Key takeaways

Elder fraud is an increasing problem given the growing population of Americans 65 and older.

People can be defrauded by strangers, or quite often by family members or friends, who should be looking out for their interests.

It’s important to take steps to protect yourself or loved ones who could be targeted for financial fraud.

Any of us can fall victim to fraudulent schemes and scams, but the reality is that elderly individuals are frequently the target of such actions and often also the most vulnerable. While fraud is certainly perpetrated by strangers, family members and friends can also be the instigators of activities that cheat elderly individuals out of their money.

Reports estimate that financial fraud affecting older adults totals $3 billion per year.1 Fraud committed by people known to the victim is said to result in an average loss per incident of $120,000.2 The problem appears to be growing, and today’s technology can result in additional issues for older Americans.

“The increasing reliance on technology among those who are elderly and vulnerable introduces more avenues to be targeted,” says Sarah Darr, senior vice president and head of financial planning at U.S. Bank. “It’s especially important for those individuals to be more vigilant or ask family members for help.”

Legislation has been proposed in Congress to try and address this issue. Still, it’s important to be aware of the most common fraud risks that exist today and understand the steps you can take to reduce your own risk or that of an elderly family member or friend.

Common types of elderly scams

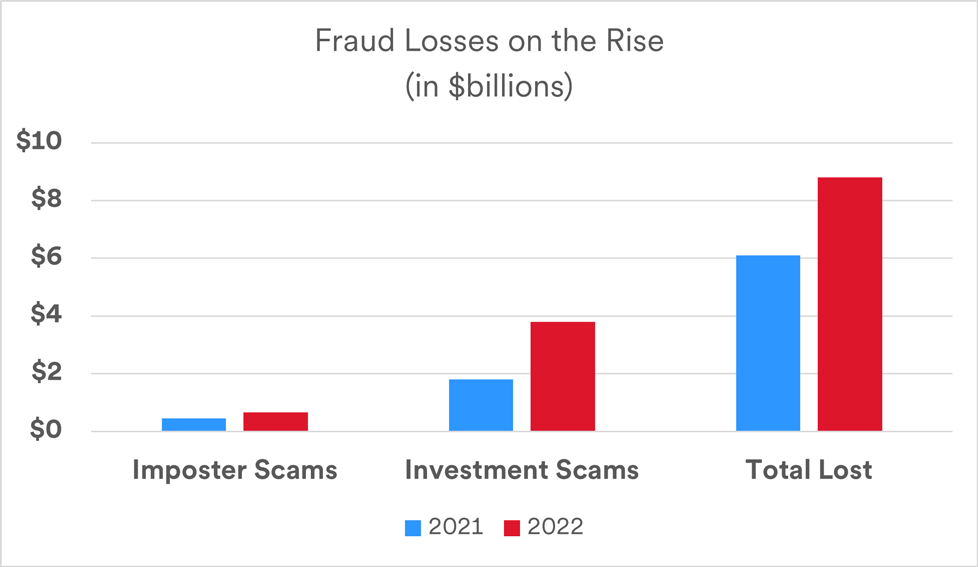

Scams come in many forms, but according to the Federal Trade Commission, some of the most common types of fraud include:

- Investment fraud. The illegal sale or purported sale of financial instruments. It can result in individuals being defrauded out of money invested in fraudulent instruments. It also relates to certain financial holdings of the victim being sold or transferred to others without their consent.

- Imposter scams. People who pretend to be someone they aren’t to try to convince individuals to send them money. For older people, a typical approach is to represent a grandchild or say they are calling on behalf of a grandchild who needs money to get out of trouble. Another is to claim to represent the IRS or other tax collection agency, seeking to make individuals pay for supposed owed taxes.

- Online shopping scams. Individuals or organizations who establish a website or social media platform designed to look like a legitimate online retail site. They may often sell inferior products that are not the genuine merchandise they claim to represent.

- Fake prices, sweepstakes and lottery scams. Individuals receive notice of having won a prize, but often are asked to pay money or provide account information in order to collect the prize.

Source: Federal Trade Commission, “A Scammy Snapshot of 2022 (based on reports to Consumer Sentinel).”

Leveraging technology to commit fraud

One challenge is that there appear to be multiple ways that fraudulent operators interact with potential victims. “All a fraudster needs to impersonate a government official is a phone and a phone number of a potential victim,” says Charity Babington Falls, managing director, head of wealth planning at Union Bank. “Too many people are subject to impersonators who claim to be from the IRS or the Social Security Administration.” This can lead unsuspecting victims to provide account information or make payments to improper parties.

“It’s important to be aware that information shared online is not as private as people might think. It actually might put individuals at greater risk, as predators can illegally obtain data access to commit fraud.”

Sarah Darr, senior vice president and head of financial planning, U.S. Bank

Perpetrators can also utilize information obtained through digital channels, such as email or text message scam offers or by tapping into existing data of companies with which you already hold legitimate online accounts. “It’s important to be aware that information shared online is not as private as people might think,” says Darr. “It actually might put individuals at greater risk, as predators can illegally obtain data access to commit fraud.”

Protecting investments from fraud

Investment scams are increasingly common, whether it be come-ons for an investment that seems “too good to be true,” or protecting your own holdings from those who might try to access your hard-earned money. “People may be approached by fraudsters promising high returns with little or no risk involved,” says Falls. “It’s important to recognize that ‘risk-free’ investments do not exist.” Falls also warns against agreeing to invest with anybody who utilizes high pressure tactics to try to convince you to put your money to work with them. “You should never feel like you have to jump into an investment product that you don’t truly understand,” says Falls.

Darr agrees that any investment considered should be consistent with your overall financial plan and the key goals you wish to achieve. While certain investment offers may indicate the potential for significant upside potential, Darr recommends that you “always thoroughly vet any investment offer you consider. The most common response from people who were defrauded is ‘I can’t believe I fell for that.’ It’s important to be vigilant in demanding and reviewing the details of any investment offer that seems too good to be true.”

Financial exploitation by friends or family

All too often, fraud stays within the family or among people who know each other. According to one study, family members, on average, steal twice as much as strangers when it comes to defrauding an elderly person.2 Victims can lose many thousands of dollars and it can jeopardize their lifestyle and caregiving needs.

“This is the most unfortunate situation we hear about,” says Darr. “Certain family members may have access to an elderly relative’s financial documents or accounts.” Darr says some who provide caregiving may feel entitled to money that isn’t theirs, and others might be relatives facing dire financial circumstances who see an opportunity to rectify their own troubles.

“There can be unfortunate situations where family members who were considered trustworthy, suddenly withdraw funds from the elderly family member’s account.” Darr says quite often, “family members trying to obtain the funds prey on the emotions of those they should be looking out for.” Darr says it’s important that multiple people can monitor financial activities for an elderly person who may be susceptible to such exploitation.

Convincing an elderly parent of the need for oversight

Family members with good intentions should talk to elderly family members or friends about the benefits of having at least one more set of eyes to help them keep tabs on their finances. It can be especially important if cognitive abilities become an issue for the person being approached.

This conversation isn’t always easy. “It’s important to acknowledge that you want the elderly individual to continue to live freely and conduct their own affairs, and that you think it would be helpful if you and/or another trusted person stepped alongside to provide support,” says Darr. “Be open about sophisticated scammers that are looking to take advantage of those who have been diligent in building wealth and saving it. Express your desire to help protect the wealth they’ve worked hard to accumulate.”

Creating a plan that maps out how to proceed together can be beneficial. Help assure them that your interest is that all involved parties agree on a strategy to manage money going forward, and that you plan to continue to work toward their benefit.

New legislation aims to address financial exploitation

Congress is considering legislation that would allow most types of investment firms to postpone a requested redemption of a security or mutual fund if there are suspicions that an investor is being exploited. Known as the Financial Exploitation Prevention Act of 2023, the bill is designed to give banks and other financial institutions more tools to protect seniors from fraudulent activities in their accounts. Specifically, it allows institutions to delay redemptions by up to 25 days (instead of the current seven days) if fraudulent activity is suspected.

“Often, victims don’t even realize they are being taken advantage of,” says Darr. “This legislation puts more protection measures in place.” Yet Darr notes it is just one step to help protect older Americans. “We need to continue to find ways to mitigate the risk of fraud, including those who have elderly family members to protect.”

Steps to help older family members safeguard their financial lives

Consider implementing these steps to help reduce the risk of elderly family members falling victim to fraud:

- Name a financial power of attorney or successor trustee to make financial decisions if the time comes when one is unable to do so.

- Authorize a trusted contact who can be reached by banks, investment firms and other financial institutions if suspicious activity is detected. The designated individual can be given “view-only” access to the account to provide additional oversight.

- Consider arranging for a credit monitoring service to provide up-front monitoring of credit scores and to provide insurance against identity theft losses.

- Shred all documents with personal information, such as bank and investment statements and tax forms.

- Never share passwords to online accounts or other sensitive information such as Social Security number over the phone or online.

- Advise older family members to consult with a trusted attorney, advisor or other family member before signing documents.

- Build a relationship with a banker who can recognize unusual activity that may occur in accounts held by elderly customers.

- Remind elderly family members that it’s okay to say “no” to a financial product or a new investment relationship – there is rarely any need to rush such decisions.

- Contact the National Elder Fraud Hotline to report suspected elder fraud.

Professional guidance can be critical

While it’s not possible to completely eliminate the risk of fraud, the steps listed above are worth exploring to try to minimize the potential of a negative event occurring.

It can also be beneficial to develop a relationship with a banker and financial advisor to help monitor financial activity. It provides another level of asset protection for an elderly person who may be susceptible to fraudulent activities. They can also be helpful in facilitating family discussions about financial matters.

Speak with your banker or financial advisor to put a plan in place to help mitigate the risk of elder fraud for you or someone you know.

Tags:

Related articles

Financial planning tips for the sandwich generation

Three tips on how to keep working toward your financial goals while supporting your children and aging parents.

Protecting your parents’ finances: 6 steps to follow when managing their money

If your parents are getting older, they might need some help taking care of their finances. This checklist will help you get the process in motion when it’s time to take over.