Volatile markets can make even the savviest of investors a little nervous

It’s not uncommon to second-guess decisions or contemplate pulling out of the market when securities are turbulent. Managing your money can feel like a full-time job – one with an uncertain future.

To get advice on investing during volatile markets, we talked to Troy Emeott, vice president and sales manager of U.S. Bancorp Investments’ Wealth Management Advisory Center. He shares how robo-advisors like Automated Investor from U.S. Bancorp Investments can help instill confidence and peace of mind within uncertain markets.

Is it OK to invest when the market is volatile?

Troy Emeott: There’s nothing wrong with investing in a volatile market. It might seem daunting, but the truth is, nobody knows what the market’s going to do tomorrow, next week, next month or next year. If you look at the last 30 years, 23 of those ended with positive returns, even in years with sizable declines.1

There’s an old saying, “It’s not about timing the market, it’s time in the market.” In other words, don’t try to time the bottom; stay in for the duration. When starting an investment, it’s best to have at least a two- to three-year time horizon. You will go through many volatile periods if you plan on making long-term commitments, but you can ride them out with time on your side.

What does “buy the dip” mean?

Emeott: Buying the dip means you're buying a stock or mutual fund after it has declined in value. For example, if a share price used to be $100 and now it's $80, you're buying it at a discount and paying less than it was worth before.

It’s challenging to know if the price is a dip or a permanent decline when you're looking at individual stocks. If you’re looking at indexes or asset classes, however, the dip will generally come back with time. Investing across different types of investments has less associated risk compared with a single stock that has a dip.

What does dollar cost averaging mean?

Emeott: Dollar cost averaging is a strategy where you systematically put money into an investment, such as every week, month or quarter. The most common way to dollar cost average is with a 401(k) plan. Every two weeks, money from your paycheck goes right into your retirement account.

When you continue to add new money to your investments, you increase the chances of growing your account over time. You don't need to worry about trying to pick the right time to invest. At times, you may buy the dip, which allows you to purchase more shares because the price is lower. As the market adjusts and goes up, you’ll participate in that rally. By investing over time, you create discipline and form good habits that can take the stress out of investing.

How does a tool like Automated Investor help give you confidence when investing during market volatility?

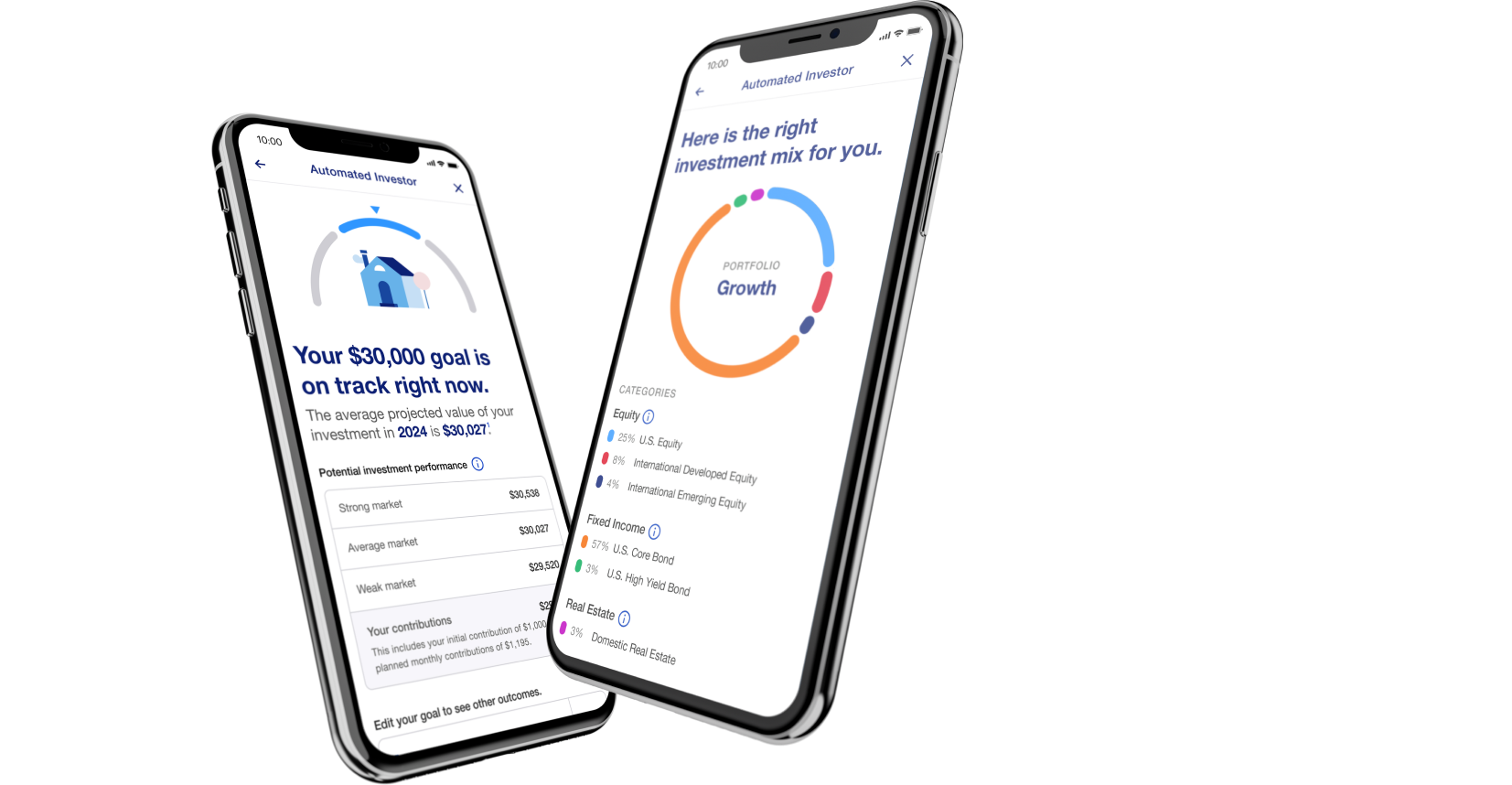

Emeott: By nature, a robo-advisor is generally less risky. The investment algorithms diversify your investments across various asset classes, based on your individual parameters like your goals and risk tolerance. You will still experience the ups and downs of the market, but movement is to be expected over any long timeframe.

In a market with higher volatility, Automated Investor will help to keep you on track. As the markets change, your investments will automatically adjust to help ensure that you're invested appropriately for your timeline. As different asset classes go up and down, the portfolio will adjust to help ensure that you're not taking too much or too little risk. Automated Investor automatically rebalances your portfolio to help adjust for volatility.

Any advice for new investors?

Emeott: Do not be intimidated by the markets. Many people know they should invest, and they have money in savings accounts. They may be hesitant to take that first step, especially when they hear news regarding recessions and volatility. It may be even more daunting to get into investing during these times. Everyone should try to educate themselves on the market, speak to advisors and potentially look into products like Automated Investor or other investing options available at U.S. Bancorp Investments.

With Automated Investor2 you don’t have to worry about what to buy and when to buy it. The program makes those decisions for you and helps keep your portfolio on track toward your goals.

Get the Automated Investor information you need

If you’re interested in learning how a robo-advisor can help you achieve your financial goals in volatile markets, visit our page on Automated Investor today for more information.