Key takeaways

China’s economy appears to be growing at a more modest rate than the rapid pace of expansion experienced in the late 1990s and early 2000s.

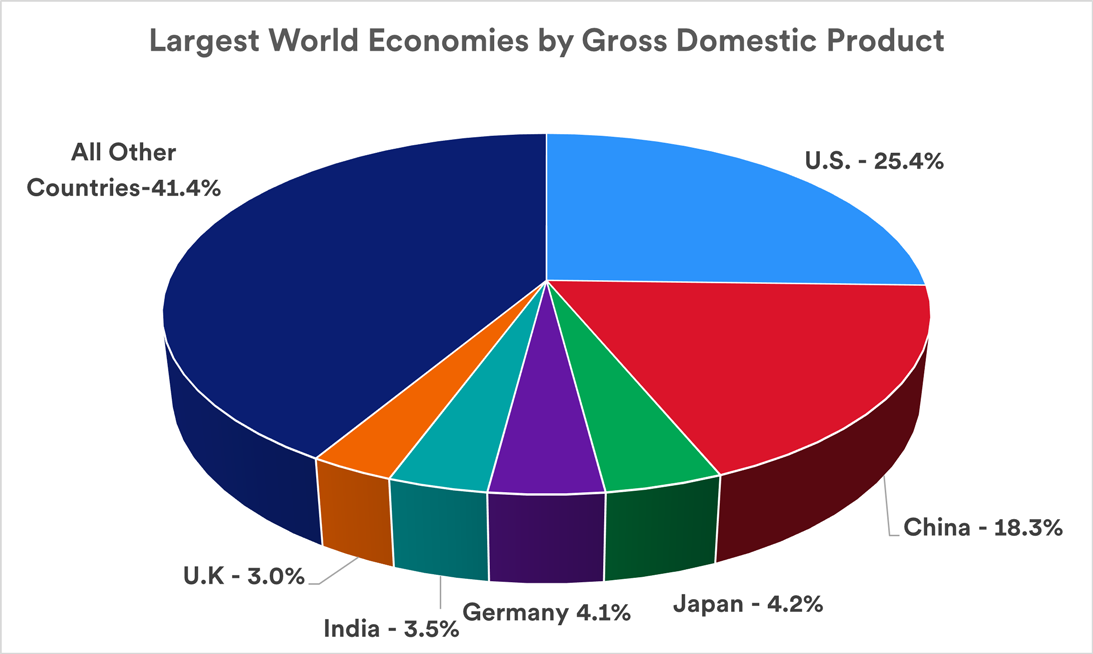

Boasting the second-largest economy in the world, however, means China continues to exert significant influence over global markets.

Emerging market funds offer access to potential growth opportunities in China’s stock market.

As investors seek to build a diversified portfolio to achieve long-term goals, international stocks can be an option worth considering. Emerging markets – developing nations that are becoming more significant global economic contributors – may offer attractive, long-term opportunities. Of all emerging market countries, China is by far the largest.

China’s increasing influence on the global economy is one of the major economic stories of the past 50 years. Prior to the late 1970s, China was a nation mostly isolated from the broader world, with most of its population living in rural areas. Since then, China has grown into an important emerging market, with a vibrant economy and urban-centered middle class.

The country is a major player in global trade, with significant influence on the world’s economy. This was apparent in the wake of the COVID-19 pandemic, when China shut down portions of its economy as part of the country’s “zero COVID policy,” aimed at preventing a wave of infections. China’s economic growth slowed as a result, which had residual effects among trading partners. Because of China’s importance in global manufacturing, temporary shutdowns of major factories also contributed to global supply chain bottlenecks.

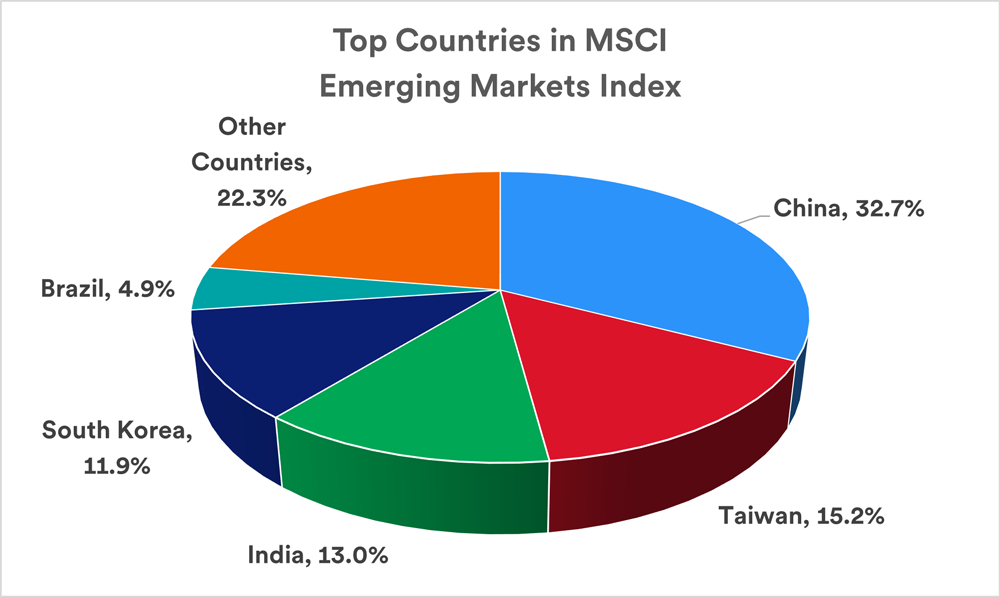

China is also a significant player in global capital markets. Its stock market alone makes up approximately one-third of the MSCI Emerging Markets Index. “Any investor who puts money to work in a broad, emerging market index likely owns a significant position in Chinese stocks,” says Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management. “The influence of China is also evident among some of the other major players in the global emerging equity markets, such as Taiwan and South Korea, which are large trading partners.”

MSCI Emerging Markets Index Fact Sheet, March 31, 2023.

How do developments in China affect global markets today, and how should you assess investment opportunities in China’s growth?

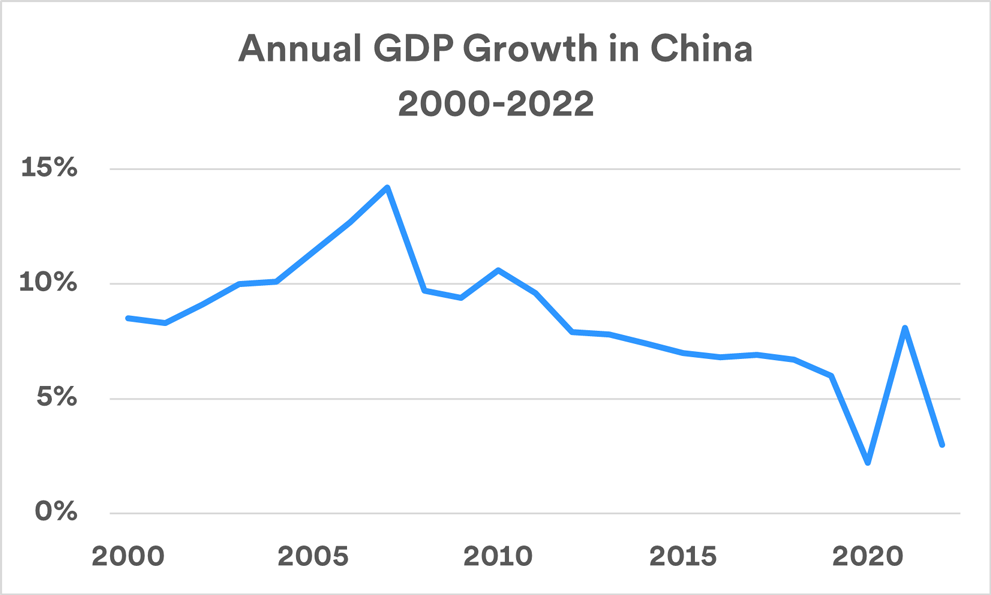

China’s evolving population

The transformation of China’s economy, from one of general subsistence living standards and an agrarian-based society to the China of today has been nothing short of astounding. The country’s economy underwent a dramatic transformation, beginning in the late 1970s, with rapid growth a staple of China’s economic story. While still considered an emerging market nation, China’s economy has evolved. “For many years, the growth of China’s middle class was a benchmark story,” says Haworth, “but that has changed.” For example, until the last decade, China’s economy (as measured by Gross Domestic Product or GDP), often grew by more than 10% per year, resulting in vast expansion of the country’s middle class. Haworth says economic growth remains strong, but the pace of growth may be more modest than the pace set in previous decades.

“Two key factors at play are the fact that China now has a well-developed middle-class, and it also has demographic issues.” China implemented a one-child limitation for families in 1980. The policy ended in 2016, but with the population of younger generations intentionally reduced, the result is an aging population and additional economic challenges that may result. This includes fewer working-age people to support the needs of its elderly population, and ultimately, a potential decline in the country’s overall population, which could hamper future economic growth. In 2023, India supplanted China as the most populous nation in the world. China had held that distinction since global population statistics were first recorded by the United Nations in 1950.

Trade tensions

After a long period of reasonably open trade with the U.S., more barriers exist today. Americans became accustomed to China’s vast manufacturing capacity resulting in more imported goods to the U.S. Then, President Donald Trump implemented new tariffs and other restrictions, most of which remain in force under President Joe Biden.

“Despite current trade tensions, activity tends to be more reflective of economic cycles than trade policies, per se,” says Haworth. “But those policies potentially color the path forward. Less investment from the U.S. results in lower trade activity.” Nevertheless, trade between China and the U.S. tends to be heavily slanted toward China exporting to the U.S. Haworth says Japan and Europe export more to China than the U.S.

“Any investor who puts money to work in a broad, emerging market index likely owns a significant position in Chinese stocks.”

Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management

The relationship between the U.S. and China has, in recent times, become increasingly tense. China’s President Xi Jinping and Russian President Vladimir Putin appear to have developed a closer relationship. Haworth notes this has not translated into China providing military support for Russia's war with Ukraine. If that occurred, it could greatly strain relations between China and western nations including the United States.

In April 2023, U.S. Treasury Secretary Janet Yellen seemed to open the door to more productive U.S-China relations. She stated that the two countries “can and need to find a way to work together.” Yellen called for “cooperation on urgent global challenges. It is important that we make progress on global issues regardless of our other disagreements.” She added, “we believe that healthy economic competition with a fair set of rules can benefit both countries over time.”

China’s economic reopening and growth trajectory

While China managed to limit the nation’s (reported) death rate from COVID-19 in contrast to many other countries, it did so by shutting down major cities for extended periods of time, greatly crippling its economy. In late 2022, China eliminated what was known as its “zero COVID policy,” and its economy rebounded.

“The recovery started slowly,” says Haworth. “Growth in the first couple of months following China’s ‘reopening’ was in the 2% range (annualized). However, China’s first quarter 2023 GDP came in at an annualized rate of 4.5%, and it’s projected that China will generate Gross Domestic Product (GDP) growth of 5% in 2023.” He notes that unlike the U.S., where the federal government provided significant stimulus payments that put individuals and businesses in a stronger position to resume spending once the economy reopened, China didn’t have a similar plan in place. “In addition, Chinese consumers tend to be thriftier than those in the U.S.,” says Haworth. That may have dampened the immediate pace of China’s economic rebound.

He expects many Chinese households will build their savings and consumer activity may expand later in 2023. Nevertheless, China’s GDP growth rate is expected to be on a slower trajectory than was the case for much of the past two decades.

Source: World Bank national accounts data.

Nevertheless, China’s status as the second largest economy in the world (as measured by GDP) makes it an important player on the global economic stage. With Chinese manufacturing returning to normal, the steadier flow of manufactured goods should help resolve lingering global supply chain issues. In addition, China’s trade activity with neighboring countries including Taiwan, Japan, Korea and Vietnam, should accelerate as China’s economy regains momentum.

Source: International Monetary Fund, “World Economic Outlook, April 2023,” GDP, Current Prices.

Investing in international stocks

International stocks can contribute to a well-diversified portfolio. Haworth believes 2023 is a potentially advantageous time for U.S. investors to consider international stocks. “One favorable factor is that the dollar is trending weaker. If the dollar loses ground compared to other currencies, it provides a boost for U.S. investors with money in overseas markets.” Haworth attributes dollar weakness to the nearing conclusion of the Federal Reserve’s current interest rate hiking cycle. “A second factor is the improvement in investment fundamentals for many overseas markets.” Haworth says many emerging market stocks, including those based in China, are coming off low valuation levels. Emerging market stocks struggled significantly in 2022, and their performance lagged that of global developed markets over the five-year period ending March 31, 2023.

“As we look at all of the risks in the market today, it makes sense to consider allocating a portion of equity assets into non-U.S. stocks, including emerging market stocks,” says Haworth. He suggests avoiding investing directly in Chinese stocks, and instead favors emerging market funds that represent a broad index of stocks. “The emerging markets index provides significant exposure to Chinese stocks, since they make up one-third of the MSCI Emerging Market Index,” says Haworth. “But it also provides exposure to other markets that help diversify investors away from potential risks arising from investing exclusively in Chinese markets.

Any changes to your investment strategy should be consistent with your goals, time horizon and risk appetite. Talk with your U.S. Bank wealth professional to review your current financial plan and determine whether there is an opportunity to incorporate emerging market stocks – with exposure to China – into your broader, well-diversified portfolio.

Note: The MSCI Emerging Markets Index captures large and mid-cap equity performance across twenty-four emerging market countries. Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility. International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments.

Tags:

Related articles

Investing in tech stocks: Is now a good time?

After an abysmal 2022, tech stocks are up this year – outperforming the broader S&P 500 by a wide margin. What does this mean for investors?

How to put cash you’re keeping on the sidelines back to work in the market

Don’t let market volatility and an uncertain economic outlook derail your disciplined investing strategy.