Key takeaways

Job growth in the U.S is slowing but remains solid despite challenges.

At the same time, the nation’s unemployment rate hovers near historic lows.

The Federal Reserve closely scrutinizes job market trends as it calibrates monetary policy to combat inflation.

The U.S. employment market continues to show resilience despite a slowing economy. In April, nonfarm payroll employment grew by 253,000, exceeding analyst estimates and maintaining a pattern of steady job growth. At the same time, the unemployment rate fell to 3.4%, continuing to hover near 50-year lows.1

The state of the employment market in the U.S. is a key focus of the Federal Reserve (Fed) in its effort to slow U.S. economic growth to combat persistent inflation. Fed officials have clarified that one objective for achieving lower inflation is tempering wage growth. A strong jobs market is more likely to push wages higher, which could contribute to higher inflation.

The job market’s continued strength has been somewhat surprising in what appears to be a slowing economy, with consistently low unemployment and solid job growth. This may reflect the unusual environment that stems from the economic recovery that unfolded in the wake of the COVID-19 pandemic. The economy may still be in an adjustment stage after this unusual period.

What do recent trends tell us about the direction of the job market? How might the Fed react to these trends as it sets monetary policy going forward? Does today’s job market provide any guidance for investors as they set expectations for the rest of the year?

Job growth – solid but slowing

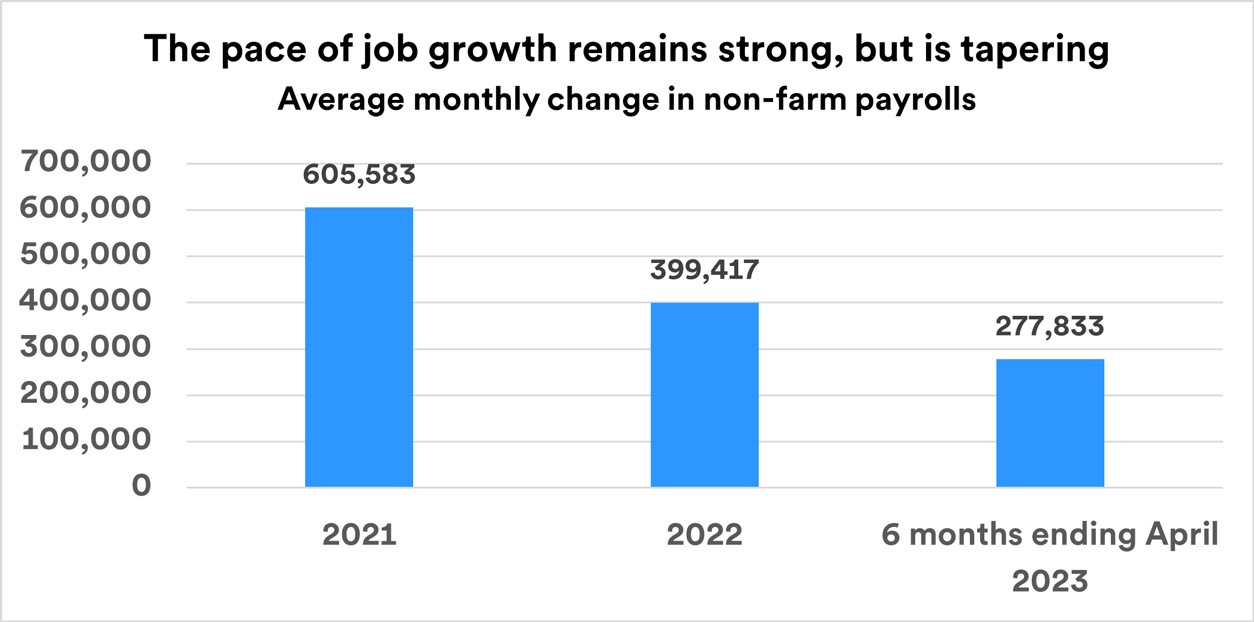

Rapid job growth was a feature of the economy throughout 2021 and 2022. The U.S. Bureau of Labor Statistics reported that for all of 2022, non-farm payrolls grew by an average of 399,000 jobs per month. While that represented a slower pace than 2021’s rapid job growth, which topped 605,000 per month, recent jobs numbers remain impressive.2 While the most current data still reflect a solid job market, the declining pace of growth may indicate a weakening trend.

Source: U.S. Bureau of Labor Statistics

The unemployment rate, which in April declined to 3.4%, has remained relatively stable since early 2022. The job market’s ongoing strength comes despite the economy’s much slower pace. Gross Domestic Product (GDP), a measure of the nation’s economic performance, grew by 2.1% in 2022, significantly slower than the economy’s 2021 growth rate of 5.9%. GDP slowed further, to a 1.1% annualized rate, in the first quarter of 2023.3

In addition, job openings are beginning to taper off. In March, the number of available jobs dropped to 9.6 million, the lowest figure since April 2021. Nevertheless, with the number of Americans looking for work at 5.3 million, there are 1.8 jobs for every unemployed person seeking work.4

“Improving labor participation is one way to address the tightness in the labor market that’s propping up wage gains.”

Matt Schoeppner, senior economist at U.S. Bank

The trends of recent jobs reports, while still showing a reasonable level of new job creation, appeared to signal the effects of the Fed’s efforts to slow the job market. The Fed is focused, in part, on rising labor costs, which can influence broader inflation measures. “Wage growth pressures appear to be easing,” says Rob Haworth, senior investment strategy director for U.S. Bank. “We’re seeing more people starting to re-enter the workforce. If these trends continue, that has the potential to help push wage growth down in the months to come – a positive trend for inflation.”

The labor force participation rate is considered a key employment measure. It represents the percentage of the population currently in the workforce. This number is considered by some analysts to be lower than desired. It showed modest improvement in December, and again in February and March. The labor force participation rate now stands at 62.6%, in April 2023, unchanged from March, but a modest uptick from January and February’s labor force participation rate.1 “Improving labor participation is one way to address the tightness in the labor market that’s propping up wage gains,” says Matt Schoeppner, a senior economist at U.S. Bank.

Continuing job market strength may seem surprising given the Fed's efforts to slow the economy. “While the Fed is taking aggressive action, it doesn’t necessarily have an immediate impact across the broader economy,” says Tom Hainlin, national investment strategist for U.S. Bank. “The workforce has undergone a number of changes since COVID-19, and adjustments are still being made.” Notably, the total number of working Americans (based on Bureau of Labor Statistics data) only recently recovered to the peak level it reached before COVID-19 began in early 2020. “What’s lacking is the growth in jobs we would normally have experienced if the pandemic had not occurred,” notes Hainlin.

Additionally, some industries still face a shortfall of workers after a number of employees left their positions or were laid off during the height of the pandemic. “Some jobs haven’t come back as quickly as we hoped,” says Haworth. This is evident in several industries, particularly in the services and healthcare sectors, where many jobs remain unfilled.

What does the job market tell the Fed?

The Fed raised its short-term fed funds target rate from near 0% before March 2022 to a range of 5.00% to 5.25% by May 2023. Though Fed officials indicated there could be a pause in rate hikes, they also dampened expectations of any near-term interest rate cuts. The tightrope the Fed is walking is whether it can maintain its policy stance, designed to dampen inflation, without triggering a recession.

One reason the Fed moved so aggressively to raise interest rates, according to Schoeppner, is that the central bank was “late to the game in addressing the inflation issue, which first flared in early 2021. Despite significant interest rate hikes, we’ve only seen the tip of the iceberg in terms of how the Fed’s actions impact business and consumer spending.” In other words, it takes time for Fed policies to work their way through the economy to create real impact.

Challenges in the labor market

The job market’s continued strength confronts the Fed with a conundrum, according to Haworth. “The Fed’s focus is on how much wages will grow. Can the Fed meet its objective of full employment while bringing inflation down?” asks Haworth. Wage growth has slowed in recent months, but in April, the 12-month change in wages rose modestly to 4.4%, compared 4.2% at the end of March.1

Source: U.S. Bureau of Labor Statistics

Schoeppner notes that the Fed’s target annual wage growth rate is in the 3.5% range. One key to achieving that could be improvement in the labor participation rate. “There’s still a need to lure more workers back to the job market,” notes Schoeppner. Given the recent, rapid pace of job creation and the number of available jobs outpacing the number of workers, Schoeppner says labor costs remain elevated, which is likely a consideration as the Fed considers further rate hikes.

A longer-term concern is productivity, which measures the level of output in comparison to input, such as capital or labor. The onset of the information age resulted in huge advancements in productivity, but the environment has changed. “We still see improvements in productivity,” says Hainlin. “But the advancements aren’t creating as much of an impact in generating jobs and economic growth as they once did.” Hainlin says it raises questions about expectations for future economic growth if both productivity rates and the size of the labor force advance more slowly.

What to expect going forward

If the economy slows further, the job market is likely to weaken as well. Haworth notes that because rate hikes take time to work their way through the economy, we may continue to see the number of new jobs created slow in the coming months. Several large companies, many in the technology sector, recently announced sizable layoffs. Signs emerged that jobless numbers could soon be headed higher. “After edging lower in January, initial jobless claims have since trended meaningfully higher,” says Schoeppner. “Jobless claims are not yet at a worrisome level, but the data seems to bear out some of the headline layoff announcements we’ve been hearing lately.” If so, it may convince Fed policymakers that they can s curtail interest rate hikes in the months ahead. The Fed next considers its policies in the mid-June 2023 meeting of the Federal Open Market Committee.

Talk with a wealth professional if you have questions about your personal financial circumstances or investment portfolio.

Tags:

Related articles

Is the economy at risk of a recession?

The Federal Reserve is focused on fighting inflation with aggressive policy moves intended to slow consumer demand. Does this put the economy at risk of a recession in 2023?

Financial planning considerations when inflation is high and interest rates are rising

The resurgence of inflation combined with rising interest rates creates challenges for investors. These tactical considerations can help you navigate today’s unique market dynamics.