This is a limited time offer so start investing today

In less than 10 minutes you can open an Automated Investor account and get $100.

How a robo-advisor works

A robo-advisor is an investment tool that uses technology to manage your investments on a day-to-day basis, so you don’t have to. This digital platform can be utilized by anyone who is new to investing or has experience with investments.

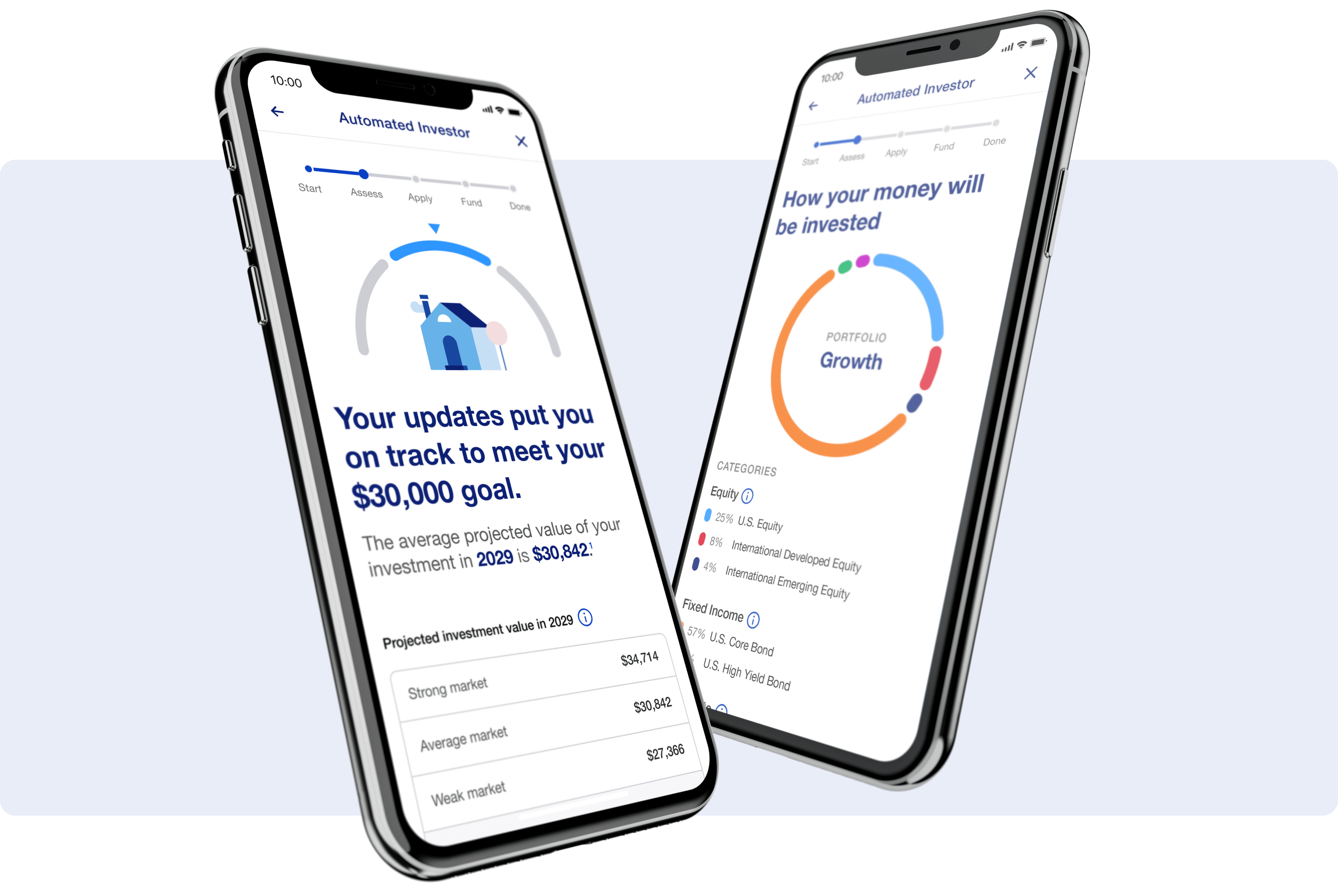

When starting with a robo-advisor, you answer questions about how much you want to invest, your financial goals, how comfortable you are with financial risk and other information. The robo-advisor analyzes your answers, using the resulting data to choose exchange-traded funds (ETFs)1 and build your portfolio, without you having to spend the time to do so.

Getting started with automated investing

To get started with a robo-advisor such as Automated Investor, the robo-advisor offered by U.S. Bancorp Investments, you:

- Determine what your primary goals are, such as investing for retirement, growing your money, working toward a big life event, investing to buy a home or others

- Establish a time frame in which you wish to achieve those goals

- Determine your risk preference

- Set up an online account and enter your details

- Provide the initial contribution money

That’s it. It’s that easy. All the research and building your portfolio is done for you. This way, you can continue with your business life while getting the low-fee professional investment management you are looking for.

Is a robo-advisor right for you?

A robo-advisor works well if you’re someone who is unsure how to get started investing and need a quick start, or if you understand investments but would prefer your portfolio be handled with minimal time-input by you.

Additionally, when using a robo-advisor, it is best to keep emergency funds on hand, understand that there is a longer time horizon for returns and accept the market risk that comes with automated investing.

Your money is invested for you with the right mix of funds tailored to your set preferences. As the market changes, we monitor and fine-tune your investments regularly to help you stay on track to reach your goals. Take our investing quiz to learn more.

More about Automated Investor

One of the best parts of our robo-advisor, Automated Investor, is the smart technology that is used to monitor and rebalance your portfolio, so you don’t have to. We use insight from our skilled investment professionals to inform how your portfolio is structured and traded.

Gather all the information you need to take the path to easy investing. See how Automated Investor could be right for you.

Other information and resources

Automated Investor IRAs

Consider an Automated Investor Traditional or Roth IRA. We make it easier to invest toward your retirement.

Automated Investor fees

Details about Automated Investor fees and minimums.

Frequently asked questions

Review our FAQ on the product, how to get started and other account details.