Key takeaways

The U.S. housing market continues to face challenges due to today’s higher interest rate environment.

Affordability hurdles owed to a combination of higher home prices and elevated mortgage rates have slowed the housing market.

The market for real estate investment trusts (REITs) has been even harder hit than the broader housing market.

The housing market continues to face challenges, stemming in large part from changes in the economic environment. A resurgence of inflation led the Federal Reserve (Fed) to dramatically raise interest rates. The Fed's actions are designed to slow the broader economy in an effort to temper the impact of inflation, and few segments of the U.S. economy felt the impact as directly as housing. By May 2023, the fed funds target rate was increased to a range of 5.00% to 5.25%. The Fed’s policy shift was reflected in higher mortgage rates, which generally translate into larger monthly payments for home buyers.

With affordability an issue, demand dampened and as a result, home prices dropped modestly from their peak in mid-2022. Yet the price drop occurs even as the availability of new and existing homes appears to fall short of demand. Significant questions remain about how the housing market’s challenges may affect the broader economy and the potential investment impact.

Home values in limbo

Owning a home remains an integral aspect of the “American dream.” Even though the housing market is subject to fluctuation in value, most homebuyers have come to expect appreciation in their property values over time.

“We’re waiting for affordability to improve to open the door to more buyers. That will require either mortgage rates declining, home prices falling or incomes rising more quickly.”

Rob Haworth, senior investment strategy director at U.S. Bank

Home prices, like those for any product or service, are driven in large part by supply and demand. A reality of recent times is that supply lagged demand, particularly in certain markets across the country. Prior to 2022, this supply-demand imbalance, supported by low interest rates on home mortgages, pushed home prices higher.

“Consumers were in a strong position to buy or upgrade their homes,” says Rob Haworth, senior investment strategy director at U.S. Bank. “That raised the demand for houses. As COVID-19 first hit, we ran into supply shortages for materials such as lumber and concrete, and even labor shortages for construction workers and building inspectors.” Home prices skyrocketed through 2020 and 2021, particularly in some suburban areas, as homeowners looked for larger houses to accommodate changing lifestyles, including more work-from-home arrangements.

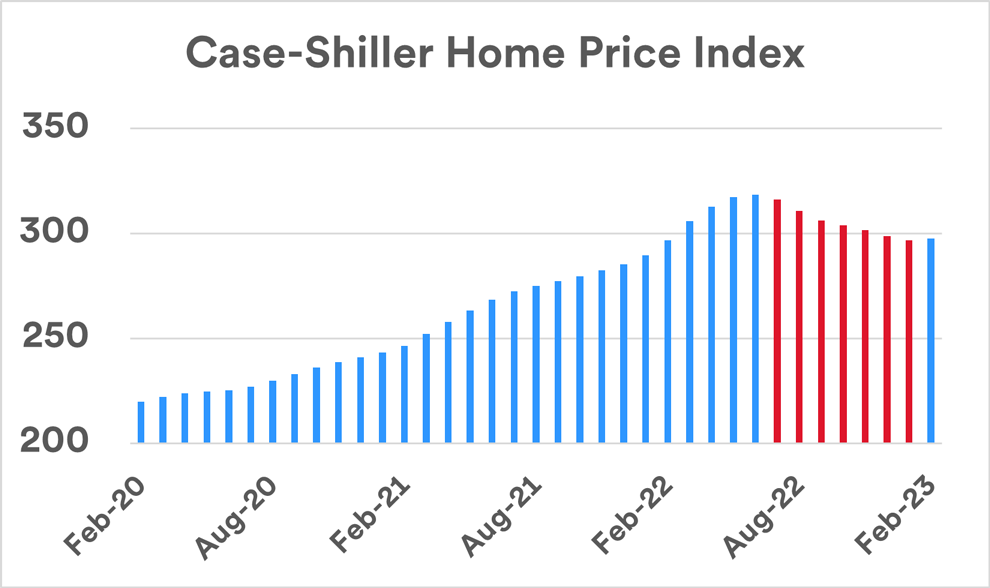

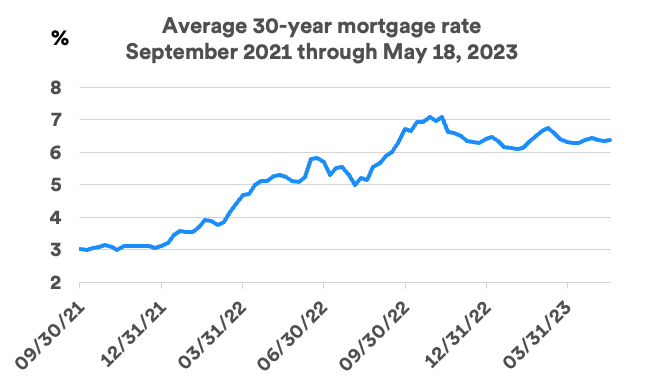

The environment quickly changed with the onset of the Fed’s new monetary policy in early 2022. By November 2022, the average 30-year mortgage rate topped 7% for the first time in more than 20 years.1 That dampened activity in the housing market, and as a result, average home prices in the U.S. began to decline. According to the S&P CoreLogic Case-Shiller 20-City Composite Home Price Index, home values started to fall in July 2022 for the first time in more than a decade.2 Following seven consecutive months of declines in home values, as reflected in the index, prices rebounded slightly in February 2023 (the most recent data available).

Source: S&P Dow Jones Indices

Notably, from the beginning of 2020 until peaking in June of 2022, home values (as reflected by the Case-Shiller Index) rose 45%. “Some who track the housing market predicted that average home prices nationally could fall by 10-15%,” says Matt Schoeppner, senior economist at U.S. Bank. “We anticipate that the decline will be more gradual, but that a downward trend in home values may extend for a period of time.” Even after February’s uptick in the Case-Shiller Index, home prices nationwide are down 6.6% from their peak. Schoeppner notes that even if values decline further in the coming months, it should not be considered a major setback. “This would rank as a modest correction after a more than 40% runup in home values over the prior two years. Homeowners still have significant home equity given the dramatic appreciation in values that occurred up until mid-2022.” Of course, price changes vary depending on location.

Another sign of the housing market slowdown is that in late February, mortgage applications to finance new home purchases fell to a 28-year low, though mortgage activity levels fluctuated up and down since that point.3 Despite uneven demand, home values may not face a precipitous loss of value, because of the limited inventory of homes on the market. Some existing homeowners appear reluctant to sell their current house, buy a different property and then borrow at today’s higher mortgage rates. “Even as the Fed tries to slow down housing demand to temper inflation, the result of today’s limited supply of available housing is that we may not see a significant deterioration in home values,” says Schoeppner.

According to a recently released study, 14 million homeowners refinanced their mortgages between the second quarter of 2020 and the end of 2021, before mortgage rates began to climb in 2022. With significantly higher mortgage rates persisting today, the report states that this “leaves homeowners somewhat disincentivized to sell or change properties.” The report notes that owners looking to sell their existing home and purchase another property “will face increased borrowing costs and higher (home) prices.”4

Existing home sales experienced a brief resurgence, rising 14.5% in February 2023 compared to the previous month.5 However, existing home sales dropped again in March and April by 2.4% and 3.4% respectively, reflecting a long-term slump in activity. After topping out at an annualized rate of 6.49 million in January 2022, existing home sales numbers proceeded to decline in 14 of the next 15 months, to an annualized level of 4.28 million in March 2023, a 31.5% drop-off in sales activity.6

Mortgage rates remain high. After peaking in November 2022 at 7.08%, the average 30-year mortgage rate in the U.S. dropped to 6.09% in early February 2023, but has been up and down since, standing at 6.39% as of mid-May 2023.7 Higher mortgage rates make borrowing more costly, which can dampen housing market activity.

Source: Federal Home Loan Mortgage Corporation (Freddie Mac)

Haworth notes there’s another impact of today’s mortgage environment. “It’s not just a question of an individual’s ability to buy a house, but how higher financing costs will affect builders in the development of new homes.” Haworth believes higher financing costs create potential barriers to builders, dampening the supply of new construction. Recently released data on new residential home construction shows a 22.3% decline in activity for new, privately-owned housing starts for the 12-month period ended in April 2023. However, new home construction picked up modestly in April 2023, compared to the previous month.8 “The good news for an insufficiently-supplied market is that homebuilder sentiment appears to be improving,” says Haworth. That could translate into more building activity to help meet current demand.

“We’re also waiting for affordability to improve to open the door to more buyers,” says Haworth. “That will require either mortgage rates declining, home prices falling, or incomes rising more quickly.” Haworth says historically, when affordability improves, homebuying activity accelerates. However, he says mortgage rates could remain elevated for some time. “Mortgage rates are heavily correlated to the 10-year U.S. Treasury note yield, and there is a risk that 10-year yields could move higher.” Haworth points out that in mid-May, 10-year Treasury yields were under 4%, well below the federal funds target rate established by the Federal Reserve, which exceeds 5%. “10-year Treasury yields are typically higher than the fed funds rate,” says Haworth. “If bond market yields revert to normal levels, it may mean that higher mortgage rates persist, affecting home affordability.”

The future of the housing market

Prior to the pandemic, housing demand climbed as millennials (born between 1981 and 1996) entered the home market. “They were supposed to provide the tailwind for the housing market,” says Schoeppner. However, the pandemic moved the market in a different direction.

As home prices soared in 2020 and 2021, affordability became an issue, particularly for first-time homebuyers. Now, even with a modest leveling off of home prices, higher mortgage rates create a different affordability issue. “You may see potential new homebuyers delay home purchasing plans for a year or two and decide to rent instead,” says Schoeppner. “The tailwind of millennial-driven demand will likely return once we get past this ‘temporary’ blip, but it’s hard to define how long ‘temporary’ may last.”

Haworth says that millennials may represent the last sizable generational cohort to move into the home ownership market. “We’re not expecting large waves of new homebuyers beyond that, based on current demographic trends,” says Haworth. “Given expectations for future generations, the prospects are that housing demand will ultimately stabilize, with immigration trends determining whether demand swings higher or remains steadier.”

Impact on the real estate investment market

For those looking to add diversification by including real estate in their portfolios, commonly used vehicles are real estate investment trusts (REITs). As interest rates rose beginning in early 2022, REITs faced significant challenges.

“Real estate as an asset class was one of the first to be repriced lower in reaction to higher interest rates,” says Tom Hainlin, national investment strategist at U.S. Bank. “Although REITs are often considered a way to hedge the risk of higher inflation, the unfavorable interest rate environment resulted in REITs underperforming other parts of the equity market. Improved yields on U.S. Treasury securities create cash flows that look much more attractive in today’s market, when compared to REITs.” As a result, demand for REITs has fallen, at least in the near term. For the 12-month period ending in April, the S&P Developed REIT Index returned -17.85%, compared to a return of 2.26% for the S&P 500, a benchmark measure of U.S. stock market performance.9

Haworth points out that results vary depending on the category of REIT. “Underlying demand in specific segments of the market influence REIT performance,” says Haworth. “There’s still steady demand for apartments, the market is softer for office properties, but the retail market remains very soft, an environment that’s existed since the pandemic began.” Haworth also notes that, as is often the case with real estate, location affects property values. “For example, demand for apartments is strongest in suburban areas, a clear pandemic-driven trend, whereas urban properties face lower demand.”

A silver lining for REIT investors, according to Haworth, is that a significant price correction has already occurred. “There are still challenges ahead, but REIT prices have already corrected much more quickly than is the case in the direct real estate market, so better values can be found there, but it’s not without risk.”

Real estate within your financial strategy

Fed policy has clearly landed housing and other real estate markets on the front lines of efforts to slow the economy’s pace and lower inflation. Thus, regardless of the extent of your real estate holdings, this is a market that can have a significant impact on the broader economy and capital markets. “The formation of households is the main driver of economic growth,” says Hainlin. “It has a large, spillover effect on the economy, including materials that go into building or remodeling, and furnishings for homes.”

Be sure to consult with your wealth management professional to determine when and how real estate investments might be a good fit for your portfolio.

Tags:

Related articles

How do rising interest rates affect the stock market?

With interest rates continuing to go up this year, learn what the likely ripple effects across capital markets may mean for investor portfolios.

Investing in real estate: 4 ways to diversify your portfolio

From your home and rental properties to REITS and mortgage-backed securities, here are few things to consider as you explore real estate investment opportunities.