Business services overview

Find innovative payments and cash management tools.

Already have a U.S. Bank business checking account? Pay bills faster and easier with this digital payment solution.

eChecks are electronic checks that contain all of the same elements as a traditional paper check, including: routing number, account number, signature, amount, recipient and check number. It’s simply a check delivered by email that can be used wherever and whenever checks are accepted.

eChecks are a low cost digital solution. No need to purchase envelopes and stamps. Create and send your eChecks digitally, and your recipients can choose how they want to recieve their payments from several available options.

The sender links their bank account to the Deluxe Payment Exchange (DPX) platform, enters payment information into DPX and hits send.

DPX sends the payment notification to the recipient by email.

The recipient is notified of the payment via email, clicks the link to view the remittance data in DPX and then chooses how to access the funds.

As an electronic payment method, Deluxe eChecks save you money by eliminating the need for paper check stock, envelopes and stamps. Find a payment solution that’s right for your business.

|

Quantity |

50 |

100 |

250 |

500 |

1000 |

|---|---|---|---|---|---|

|

Price |

$30.00 |

$55.00 |

$125.00 |

$245.00 |

$480.00 |

|

Each |

$0.60 |

$0.55 |

$0.50 |

$0.49 |

$0.48 |

Quantity

Price

50

$30.00

100

$55.00

250

$125.00

500

$245.00

1000

$480.00

Quantity

Each

50

$0.60

100

$0.55

250

$0.50

500

$0.49

1000

$0.48

When you include the soft costs of employee time, industry experts such as The Aberdeen Group estimate that each check can cost a business up to $7.78 to create, stuff, mail, and track. Sending an eCheck takes just seconds!

Senders purchase eChecks through U.S. Bank or Deluxe Checks and then login to the Deluxe Payment Exchange (DPX) to fill them out. Then, send a single check or a multiple batch, enter an email address and hit “Send”. Senders can also link their eChecks to common accounting software like QuickBooks® for additional time savings and convenience.

eChecks are the next evolution to paper checks. eChecks function like traditional checks, but they’re delivered to the recipient digitally. Save yourself rush payment charges the next time you run out of paper checks or have a payment that needs to be received overnight. Online ordering, fulfillment, and delivery means you can order, create, send, and confirm delivery of a Deluxe eCheck within minutes, with no additional cost.

Setting up a DPX account only takes a couple of minutes, however, before you can start sending eChecks, you’ll need to verify that you’re authorized to access the checking account you added. This verification process can take minutes or up to 48 hours, depending on the complexity of the required verification.

Deluxe eChecks are sent digitally so your payment can reach your recipient within seconds of being sent.

Yes, Deluxe eChecks are exactly like any other check accepted by your bank. If your bank has questions, they can simply follow the directions on the check to verify its authenticity.

Deluxe eChecks have multiple security features to minimize the chance of fraud.

Platform Security- Deluxe DPX servers are housed in a secure, camera-monitored environment. By employing an intricate system of checks and balances, they control who can access their records. Deluxe eChecks are not sent as an attachment but are retrieved via a link from their secure DPX system.

Organizational and Financial Controls- Your company’s eCheck Administrator can designate who can log into the DPX account and what they can do within the account. These permission levels include options such as create checks and/or sign and send checks.

No need to store sensitive financial information- All you need to send eChecks is your recipient’s email address. There is no need to obtain recipient’s sensitive financial information, so you don’t have to worry about keeping someone else’s bank information secure.

Deluxe Payment Exchange (DPX) is a digital payment platform that U.S. Bank utilizes to enable our customers to make digital eCheck payments for business purposes. The platform offers the sender the ability to disburse an eCheck payment (including remittance information and attachments) through email.

The QuickBooks integration setup takes less than 5 minutes and can save you hours by reducing time-consuming accounts payable processes. Once logged into the Deluxe Payment Exchange (DPX), select the Add-ons option from the left menu. Follow the set-up instructions or call Deluxe Support to be walked through the set-up.

If you use QuickBooks Online or QuickBooks Desktop, simply download the free Deluxe eChecks add-on for QuickBooks to get started. Installation is fast and easy. Create check transactions in QuickBooks like you normally do. Once integrated, Deluxe will pull eCheck transactions from Quickbooks and send the eCheck & remittance. No double entry required. After an eCheck is created, your check register will be populated with the check numbers.

Deluxe eChecks integrate with almost every other accounting software available. Create check transactions in your accounting software like you do today. Simply export a .CSV file containing the email addresses and remittance data for your outgoing checks. Upload the file to your Deluxe eChecks account, and deliver your payments within seconds. If you need assistance, Deluxe Support can walk you through your integration.

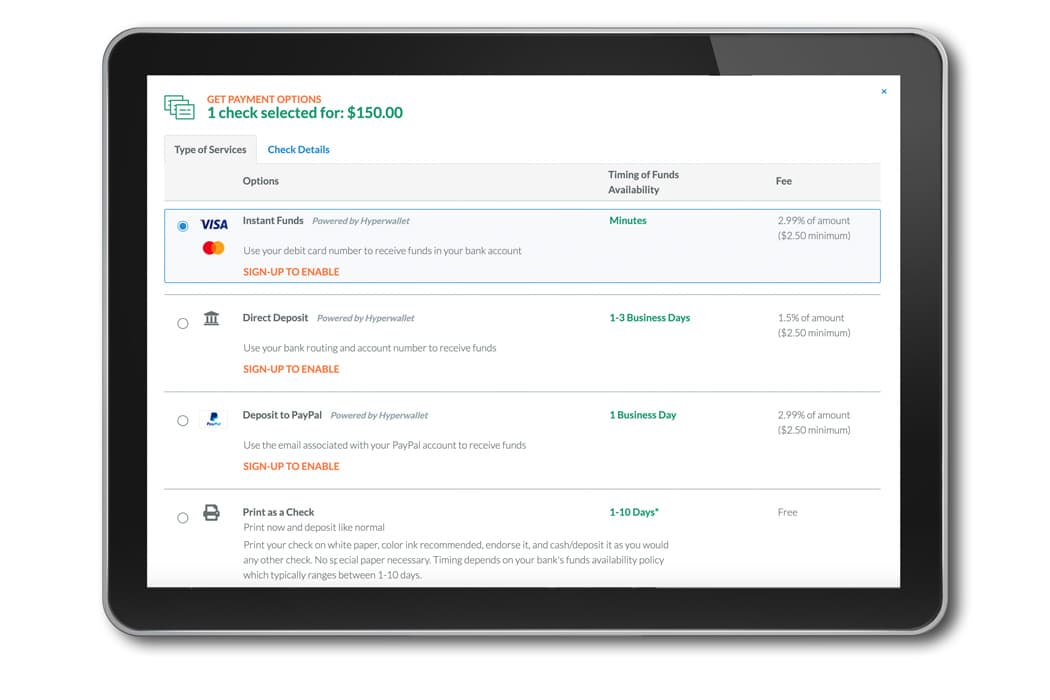

eCheck recipients click the secure link within the email to retrieve the eCheck from the Deluxe Payment Exchange (DPX), a secure online portal, and then print and deposit like any other check. Or, they can set up an account in DPX and transfer the eCheck funds directly to their bank account or PayPal account for a fee.

Recipients can print the check for deposit using a standard printer.

A Deluxe eCheck is deposited just like any other check-at a bank branch, through an ATM or using Remote Deposit Capture on a smartphone.

When available, recipients can choose eDeposit Services within DPX and have their funds available in minutes. The recipient can deposit directly to a bank account, a debit card or a PayPal account. Recipients pay a small fee that is conveniently deducted from the eCheck amount.

Send checks instantly.

Contact eChecks customer support.

Use your Deluxe Payment Exchange (DPX) Account.