Webinar replay: Spring investment outlook

Key takeaways

U.S. stocks have recovered some ground lost since reaching bear market lows late last year.

However, stocks seem to be “on pause,” unable to sustain enough momentum to recover all the ground given up in 2022.

Expectations for a slower economy contribute to a challenging environment for stocks in 2023.

Coming off a bear market low for stocks (defined as a drop of at least 20% from peak value) in October 2022, U.S. markets managed to recover some lost ground in the six months since. Yet in recent months, the stock market appears to be stuck “on pause,” with prices fluctuating in a narrow trading range.

"Investors seem to be in a wait-and-see mode, looking for more clear indicators to give them confidence about the future direction of the market one way or the other,” says Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management. “A variety of factors are at play in the current environment that could influence whether a sustained rally begins or if stocks will lose ground.”

These factors include persistently elevated inflation, rising interest rates and the potential for slowing corporate earnings growth, which could have a direct impact on stock prices.

These and other factors will likely dictate the direction of the stock market in 2023.

Clawing back from a challenging year

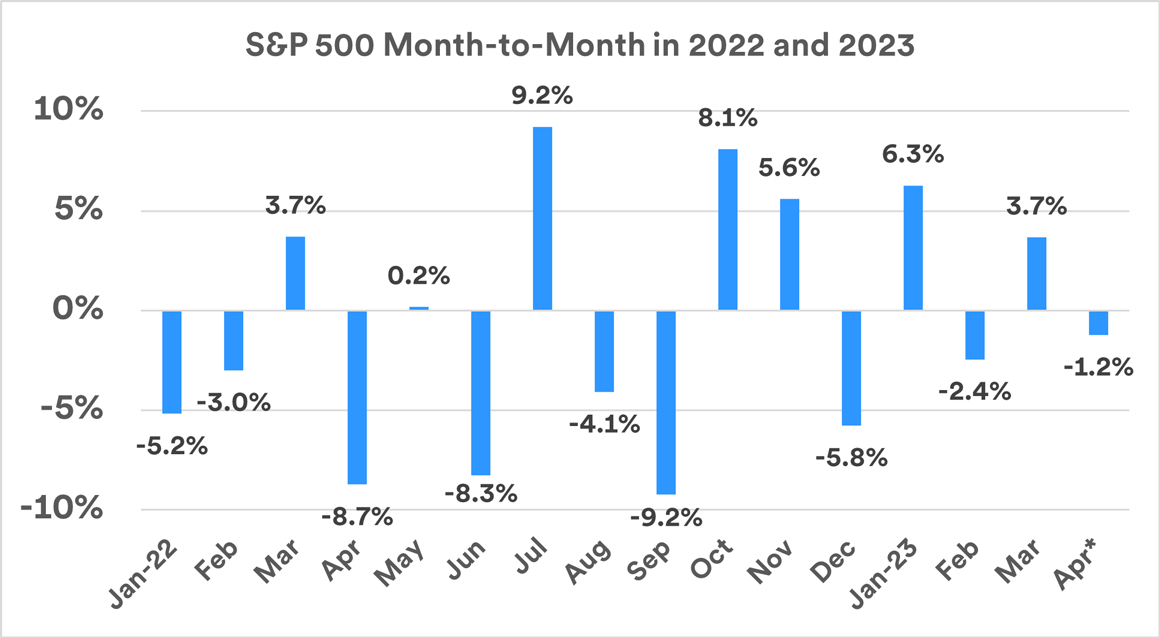

Last year will be remembered as a difficult year for investors, one where both stock and bond markets suffered setbacks. At its lowest point, when it dropped to an index value of 3,583 in October 2022, the benchmark Standard & Poor’s 500 stock index was down 25%, from its peak the previous January of 4,796. On the road to recovery, the S&P 500 topped out in early February 2023 at 4,179. Though the index had not yet regained half of the bear market losses suffered in 2022, the upward momentum stopped. Since then, the S&P 500 index has been trading at levels between 3,855 and 4,155, still well below its January 2022 high.

“Investors seem to be in a wait-and-see mode, looking for more clear indicators to give them confidence about the future direction of the market one way or the other.”

Rob Haworth, senior investment strategist, U.S. Bank Wealth Management

Stock market downturns occur periodically, and for various reasons. Sometimes the changes are related to excessive market valuations after an extended bull market. In other cases, they may be due to external events which overwhelm other fundamental factors that traditionally drive stock market performance.

“The market’s downturn in 2022 can be attributed to the rising level of uncertainty for investors,” says Haworth. Three key events contributed to this uncertainty, including persistently high inflation, a significant change of monetary policy by the Federal Reserve and the economic fallout from Russia’s invasion of Ukraine.

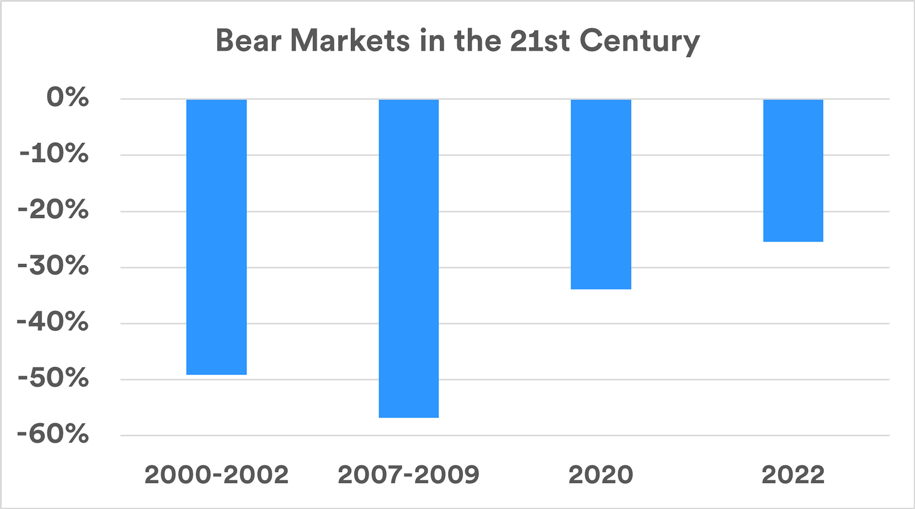

Tracking previous bear markets

Four bear markets have occurred in the U.S. stock market in the 21st century. You’ll note that the level of decline in the most recent bear market cycle is not as dramatic as the previous three.

Source: S&P 500 daily close. 2022 bear market represents the Index’s peak-to-trough through December 2022.

The bear market of 2000 to 2002 was attributed primarily to the bursting of a stock market “bubble” in prices for technology stocks, particularly some early-stage dot-com companies. The 2007 to 2009 bear market was driven in large part by a collapse in home prices. In February and March 2020, the shutdowns to combat the COVID-19 pandemic resulted in a short-lived downturn and economic recession.

“In 2022, we saw a massive change in sentiment,” says Haworth. The persistent nature of elevated inflation appeared to cause investor anxiety. Higher inflation was a result of demand for goods and services outpacing supply. Haworth notes that despite policy moves by the Federal Reserve (Fed) to slow economic growth, higher inflation endured.

Stock markets continue to exhibit volatility. Notably, after the S&P 500 regained significant ground in October and November 2022, results have been inconsistent since.

*April 2023 results through 4/26/23.

Source: S&P Dow Jones Indices. Figures shown represent monthly total returns for the Standard & Poor’s 500 Index, an unmanaged index of stocks. It is not possible to invest directly in the index. Past performance is no guarantee of future results.

Key factors to watch

What factors could signal the end of the market’s current “pause,” and lead to more definitive and sustained stock price movement. Haworth is watching three key factors:

- Persistent inflation. Issues that spurred inflation's surge in 2021 and 2022, such as supply chain constraints and rising energy prices, have largely subsided. However, costs for “experiences,” such as travel and recreation, increased due to booming consumer demand. Nevertheless, after peaking at 9.1% for the 12-month period ending in June 2022, inflation (as measured by the Consumer Price Index) dropped to 5.0% for the 12-month period ending in March 2023. Haworth notes that the Fed’s primary focus is how wage gains might affect inflation. “Indications are that average hourly earnings growth, which rose significantly in 2022, is slowing.” He notes that the unemployment rate remains historically low, with significant job openings still reported. If that changes and the labor market weakens, the Fed may feel its inflation goals are within reach.

- Fed interest rate policy. The Fed’s 2022 monetary policy shift was a key driver of the stock market’s bear market turn. The Fed hiked the short-term federal funds rate, from near 0% in early 2022 to almost 5.00% by March 2023, a significant attempt to slow inflation. The Fed’s rate hikes boosted yields across the bond spectrum and borrowers’ loan costs increased. This appears to be having the desired effect of slowing demand, which the Fed anticipates will help quell inflation. “If we look at the Fed’s definition of progress on inflation, they want to get it closer to their target of 2% per year,” says Eric Freedman, chief investment officer at U.S. Bank Wealth Management. “The question is how much further inflation must level out before the Fed is again willing to change course on interest rates.”

- Corporate earnings. “Early reports on first quarter, 2023 earnings (company profits) are better than many expected,” says Haworth. Nevertheless, earnings expectations for all of 2023 are lower today than was the case earlier in 2022. Consumer and business spending drive earnings results. “Consumer spending on ‘experiences’ remains solid,” says Haworth, “but spending on goods is slower.” In addition, Haworth notes that businesses are cautiously spending money. In addition, consumer and business borrowing activity has slowed, likely due to higher interest rates. New corporate bond issuances have tapered off. This could be a trigger for slower economic activity, and softer earnings may be reflected as a result. “If investors’ confidence in earnings improves, that could give the market a boost,” says Haworth. “Unfortunately, most companies are hesitant to provide clear guidance on their earnings outlook, so investors may remain cautious about stocks in the near term as a result.”

Haworth believes the outcome of these three variables will likely play the biggest role in determining the stock market’s performance in 2023.

Policy issues that could impact the market

While they may not represent decisive factors, policy issues and geopolitical matters could affect investor sentiment in 2023. Haworth says markets may already reflect the current reality of these issues, but any surprising developments could impact capital markets, at least in the short term. Matters that bear monitoring include:

- The debt ceiling debate. The U.S. government’s ability to borrow to meet existing expenses is at stake. Congress needs to authorize further debt issuance, likely no later than this summer, for the government to avoid a debt default. The Republican-led House appears to be on a collision course with the Democratic-led Senate and President Biden over the terms of a debt ceiling extension. This adds a degree of market uncertainty and, if the issue proves to have a negative economic impact as some predict, could also have capital market implications.

- The Russia-Ukraine war. Haworth notes that with the war appearing to be a stalemate more than one year since Russia’s invasion of its neighbor, markets appeared to adjust to the stresses created by the war. “There is less of an immediate economic challenge,” says Haworth. “Over the next few months, we’ll be watching whether grain harvests from Russia and Ukraine can move smoothly through shipping channels. We’ll also keep an eye on western Europe’s ability to stockpile energy supplies to meet their needs next winter.” Haworth says the market could react to any major development that shifts the conflict’s current course.

- Growing U.S.-China tensions. In recent years, new tensions flared in what has been a mostly cooperative economic relationship between the two largest economies in the world. While the economic partnership continues on many levels, China's priorities can, at times, be at odds with U.S. interests. If any major issues should flare up (such as China providing military support to Russia in its conflict with Ukraine), it could raise market concerns.

Keep a proper perspective

Market volatility and periods of market uncertainty are not unusual. “Keep in mind that we’re likely to periodically experience market ups and downs, and over time, markets have shown an ability to recover,” says Haworth. Market volatility can be expected to persist given the range of issues that contribute to the market’s near-term uncertainty. “While we may see a more favorable environment develop down the road, the market still faces many challenges given the current fundamental and policy underpinnings,” says Haworth.

Freedman says it’s important to maintain an appropriate perspective about the markets. He encourages investors to view markets with a long-term lens. “Timing the markets and trying to be precise on when to be in and when to be out is challenging,” says Freedman. “Markets will do things at the exact opposite time you expect them to.”

Freedman emphasizes that having a plan in place that helps inform your investment decision-making is critical, particularly in times like these. “That’s the foundation of investing,” he says.

As the stock market faces continued volatility in 2023, Haworth says investors shouldn’t expect the sudden appearance of an “all-clear” sign that market risks have subsided. “If you have cash on the sidelines, a top priority should be earning a more competitive return on it.” Haworth notes that many fixed income vehicles, including Certificates of Deposit and short-term U.S. Treasury securities, offer competitive yields. “As you look at building long-term wealth, also consider putting a portion of your portfolio to work in the equity market in a systematic way, such as dollar-cost averaging available cash over a series of months.” For those with equity exposure, Haworth says investors may consider putting more money to work in infrastructure investments and real assets. “These tend to have more defensive characteristics during volatile times and also generate cash flow through competitive dividend payouts.”

Check in with a wealth planning professional to make sure you’re comfortable with your current investments and that your portfolio is structured in a manner consistent with your long-term financial goals.

The S&P 500 Index consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. Diversification and asset allocation do not guarantee returns or protect against losses.

Tags:

Related articles

How to put cash you’re keeping on the sidelines back to work in the market

Don’t let market volatility and an uncertain economic outlook derail your disciplined investing strategy.

6 reasons to consider a buy-and-hold strategy for long-term investing

Rather than trying to time the market, consider more time in the market with a buy-and-hold strategy.