot.com bubble, 2008 financial crisis and COVID-19 correction.

The graph below illustrates the performance of hedge funds as compared to the S&P 500 Index over the past 30 years, which captures each of these market corrections.

Past performance does not guarantee future results. Returns shown represent results of market indices, are not from actual investments, are not available for direct investment and are shown for ILLUSTRATIVE PURPOSES ONLY.

- Variable market exposure. Since there are a wide range of hedge fund strategies, they can be positioned to either capitalize on a strong market (by exposing more than 100% of the portfolio to equities) or protecting the portfolio by holding less than full market exposure.

- Ability to assume significant short positions. Hedge funds regularly use short selling as a way to capitalize on a potential decline in value for a specific security.

- The possibility for upside regardless of market conditions. Hedge fund managers have tremendous flexibility to pursue attractive investment opportunities – during bear and bull markets alike – across security types, economic sectors and geographic regions, using a variety of sophisticated strategies.

Potential downsides of hedge funds

If you’re considering investing in hedge funds, it’s important to understand some of the possible risks that might impact your experience. These include:

- The speculative nature of hedge funds. Because hedge fund managers have a great deal of leeway in how they structure their portfolios, the investment could include more speculative types of investment strategies. Short selling, the use of leverage and derivatives can all add to the risk of an investment even though they’re applied with the intention of moderating risk.

- High fee structure. Hedge funds typically charge both a management fee and performance fee. Management fees are typically between 1 and 2% annually, regardless of performance. In addition, most funds charge performance fees ranging from 15 to 20% of the profit generated by a fund in a given year. The better the fund performs, the greater the expense to the investor.

- Lack of liquidity. Hedge funds are considered a long-term strategy and are generally illiquid. Hedge funds use lockups, withdrawal gates and side pockets to restrict or prohibit investors from moving money out of the fund under certain circumstances. These tools may be used when there is a mismatch between the liquidity offered to clients and the liquidity of a portfolio’s underlying securities due to periods of market stress.

- Complex tax reporting. Money held in a taxable account can be subject to short-term or long-term capital gains or other types of investment taxation. Each year, hedge funds investors receive a form K-1 with tax reporting information. However, in many cases, those forms are not provided before the standard April 15 tax filing deadline, which may require investors to file a tax extension.

- Choosing an appropriate fund. As is the case with other types of funds, hedge funds vary in terms of key objectives and investment strategy. It’s important to identify funds with the investment characteristics that fulfill the needs of your portfolio.

Qualifications to invest in hedge funds

Potential investors must meet eligibility requirements to invest in a specific Fund. A fund may require that the investor meet Accredited Investor, Qualified Client and/or Qualified Purchaser standards to invest. Definitions of standards are provided in the disclosure section.

Alternatively, an entity such as a trust with assets of more than $5 million or an entity where all investors are considered accredited investors can also qualify to invest in a hedge fund.

Selecting from different hedge fund strategies

Hedge funds pursue different investment strategies. Due diligence is a vital part of the selection process. It’s important to seek out hedge funds that demonstrate a solid performance and risk management track record but that also fit your specific investment objectives.

Here are six broad categories of hedge funds:

- Equity hedge. This category is comprised of equity long/short funds and is the most used hedge fund strategy by investors. The fund’s premise is to buy undervalued stocks (long positions) and sell stocks considered to be overvalued (short positions). Such funds are often able to limit volatility compared to its competitive stock index by hedging its positions. These funds tend to maintain a large degree of exposure to broader stock market indices such as the S&P 500, but with the potential for less risk.

- Long/short credit. These funds take long and short positions in the bond market. Much of the return comes in the form of coupon payment generated by the bonds and some from capital appreciation (in long positions) or depreciation (in short positions) depending on changes in a bond’s credit quality. These funds invest across various investment grades, maturities, types of collateralizations and all levels of the capital structure used by a company to finance its operations and growth.

- Event driven. Funds taking positions based on an event or catalyst that is expected to increase the value of the company’s stock or bond price. These can be events like the merger between two companies, a firm spinning out a subsidiary unit, or restructuring a company’s capital structure to improve its financial situation. The event, often referred to as a “special situation,” is key in determining the value of the stock or bond.

- Relative value. A strategy seeking to exploit pricing differences of related financial instruments. They typically have less exposure to stock and bond markets compared to equity hedge and long/short credit strategies. Most of these funds focus on distressed debt and sovereign bonds, along with high yield and investment grade bonds.

- Global macro. Funds having the broadest investment mandate of all hedge fund strategies, with the ability to invest in virtually all asset classes, markets and types of investments. Managers assess the global economic landscape and seek to profit from imbalances or dislocations due to macroeconomic and geopolitical events. Because of the significant leeway managers have in structuring the portfolio, these funds can generate attractive returns during periods of market uncertainty.

- Managed futures. Strategies focused on trading futures and forward contracts on all types of commodities with the objective of generating an uncorrelated return relative to the stock and bond markets. Trading is usually directed by computer-driven algorithms rather than relying on the discretion of the fund manager. The models that result from these algorithms look to identify trends in the market for each specific commodity and take positions based on the expected direction of the commodity price. Managed futures are among the most liquid of the hedge funds available to investors.

Determining if investing in hedge funds is right for you

The potential benefits of investing in hedge funds are significant, but so are the potential risks. Talk with your financial professional and take the time to understand the expected returns, risks and fees associated with investing in a hedge fund to determine if it’s a good fit for your portfolio and investment objectives.

Learn how we approach your long-term investing success.

Based on our strategic approach to creating diversified portfolios, guidelines are in place concerning the construction of portfolios and how investments should be allocated to specific asset classes based on client goals, objectives and tolerance for risk. Not all recommended asset classes will be suitable for every portfolio. Diversification and asset allocation do not guarantee returns or protect against losses.

Indexes shown are unmanaged and are not available for direct investment. The S&P 500 Index consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The HFRI Fund Weighted Composite Index is a global, equal-weighted index of over 1,400 single-manager funds that report to HFR Database. Constituent funds report monthly net of all fees performance in U.S. dollar and have a minimum of $50 million under management or a 12-month track record of active performance. The HFRI Fund of Funds Composite Index consists of over 800 constituent hedge funds, including both domestic and offshore funds. Fund of Funds invest with multiple managers through funds or managed accounts. The strategy designs a diversified portfolio of managers with the objective of significantly lowering the risk of investing with an individual manager. The Fund of Funds manager has discretion in choosing which strategies to invest in for the portfolio. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities.

Accredited investor: For individuals, the requirement is generally met by a net worth that exceeds $1 million (excluding primary residence and any related indebtedness), income in excess of $200,000 (individually)/$300,00 (jointly with spouse) in the two most recent years with an expectation of the same in the current year, or individual has a Series 7, 65 and/or 82 securities license(s). (Relying on joint net worth or income does not mean securities must be jointly purchased.) For entities (including trusts, non-profit corporations exempt under s. 501(c)(3), LLCs, LLPs, corporations, etc.), the requirement is generally met with if the entity has assets in excess of $5 million (assuming the entity was not formed for the specific purpose of acquiring the securities offered), or when all of the entity owners are accredited investors. Please refer to Rule 501 under the Securities Act of 1933 for the complete definition. Qualified Client: The requirement is generally met if the investor has at least $1M under investment with the fund manager, the investor has a net worth of more than $2.1 million (excluding primary residence and any related indebtedness), or the investor is a Qualified Purchaser (see below). Please refer to Rule 205-3 under the Investment Advisers Act of 1940 for the complete definition. Qualified Purchaser: For individuals, the requirement is generally met when the investor owns (individually or jointly) $5 million or more in investments. [Relying on joint ownership of investments does not mean securities must be jointly purchased.] For entities (including trusts), the requirement is generally met if the entity owns $25 million or more in investments; the entity owns $5M or more in investments AND it is owned by two or more natural persons who are related as siblings/spouse; or all beneficial owners of the entity are each Qualified Purchasers. Please refer to Section 2(a)(51) of the Investment Company Act of 1940 for the complete definition.

Tags:

Related articles

Why – and how – to invest in commodities

There are multiple ways to invest in commodities, but the risks are high and the returns are unpredictable.

Is investing in an initial public offering a good idea?

It’s easy to get caught up in the excitement surrounding initial public offerings. Review these common misconceptions before investing.