Key takeaways

Capital gains tax is a tax on any profit you make from the sale of a capital asset, such as property or equities.

Capital gains and/or losses may be either short-term (held less than one year) or long-term (held one year or more).

Where you have realized capital gains, the capital gain tax rate you pay depends on whether the gain is long-term or short-term, as well as on your income level.

Implementing strategies such as tax loss harvesting and planned charitable giving as part of your overall tax plan may be able to help you lower your overall tax liability.

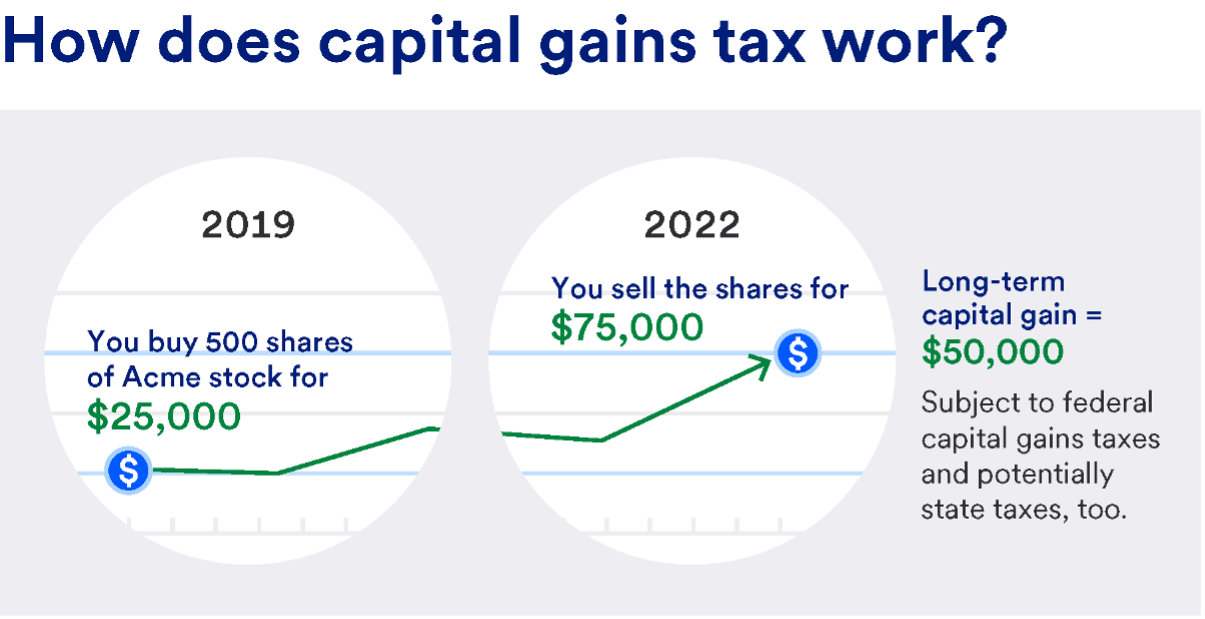

Despite market turbulence over the past year, many investors will have taxable capital gains at year-end. What is capital gains tax? You have a taxable gain when you sell a capital asset—such as shares of a publicly traded company on a stock exchange—for more than your total cost basis (what you paid for it, plus or minus any adjustments).

For example, if you bought 500 shares of Acme Co. stock in 2019 for $25,000 and you sold those shares this year for $75,000, your long-term capital gain would be $50,000, assuming there are no related expenses. That $50,000 in profit will be subject to federal capital gains taxes, and depending on where you live, potentially state taxes as well.

“A financial professional can help you build a larger financial planning strategy that identifies risks and opportunities while mitigating your tax liability.”

Dan Willing, vice president and senior wealth planner, U.S. Bank Private Wealth Management

Capital gains tax and financial planning

Taxes on capital gains are by no means inconsequential. The federal government collected about $170 billion in capital gains tax revenue in 2018, according to a Tax Foundation analysis of Congressional Budget Office data.

Having a tax strategy and understanding your tax exposure is therefore an important part of any good investment plan. Specific to capital gains taxes, it’s important to evaluate both gains and losses that you may have accrued throughout the year and be aware of steps that you can take to reduce that tax liability before year-end.

While it’s important to discuss your tax situation with your accountant and/or tax attorney, you should also involve your financial professionals in your tax discussions throughout the year and particularly near year-end. “While we don’t provide tax advice, we can help you build a larger financial planning strategy that identifies risks and opportunities while mitigating your tax liability,” says Dan Willing, vice president and senior wealth planner at U.S. Bank Private Wealth Management.

What is your capital gains tax rate?

One of the first things to understand about capital gains is that the federal tax rate can vary depending on the circumstances. Even if you and your neighbor both sold the same number of shares of Acme Co. stock, the two of you may owe very different amounts in capital gains taxes. That’s because the federal capital gains tax rate is determined by two factors: your income bracket and the amount of time you held that asset.

Say you held that Acme Co. stock for one year or longer. The proceeds would be taxed at the long-term capital gains rate, which is lower than the tax rate for short-term capital gains, which is taxed at ordinary income tax rates. Depending on your tax bracket, you could owe 0%, 15% or 20% on capital gain, regardless of whether you own the asset for one year or 10.

If your neighbor held that Acme Co. stock for less than one year, the proceeds would be taxed the same as ordinary income, meaning that they could end up paying as much as 37% depending on their federal income tax bracket.

Gains from the sale of an investment also can trigger the net investment income tax (NIIT), a 3.8% federal tax that layers on top of federal capital gains taxes. Individuals who exceed a certain threshold of modified adjusted gross income, or MAGI ($200,000 for single filers and $250,000 for married couples filing jointly) are subject to NIIT on that gain.

Some states also charge capital gains taxes on top of what they owe the federal government. As an example, if the top individual income tax rate in Minnesota is 9.85%, that rate applies to W2 income and any short or long-term capital gains. In comparison, a state such as Florida has no income tax and no capital gains tax. So, for someone who lives in Minnesota and is planning to retire to Florida, it may be beneficial to wait to sell investments.

How to reduce capital gains tax

Individuals can take a variety of steps to reduce or offset capital gains. “Once again, it’s important to look at capital gains from a broader financial strategy perspective,” says Willing. “In some situations, it can even make sense to harvest gains now when there are opportunities to offset those gains with losses.”

Tax loss harvesting. No one likes to sell investments at a loss. However, there can be tax benefits to selling investments in a down market. Hold period is once again important. First, long-term capital gains need to be netted with long-term capital losses, and the same with short-term gains and losses. Then, the total net long-term capital gain or losses is netted with the total net short-term gain or loss. If you have a loss that is greater than your gains at the end of all this netting, then you can carry that loss forward to use in future years. However, where you have a net capital loss for the year, the IRS does allow you to deduct $3,000 in capital losses from your ordinary income.

Donate appreciated assets to charity. Rather than making a cash donation to a charity or donor advised fund, consider donating appreciated stock. The net amount is the same, but you won’t have to pay capital gains tax or NIIT on the appreciated value of the stock, and qualifying tax-exempt charities are not taxed on gains when they sell that stock.

Create a tax-diversified investment portfolio. Consider adding investments that are more tax friendly. For example, municipal bonds issued in the state where you live typically generate income that is exempt from both federal and state income taxes. Treasury bonds are also exempt from state taxes. The returns tend to be lower than corporate bonds, but they create a tax-free income stream. Some insurance products, such as variable index products, are also advantageous from a tax perspective.

Section 1202 Small Business Stock Gain Exclusion. For those who own a small business or shares in a small business of (a qualifying C corporation with less than $50 million in assets), the IRS allows an exclusion of up to $10 million of long-term capital gain if shares are held for at least five years.

How to calculate capital gains taxes

When calculating capital gains taxes, there are different expenses that you may have paid over the hold period that can offset a gain. For example, you can include transaction fees or taxes paid on reinvested dividends to calculate the cost basis on the sale of an asset, which reduces the overall gain.

The sale of a home automatically includes a $250,000 exclusion on gain for an individual and $500,000 for a married couple filing jointly. If you net value above that cap, you could include a variety of factors in your cost basis outside of the original purchase price to help offset the gain. Some examples include money paid out for a realtor’s commission, qualifying renovations, repairs and improvements to the home.

“You never want taxes to be the tail that wags the dog on investment strategy,” Willing says. “Regardless of whether you’re selling investments for a gain or a loss, it needs to fit into a larger investment strategy.” He adds, however, that generating losses and carrying them forward can make financial sense for many investors.

“Tax laws are very complex, nuanced, and in some cases, downright odd. So don’t try to do it on your own,” says Willing. “It’s wise to work with your financial professional, accountant and tax attorney to create a tax strategy that makes sense for you.”

Learn how our approach to wealth planning can help you see a full view of your financial picture.

Tags:

Related articles

What is tax loss harvesting?

If you sell an asset for profit, such as property or a business, that profit will be subject to capital gains tax. Tax loss harvesting is a strategy that can help you manage and potentially reduce your tax liability.

Impact of taxes on your investment returns

Understanding your portfolio’s tax characteristics is a step toward more efficient investing.