Key takeaways

There are signs that Federal Reserve monetary policy is helping reduce inflation in the U.S.

The pace of rising inflation continues to slow after peaking last summer.

Yet concerns persist over ongoing inflationary pressures.

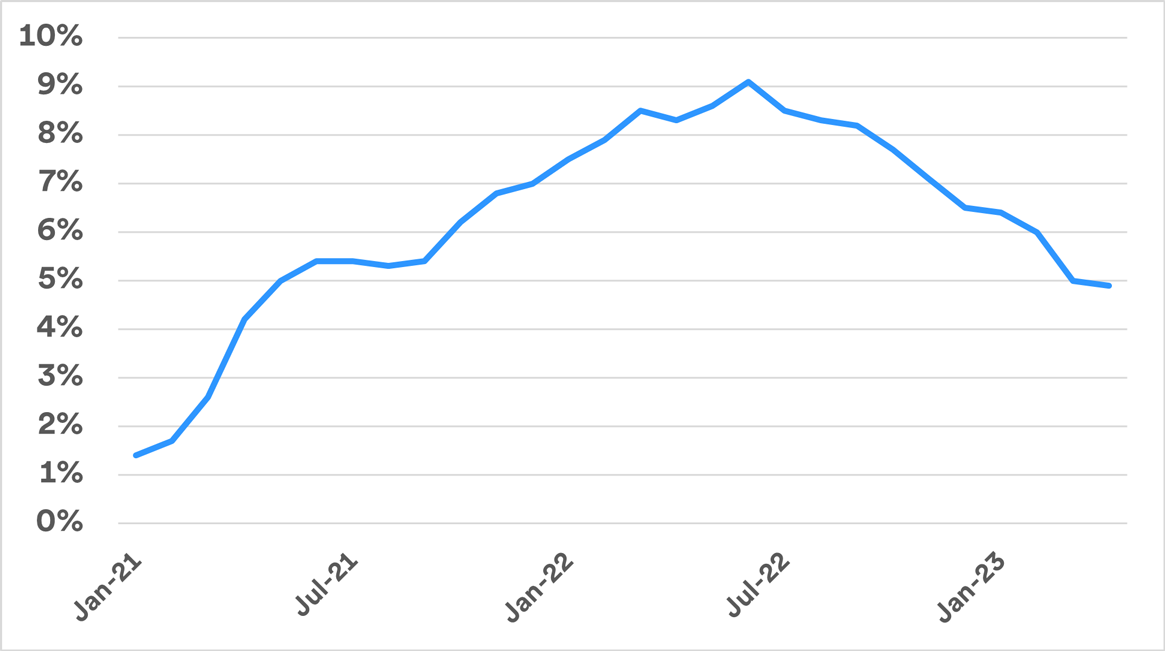

After peaking in June 2022, inflation’s pace slowed. By the end of 2022, the 12-month CPI reading was down from a high of 9.1% to 6.5%, and favorable trends continued in the opening months of 2023. For the 12-month period that ended in April 2023, CPI fell to 4.9%. It represented the slowest pace of inflation over a 12-month period since April 2021.1

Inflation trends – 2021-2023

Consumer Price Index year-over-year2

Source: U.S. Bureau of Labor Statistics, U.S. Bank Asset Management Group

Another important measure, that of “core” inflation (excluding the volatile food and energy sectors) rose 5.5% for the 12 months that ended in April. This was only a slight drop from March’s 5.6% reading. Prices for items such as transportation services, shelter and new vehicles contributed the most to the elevated inflation reading.

A separate government report on producer prices (what companies pay for goods and services) showed more encouraging news about inflation’s direction. The Producer Price Index for April, rose by just 0.2%,. For the past 12 months, PPI stands at 2.3%. However, core PPI (again, excluding food and energy measures) rose 3.4% over the 12 months ending in April.3

The Federal Reserve (Fed) remains committed to lowering inflation through monetary policies, an approach it began in early 2022. This includes significant increases in short-term interest rates and an end to its regular investments in the bond market, a strategy known as “quantitative easing.” The Fed’s current stance represents a dramatic change from its “easy money” approach that was in place prior to 2022.

When inflation peaked in June 2022, it represented the largest jump in the cost-of-living since 1981. Inflation’s gradual decline since that time indicates the progress resulting from Fed policies. The Fed’s efforts are aimed at achieving a 2% target inflation range. Fed Chair Jerome Powell has made clear that despite the favorable inflation trends, the Fed remains committed to achieving its long-term 2% CPI target.4

As the inflation threat evolves, investors may have questions that include:

- How long will higher inflation persist?

- Are there risks that inflation could reverse course in 2023 and rise again?

- How should I position my investments given today’s environment?

Why inflation matters

Inflation represents increases in the cost-of-living over a given period. It’s a measure of how much purchasing power is lost due to rising prices. CPI is the commonly cited statistic used to illustrate inflation on a broad level. CPI provides a measure of prices of goods and services that meet the primary needs of consumers, including food items, transportation, housing and medical care. Recent CPI data indicates that inflation remains a significant concern.

The U.S. Commerce Department’s Personal Consumption Expenditure price index, or PCE, is another important inflation gauge, and when excluding volatile food and energy prices, is considered the U.S. Federal Reserve’s preferred inflation measure. As the country’s central bank, the Fed is mandated by Congress to promote full employment, stable prices and moderate long-term interest rates, so watching inflation is essential to their function.

The broad PCE inflation measure rose 4.2% for the one-year period ending in March, a notable improvement from its June 2022 peak reading of 7.0%, which was the highest level in more than 40 years. March PCE’s number also came in considerably lower than the 5.1% PCE figure for February. The narrower “core” PCE gauge (excluding the volatile food and energy categories) showed a 4.6% inflation rate for the 12 months ending in March, only a slight improvement from February’s 4.7% reading.

The evolution of the current inflation cycle

Inflation often occurs due to an imbalance between supply and demand across specific segments of the economy. In the initial stages of the current inflation cycle in early 2021, the imbalance affected items such as lumber (reflecting significant new construction and remodeling), airfare, lodging and energy costs. “In this unusual economic environment, people spent more on specific items, driving up demand,” says Tom Hainlin, national investment strategist at U.S. Bank Wealth Management.

Some of the difficulties were also attributed to supply chain disruptions. For example, a shortage of semiconductor chips, now a key component in the production of motor vehicles, meant fewer cars at automobile dealerships. The COVID-19 pandemic also played a role in the return of inflation, according to Rob Haworth, senior investment strategy director at U.S. Bank. “Many of our supply constraint issues were the result of pent-up demand for goods and services. Haworth notes the slowing of inflation after it peaked in June 2022 indicates that there’s been demand normalization.

International issues contributed to ongoing inflation in 2022, including the outbreak of the Russia-Ukraine war (which affected energy and agricultural supplies) and China’s periodic manufacturing delays due to a now repealed “zero COVID” policy that temporarily shut down selected cities. While some challenges remain related to these issues, the markets have made adjustments in response.

Will higher inflation continue to recede?

The Fed’s major 2022 policy shift demonstrated an intense focus on tempering inflation’s spike. Interest rate policy played a significant role. After maintaining a near zero-interest rate policy since early 2020, the Fed raised rates over the course of 2022 and into early 2023. The federal funds target rate, the primary interest rate the Fed controls, was set at 5.00% to 5.25% at the Federal Open Market Committee’s (FOMC) May meeting. Fed officials indicated that they may hold rates at current levels to assess inflation developments going forward.

“One key factor to watch is which companies can adjust their prices to reflect the inflationary environment and maintain earnings growth.”

Rob Haworth, national investment strategist at U.S. Bank Wealth Management

Another aspect of the Fed’s monetary tightening strategy was to end its “quantitative easing” program. Under that program, the Fed purchased $120 billion in U.S. Treasury and mortgage-backed bonds each month to help add liquidity to the market and boost the economy. Now, the Fed is trimming $95 billion per month from a balance sheet that had grown to nearly $9 trillion in assets.

Even with these dramatic steps, there was a delayed reaction to the Fed’s monetary tightening measures, according to Haworth. “Fed officials know that monetary policy works with long and variable lags,” says Haworth. “Each rate hike takes 6-12 months to work its way into the economic engine.” That, in part, explains the limited impact the Fed’s actions had on inflation until late 2022.

Haworth says “success, as measured by the Fed, is still out in the future, but we’re on the right path.” Nevertheless, says Haworth, investors can expect the Fed’s tighter monetary policy to remain in place for some time. Fed Chair Powell seemed to confirm this expectation in comments made after the Fed’s May 2023 rate hike. “It will take some time (for inflation to slow) and in that world…it would not be appropriate to cut (interest) rates and we won’t cut rates.” “Even so, Haworth believes it is likely that the Fed is close to the peak fed funds rate it is likely to set unless current favorable inflation trends reverse course.”

Key areas to watch – energy, food and wages

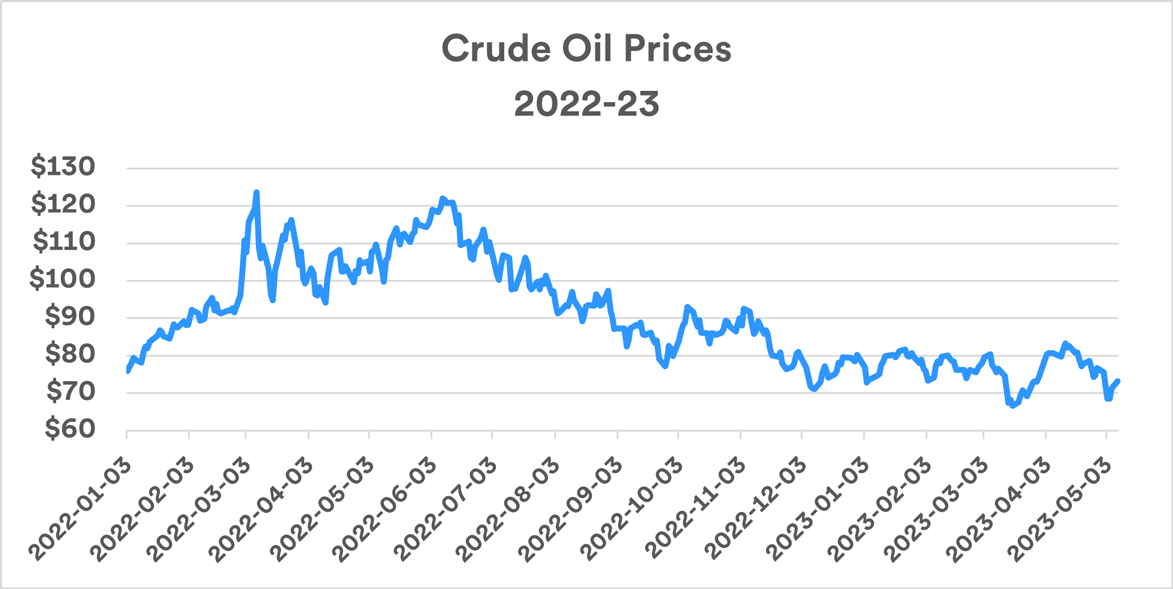

During inflation’s rise, various factors contributed to the surge in the cost of living. Perhaps the most notable when inflation peaked in June 2022 was the energy sector, where costs rose 41.6% over the previous the 12-month period. The situation has improved significantly since then, with the 12-month change in energy costs showing a decline of 5.1% ending in April 2023.2 Oil prices are a primary driver of energy costs, and they fell from more than $120/barrel in March 2022 to below $70/barrel in early May, 2023. Although production cuts announced by the Organization of Petroleum Exporting Countries (OPEC) in early 2022 led to a temporary upturn in oil prices, they fell again in April and May.

Source: Federal Reserve Bank of St. Louis, West Texas Intermediate Crude Oil – Cushing, Oklahoma. As of May 8, 2023.

Like energy costs, food prices are another “non-discretionary” expense for households. In April 2023, food prices rose 7.7% over the previous 12-month period, a drop from March’s reading of 8.5%, but still considered elevated. Although housing market activity has slowed in the past year, housing costs were among the largest contributors to the still high inflation reading in April, rising 8.1% over the previous 12 months. Shelter costs remain a chief Fed concern and will be one of the data points drawing scrutiny.

Wage trends represent another category that generates significant interest. “Wage growth started to slow in recent months,” says Haworth. “If the economy improves but wage growth remains steady while the labor market holds its ground, that would be considered close to an ideal scenario by the Fed.” Wage growth ticked slightly higher in April, up 4.4% over the past 12 months. One reason the labor market seems to be strong is that, according to the Bureau of Labor Statistics, there are 9.6 million job openings, representing 1.8 positions for every American currently unemployed who is looking for work.6 The supply-demand imbalance for labor may help keep wage gains higher-than-normal. “As it tracks inflation trends, the Fed continues to closely monitor wage growth,” says Haworth.

How to manage inflation in your financial life

Inflation’s resurgence and a significant upturn in interest rates in 2022 resulted in negative stock and bond market performance. The environment so far in 2023 is more favorable but remains challenging given the persistent nature of inflation and the Fed’s response. In the bond market, a major question is whether interest rates will continue to rise. In 2022, bond yields moved up significantly, reflecting the high inflation environment. In October, the yield on the 10-year U.S. Treasury exceeded 4% for the first time since 2010. It topped 4% again in March 2023, but interest rates fell since then.

“Interest rates across the bond market are still higher than they were before the Fed changed its policy in 2022,” says Haworth. “However, bond yields retreated recently. If further Fed rate hikes occur, it seems reasonable to expect that interest rates in the bond market will rise further, creating a bit of risk for those putting money to work in fixed income after yields have fallen.” This is because when bond yields rise, the market value of existing bonds declines.

Haworth says the near-term outlook for stocks is also clouded. He notes that higher interest rates could put more pressure on corporate earnings in 2023. “One key factor to watch is which companies can adjust their prices to reflect the inflationary environment and maintain earnings growth.” Haworth says that higher borrowing costs could also impact profit margins for some companies. That could contribute to continued stock market volatility. However, stock market were off to a solid start in 2023, though volatility persists.

Haworth recommends that investors assess their portfolio’s inflation-sensitivity. “We look for opportunities to tilt equity holdings toward assets that are positively correlated to inflation.” Among the more attractive investment areas are infrastructure-related stocks, which tend to have pricing that adjusts to the inflationary environment. These include utilities, transportation, communications, midstream energy companies and pipelines.

It may be beneficial to consider whether any adjustments are needed to your portfolio. Generally, a consistent long-term strategy tends to work to the benefit of most investors. That should preclude any dramatic changes in your asset mix as a response to the inflationary environment.

Take time to assess how inflation might impact other aspects of your financial plan. For example, if you have variable interest rate loans, consider locking in a long-term fixed rate on the loan. This may help you avoid future interest rate increases, which could result from the current inflationary environment.

Be sure to talk with your financial professional about what steps may be most appropriate for your circumstances.

Tags:

Related articles

Is the economy at risk of a recession?

The Federal Reserve is focused on fighting inflation with aggressive policy moves intended to slow consumer demand. Does this put the economy at risk of a recession in 2023?

How far will the market correction go?

With stocks slipping in and out of bear market territory, learn how the market correction and ongoing volatility could impact your investments.