Key takeaways

Persistent inflation and higher interest rates can affect your ability to meet your financial goals.

It may be a good time to review your financial plan to determine if adjustments are needed.

These strategies are potentially helpful if your financial plan calls for generating income or you're seeking capital appreciation.

Higher inflation (which peaked at more than 9% in June 2022 and remains at a higher-than-average 5% for the 12 months ending in March 20231) combined with elevated interest rates contributes to a challenging capital market environment for investors. If you’re considering adjustments to your financial plan, be sure to consider your financial objectives, time horizon and the level of risk tolerance you’re willing to assume. You won’t necessarily need to implement dramatic portfolio changes, but you may want to explore opportunities to better position your portfolio.

While dramatic changes are likely unnecessary, there may be opportunities to better position your financial plan to capitalize on evolving market dynamics.

“When prices rise at a 5-6% rate rather than the 2-3% to which people became accustomed, while wage growth is near 4% and many types of cash savings accounts pay much less, people lose purchasing power. Individuals at all wealth levels should consider how their assets are positioned considering that,” says Charity Babington Falls, managing director, head of wealth planning at Union Bank. “To avoid loss of purchasing power, you want to ensure your assets earn returns that keep pace or exceed the rate of inflation,” says Falls.

Re-assessing your current strategy can be important given how significantly the landscape shifted since early 2022. “It’s critical for people to consider the benefits of an updated financial plan given the realities of today’s economic and market environment,” says Falls.

Considerations for conservative investors with lower risk tolerance

If you’re trying to generate income to meet current cash flow needs, you may find yourself facing significant challenges in a higher inflation/rising interest rate environment. Here are two tactics to consider.

Gradually shift money out of cash

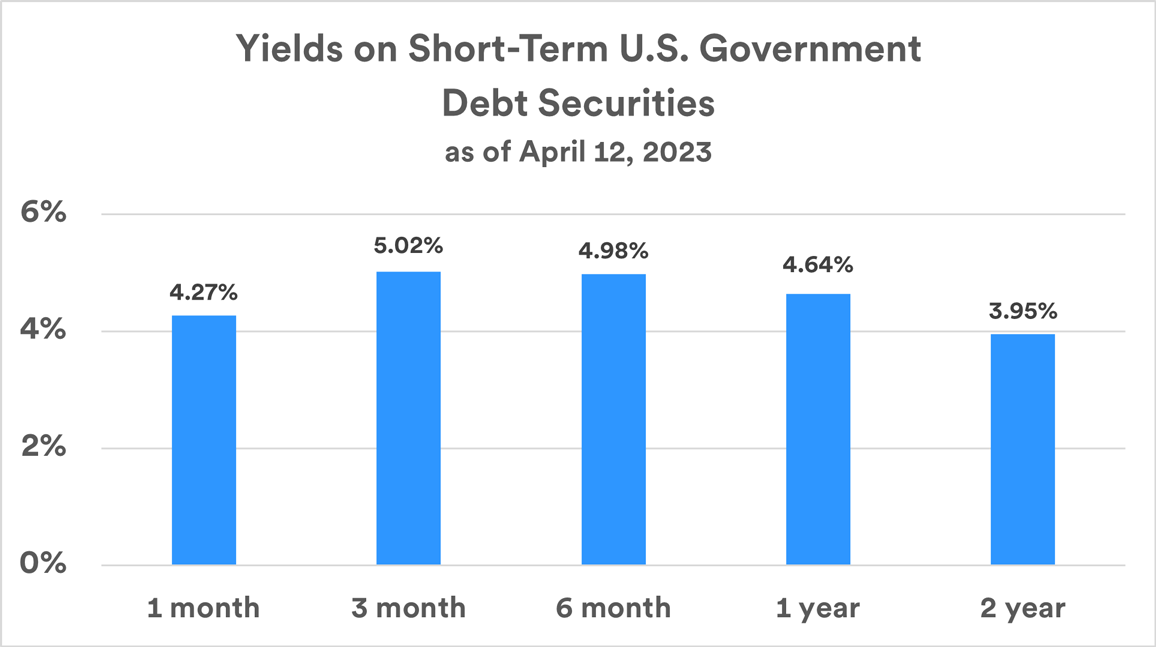

If you have significant cash holdings, it may be beneficial to move some of those dollars incrementally into certificates of deposits (CDs), U.S. Treasuries, bonds and other types of securities that offer more attractive yields. Certain cash-equivalent investments you choose won’t necessarily have the liquidity of a checking or savings account, but other options may offer a higher rate of return, or yield, mitigating some lost purchasing power owed to inflation.

Source: U.S. Department of the Treasury, Daily Treasury Par Yield Curve Rates.

Reconsider trust strategies

“In a rising interest rate environment, individuals looking to establish or modify wealth transfer strategies need to consider options that might not have been top-of-mind before,” says Falls. Certain wealth transfer strategies involving trusts, such as Grantor Retained Annuity Trusts (GRATs) and sales to Intentionally Defective Grantor Trusts, may in the current environment, produce less favorable long-term results. Certain other wealth transfer strategies, however, become more attractive as interest rates rise. Here are two examples:

Charitable Remainder Trusts

A Charitable Remainder Trust allows a person to contribute assets to a trust and retain the right (for life or a term of years) to receive an annual income stream from the trust. At the trust’s expiration, remaining assets pass to a designated charitable organization. The grantor of the trust can claim a charitable tax deduction at the time of the gift equal to the present value of the charitable remainder interest. “When interest rates rise, the growth rate of the assets and thus the value deemed to go to the charity increases because the calculation of the gift’s present interest uses the IRS’ prescribed interest rates. The higher the deemed value of the interest preserved for charity, the larger the grantor’s income tax deduction,” says Falls. That deduction is claimed when funding the trust.

Charitable remainder trusts can be supercharged if you contribute appreciated assets such as real estate or small business stock. In the year in which assets are granted into a trust, you can claim an income tax deduction equal to the present value of the charity’s remainder interest at the time of contribution. In addition, the trust can later sell contributed assets with no income tax liability. In summary, says Falls, “sales of appreciated assets in a charitable remainder trust can create a significant income tax deferral opportunity, provide an income stream, and later support causes about which you are most passionate.”

Qualified Personal Residence Trust

Like gifts to Charitable Remainder Trusts, gifts to Qualified Personal Residence Trusts (“QPRT”) are split between a retained portion and a portion treated as a taxable gift to another person. A QPRT is a trust in which a person contributes a primary or secondary residence in trust and retains the right to unfettered use of the residence for some period of time. At the end of the trust term, the home passes to the designated beneficiary of the trust (generally a child, grandchild, or a trust for the benefit of the child or grandchild). The strategy is a way to remove a major asset from the grantor’s estate. If the contributor to the trust wishes to remain in the home after termination of the QPRT, they can rent the home from the beneficiary at fair market value, potentially further reducing the size of the taxable estate (and thus estate taxes). The present value of the gift is determined by reducing the total value of the residence by the retained interest. When interest rates rise, the value of the retained interest increases, reducing the taxable gift to heirs.

“QPRTs have been out of favor for a number of years due to historically low interest rates,” says Falls. “However, with property values increasing since the financial crisis, those who funded QPRTs with appreciating real estate during the last rate spike in 2007 and 2008 are not disappointed in the outcome.” For example, an individual who funded a QPRT with coastal property worth $300,000 in 2007, in effect removed an asset from the taxable estate that is now valued at $3.5 million, potentially reducing an estate tax liability to heirs by more than $1 million.”

All wealth planning strategies should consider your specific goals, family dynamics and financial situation. Changes in the economy and markets, tax laws, and other external factors can also have a significant impact on how effectively strategies work when implemented. U.S. Bank and U.S. Bancorp Investments and their representatives do not provide tax or legal advice. Your tax and financial situations are unique. You should consult your tax and/or legal advisor for guidance and information concerning your specific situation prior to establishing any trust.

Considerations for aggressive investors with higher risk tolerance

If you seek to generate portfolio growth, you should be aware that today’s higher inflation, rising interest rate environment can impact the performance of various investments. Here are some tactical considerations to keep in mind:

Maximize 401(k) savings strategies

If you typically “max out” your contributions to workplace savings plans, you may be able to invest additional sums through employer matches and after-tax contributions for a current maximum of $66,000 ($73,500 for those 50 and older).

Consider Roth IRA conversions

A Roth IRA is a retirement vehicle funded by after-tax contributions that can grow tax deferred with the potential for future cash-free withdrawals. Significant amounts held in traditional IRAs and certain 401(k)s can be converted to a Roth IRA. Tax on appreciated value is due in the year the conversion occurs, based on ordinary income tax rates. Converting a 401(k) or traditional IRA to a Roth IRA is often more attractive during down market periods. This is because you convert an equal number of shares to the same investments, but the cost to do so (paying tax on the accrued capital gain) is reduced due to stock price depreciation. Once you convert a 401(k) or IRA to a Roth IRA, you generate tax-free growth of earnings for your retirement when inflation and/or taxes might be higher, provided you’ve met qualifying holding period requirements. However, many people assume they’ll be in a lower tax bracket after retirement,” says Falls. “Therefore, a careful analysis is imperative before electing to convert tax-deferred assets into a Roth IRA and paying income taxes today. You may determine the income tax cost today could be higher than the tax cost in the future if you are in a lower tax bracket.”

Additional steps to consider

Beyond the considerations mentioned above, there are other steps you may want to explore to adjust your financial strategy to adapt to an environment featuring elevated inflation, rising interest rates, and market volatility:

- Pay down credit card debt. Look for ways to eliminate debts with high interest rates (which may adjust upward) to avoid facing higher expenses associated with this type of borrowing.

- Seek more affordable borrowing options. If you can’t pay off all your debt, put a particular focus on reducing balances on higher interest loans and look to consolidate debts using a less expensive form of borrowing.

- Invest in your own growth. Pursuing education or experiences that can enhance your ability to boost earnings can be a valuable way to protect your long-term financial position.

- Harvest your eligible investment losses. Tax-loss harvesting is a strategy that may be used when selling taxable* investment assets such as stocks, bonds and mutual funds at a loss to help lower your tax liability. You can apply such losses against capital gains elsewhere in your portfolio, which reduces the capital gains tax you owe. *Note: Tax-loss harvesting does not apply to tax-advantaged accounts such as traditional, Roth, and SEP IRAs, 401(k)s and 529 plans.

Take action that’s appropriate for you

The current economic and market changes may not require dramatic alterations to your own asset mix or financial strategy. However, some adjustments may be worth considering. You’ll want to meet with your financial professional and tax advisor to discuss strategies that are most appropriate for you.

Tags:

Related articles

How to put cash you’re keeping on the sidelines back to work in the market

Don’t let market volatility and an uncertain economic outlook derail your disciplined investing strategy.

How do rising interest rates affect the stock market?

With interest rates continuing to go up this year, learn what the likely ripple effects across capital markets may mean for investor portfolios.