There are plenty of reasons to invest your money

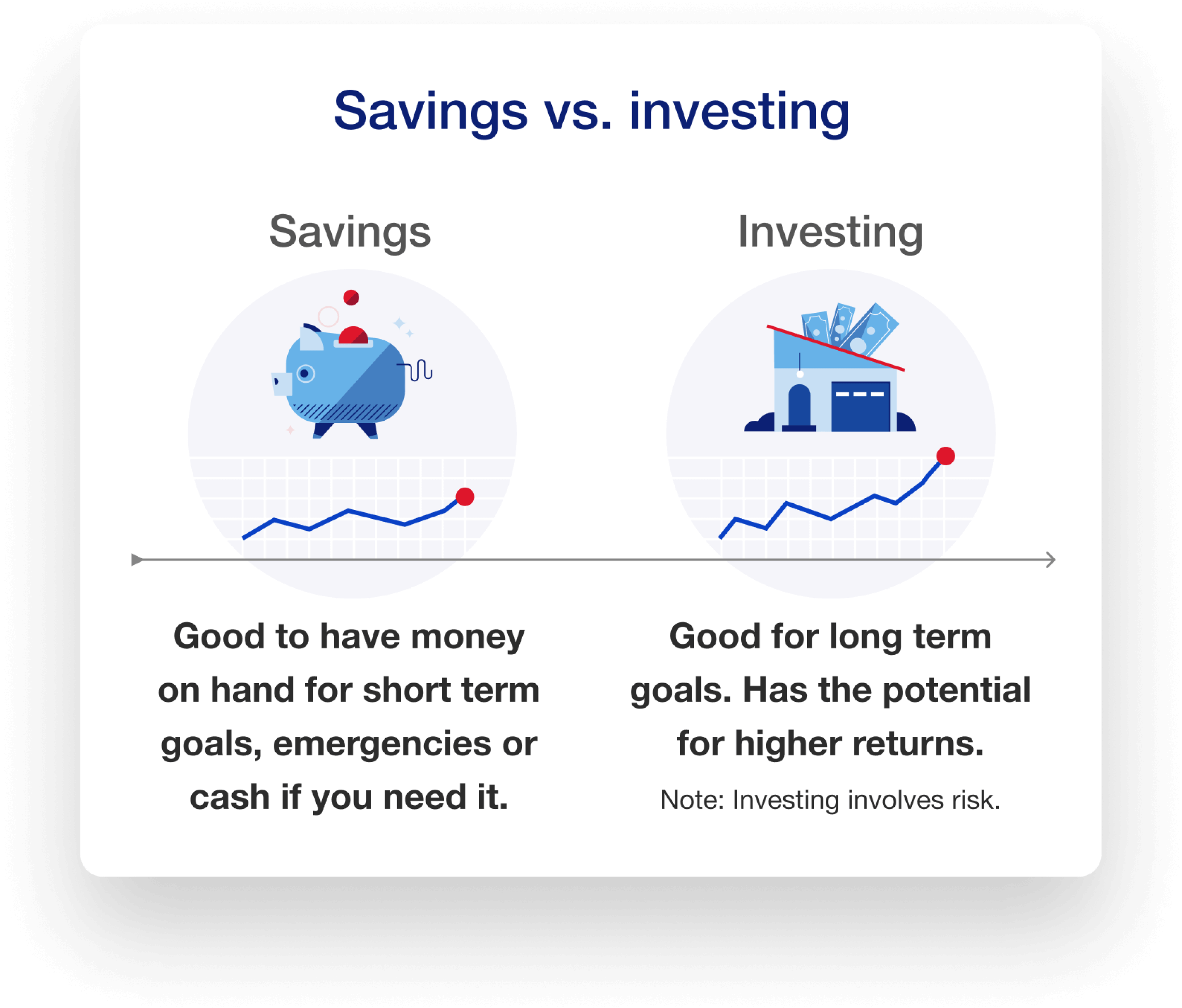

You may be working towards a lifestyle goal, like retirement. You may be gearing up for a big purchase, such as a new house. Or you may just want to build your wealth and know that your money is working harder for you. Investing can be a smart strategy for big goals because of the potential benefits compared with simply putting it into a traditional savings account.

If you’re new to investing, you may feel a little intimidated by how markets work and the investments you must choose from. We sat down with Troy Emeott, vice president and sales manager of U.S. Bancorp Investments Wealth Management Advisory Center, to discuss the basics and how you can start working toward your financial goals.

What do you need to know before you begin investing?

Before you invest money, make sure you’re in a financially sound place. For example, you should have three to six months’ worth of expenses set aside for emergencies, such as if your car breaks down or your air conditioner goes out. You should have your debts under control and a steady source of income.

Once that’s settled, go into the investment with a goal and timeframe in mind, such as retirement or saving for your first house. When you have a set goal, investing feels more real, and you'll be more determined to hit that goal. Make sure to stick to the timeframe.

Finally, you should have a general understanding about how investing and the stock market work. Educate yourself on these markets and the risk associated with investing, so you know what you're getting into.

What can you invest in?

When it comes to choosing an investment, you have several choices, including stocks, bonds and mutual funds/exchange-traded funds (ETFs).1 When you purchase stocks, you own a small stake in a specific company. Bonds are loans to a company or government that agrees to pay you a set interest. Mutual funds and ETFs are funds that hold a variety of stocks, bonds, and assets. Since they have more coverage, this type of asset is considered to be less risky than owning individual stocks.

How is general investing different from a 401(k)?

A 401(k) is a tax-deferred account issued through your employer that is designed to help you save for retirement. The specific set of investments is managed by an investment firm that runs the company’s 401(k) program.

A self-directed brokerage account is an investment account you open on your own. When you engage in self-directed investing, you select your own investments. While general investing can be used during retirement, you can withdraw money whenever you wish without incurring any penalties. You’ll pay capital gains tax only on the earnings when a general investing account is not tax deferred, such as with an IRA.

How can a robo-advisor help?

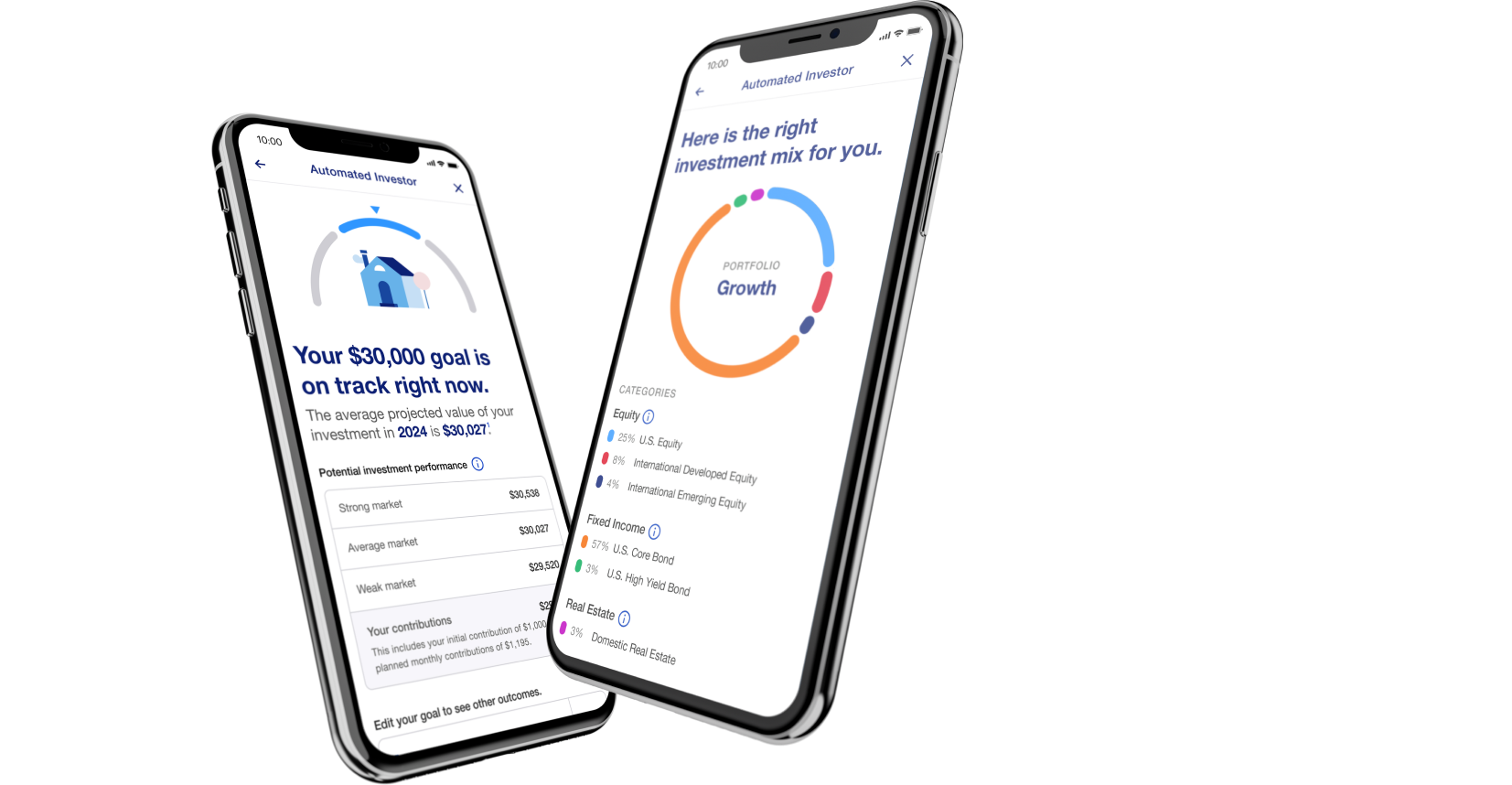

A robo-advisor, like Automated Investor from U.S. Bancorp Investments, is an online investment account designed to help investors reach their financial goals. To open an account, simply enter the initial amount you want to invest. Next, enter any additional money you want to invest over time, such as making monthly contributions. Finally, indicate how much risk you want to take with your investments. If you don’t know your risk tolerance, Automated Investor will ask questions to help guide you to the appropriate risk level based on your answers.

From there, you set your timeframe, and the program selects a portfolio of different investments across different asset classes, investing the money according to those parameters. As the markets change, your investments will change to rebalance the portfolio, helping to ensure that you’ve invested appropriately over time.

When you choose a tool like Automated Investor, you don’t need tens of thousands of dollars to invest; you can start with as little as $1,000.2 You also don’t have to worry about selecting which investments to purchase; it’s done for you. As the market goes up and down, your account automatically adjusts based on your goal, timeline and risk level.

Get the Automated Investor information you need

Ready to learn more beyond investing basics? If you’re interested in Automated Investor and how it can help you achieve your financial goals, visit our Automated Investor page today for more information.