Source: U.S. Bank Asset Management Group

Key takeaways

The Federal Reserve persists in its determination to slow the economy sufficiently to tamp down higher inflation.

Since March 2022, the Fed has raised the target federal funds rate by 5.00% while gradually reducing its asset holdings.

Investors may want to consider if portfolio adjustments are needed in light of the higher interest rate environment.

Following a pattern started in March 2022 to help lower inflation, the Federal Reserve (Fed) continued to raise short-term interest rates in 2023. At its most recent meeting, held May 2-3, the policy-making Federal Open Market Committee (FOMC) lifted its short-term target federal funds rate to a range of 5.00% to 5.25%. It was the tenth consecutive interest rate hike engineered by the FOMC since its current monetary policy was initiated early 2022. The Fed significantly moved the target rate off a 0% level that it had maintained for two years – with the primary goal of fighting persistently high inflation that emerged in 2021.

At the May meeting, the Fed signaled that it may be prepared to pause the current rate-hiking cycle. The Fed’s latest decision to raise rates came on the heels of news that a few regional banks faced financial failure. There was speculation that concerns about additional problems in the banking sector, which can affect the availability of credit in the broader marketplace, might alter the Fed’s rate-hiking strategy.

The Fed also retains its commitment to reversing a previous policy of quantitative easing (QE) that involved purchases of Treasury and mortgage-backed securities. QE was aimed at providing more liquidity to capital markets. The Fed began trimming its balance sheet of those assets, from its peak near $9 trillion.1 This so-called “quantitative tightening” approach, combined maintaining higher interest rates, is designed to temper inflation by slowing economic growth.

Cost of living changes, a virtual non-issue for decades, became a dominant concern for consumers in early 2021 and remains an issue today. Powell says the Fed continues to “have the resolve it will take to restore price stability on behalf of American families and businesses.” He notes that price stability is a primary Fed responsibility and seems to indicate that the Fed recognizes the importance of tamping down the inflation threat. “Without price stability, the economy does not work for anyone,” says Powell.2

Fed’s new interest rate policy

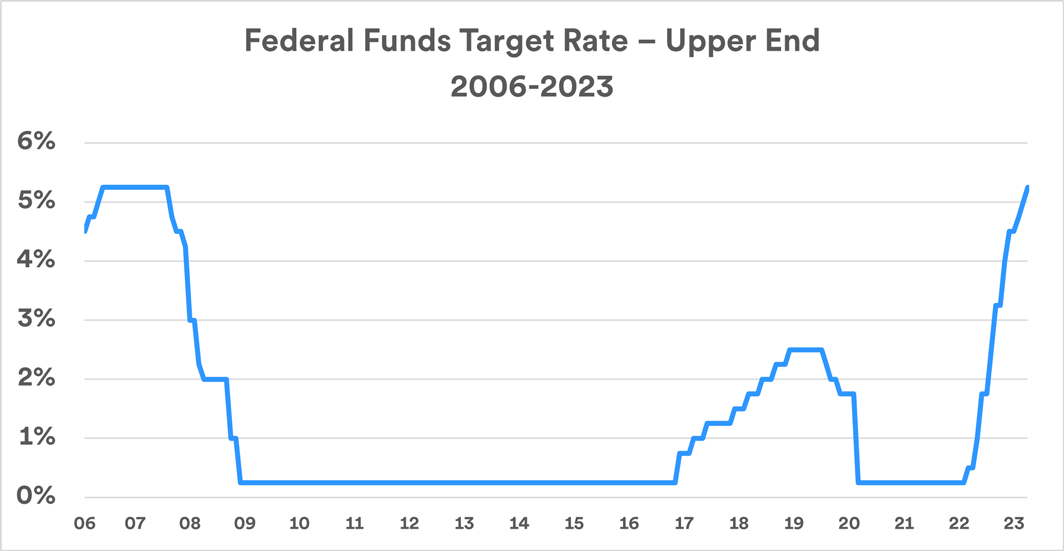

The FOMC started the “tightening” process in March 2022 by raising interest rates 0.25%. At subsequent meetings, the Fed greatly accelerated the pace of rate hikes, and by the end of 2022, the fed funds target rate stood at 4.25% to 4.50%. The 0.25% rate hike in May 2023 followed similar rate increases in February and March. The fed funds target rate, is at its highest level since October 2007.3

Source: Federal Reserve Board of Governors. Chart depicts The Federal Reserve’s federal funds interest rate target during the years January 2006 – March 2023.

The Fed’s actions appear to have achieved some success. By the closing months of 2022 and into early 2023, inflation showed signs of easing. Through March 2023, living costs (as measured by the Consumer Price Index) rose 5.0% over the previous 12 months, a decline of 4.1% from the peak inflation level reached in the 12-month period ending in June 2022. After the May 2023 FOMC meeting, Powell stated, “we remain strongly committed to bringing inflation back down to our 2% goal.”4 Powell added the FOMC does not anticipate inflation reaching that level quickly. “It will take some time,” he stated. “It would not be appropriate to cut rates and we won’t cut rates,” for a period of time. Powell made clear that the Fed is “prepared to do more if greater monetary policy is warranted,”5 considered a signal that the Fed is not ruling out the possibility of further rate hikes.

Role of the Fed

The Federal Reserve acts as the U.S. central bank. Its functions include maintaining an effective payment system and overseeing bank operations. Investors, however, primarily focus on the Fed’s monetary policies.

In setting monetary policy, the Fed attempts to fulfill three mandates:

- Price stability. The Fed seeks to maintain a stable inflation rate. Its current target is inflation averaging 2% per year over the long term.

- Maximum sustainable employment. Officially referred to as “maximum employment,” it technically refers to a labor market where the unemployment rate is at a low level. The Fed does not use a specific measure (i.e., unemployment rate, labor force participation rate) to as its goal. Instead, it utilizes a more subjective assessment of the employment environment.

- Maintain moderate long-term interest rates. The level of interest rates impacts many aspects of economic activity, from consumer mortgages to business financing. Therefore, the Fed seeks to keep rates at modest levels.

The Fed also influences short-term interest rates, specifically, the target fed funds rate, which is the interest rate applied to overnight loans from one financial institution to another. While Chairman Powell receives much of the attention, the FOMC establishes Fed monetary policy. It’s the committee that sets the fed funds rate target and has other authority, including buying and selling of securities.

Fed funds rate nears a high

Following its May 2023 meetings, indications from the Fed are that the current rate-hiking cycle will be paused, and perhaps be at an end. Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management, notes that even with the top fed funds rate currently at 5.25%, it’s difficult to define this as “tight” monetary policy. “The Fed is looking at inflation measures that are fairly close to the current fed funds target rate,” he says. “The Fed wants to get the fed funds rate clearly above the inflation rate if living costs remain elevated.”

“It’s very unusual for bond markets to decline in two consecutive years, so there may be an appealing opportunity in bonds in 2023 and beyond.”

Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management

The intended impact of higher interest rates is to slow the economic activity, a strategy designed to cool off the surging inflation rate. If successful, it will likely result in weakening the job market as businesses slow hiring and investments in the wake of higher borrowing costs. However, unemployment hovers near historic lows and job openings greatly outnumber available workers. To attract and retain employees, employers boosted wages. Recent reports show that compensation costs for workers rose 5.1% for the 12 months ending in March 2023, a slight increase from what had been a downward trend in wage growth. Haworth believes the Fed sees wage growth as an important measuring stick to determine its inflation-fighting progress.

Powell appeared to solidify the Fed’s determination to quell the inflation threat, even though economic hardship may result. In comments after the May 2023 FOMC meeting, Powell stated that “reducing inflation is likely to require a period of below-trend (economic) growth and some softening of labor market conditions. Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the long run.”4

An end to the era of “quantitative easing”

The QE strategy the Fed implemented at the start of the COVID-19 pandemic has been curtailed. When QE was in place, the Fed purchased longer-term securities on the open market, including U.S. Treasuries and mortgage-backed bonds. “Under this program, the Fed became one of the biggest buyers of Treasury securities in the market,” says Tom Hainlin, national investment strategist at U.S. Bank. “They impacted the interest rate environment just by their large presence.” Hainlin notes that with the Fed bumping up demand for bonds, long-term interest rates remained low (high demand for bonds typically helps keep interest rates lower).

Since September 2022, the Fed is cutting back its bond portfolio by about $95 billion per month (only about 1% of its holdings each month) by not purchasing new securities to replace maturing bonds. The balance sheet dropped to roughly $8.3 trillion, down less than 7% from its peak in April, 2022.6

The process of the Fed “unwinding” its balance sheet is commonly referred to as quantitative tightening. “This means the Fed is putting less liquidity in the market, requiring other investors to generate demand for bonds,” says Bill Merz, head of capital market research at U.S. Bank.

The Fed added liquidity to the banking sector after several regional banks ran into problems beginning in March 2023. The most recent issue arose when another regional institution, First Republic Bank, faced a potential collapse and was acquired by a larger bank. Concerns about additional bank problems, particularly among regional banks, have added volatility to the markets.

Bond markets respond to events

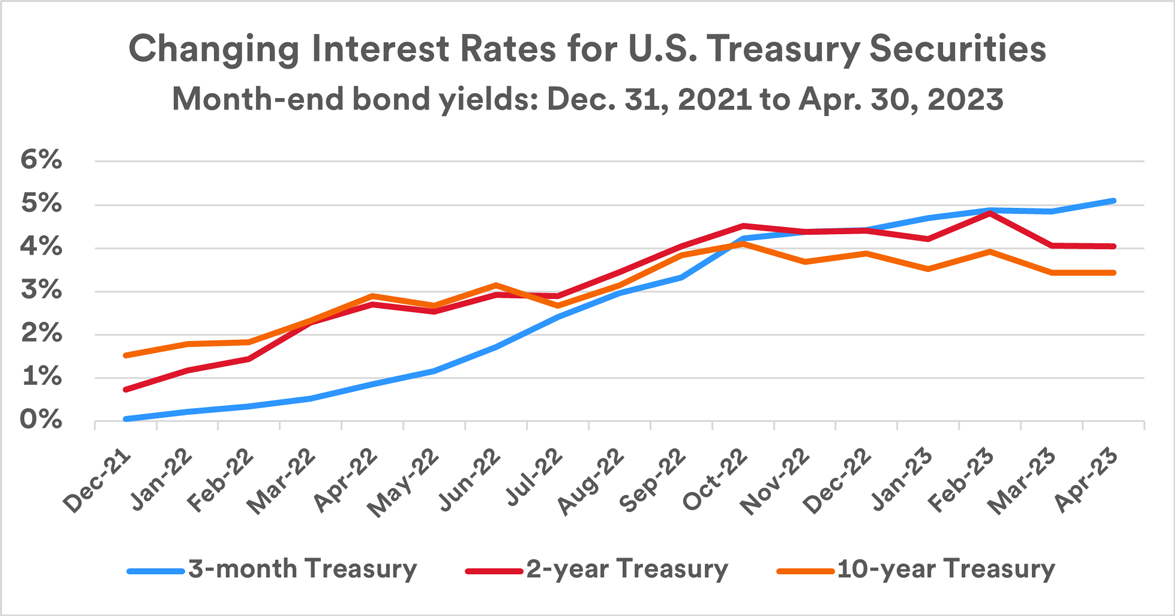

The interest rate environment across the broader bond market has changed dramatically since early 2022. In October 2022, yields on the benchmark 10-year U.S. Treasury note rose above 4%, the first time since 2010. Yields on 10-year Treasuries moderated after that point, but again topped 4% in early March 2023. In an unusual occurrence, yields on shorter-term Treasury securities are higher than the yield on 10-year and 30-year bonds. At the end of April 2023, the yield on 3-month Treasury bills stood at 5.10% and yields on 2-year Treasury notes at 4.04% compared to a yield of 3.44% on 10-year Treasury notes. This is in contrast to normal circumstances, when investors demand higher yields for bonds with longer maturities.

Chart depicts the interest rates, or yields, paid on 3-month, 2-year and 10-year U.S. Treasury securities December 2021 – April 2023.

Inflation remains a challenge

Despite the Fed’s dramatic strategy shift, inflation remains its primary concern. Haworth points out that the economic impact of rate changes can take time. “Each rate hike will take six-to-12 months to work its way into the economic engine.” That may be, at least in part, why inflation rates have yet to ease significantly despite the Fed’s drastic policy shift.

With the Fed maintaining its focus on fighting inflation, concerns grow that its actions will ultimately lead to a recession. “There’s a growing expectation that corporate earnings will suffer if the economy slows, and that factor was not priced into the stock market during its earlier setbacks in 2022,” says Haworth. “How slow the economy will get depends in part on events that are going on around us. For example, if inflation suddenly spikes up again, that could create more challenges.”

Will the investment environment change?

As the Federal Reserve approaches the peak in its current interest rate-hiking cycle, how should investors assess the current opportunity in the markets?

- Fixed income market. Today’s higher interest rates make fixed income securities more attractive. “It’s very unusual for bond markets to decline in two consecutive years, so there may be an appealing opportunity in bonds in 2023 and beyond,” says Haworth. Investors may consider a focus on high quality investment-grade taxable and municipal bonds. However, if rates continue to rise in the near term, bond prices could decline further. Consider including positions in short-term U.S. government bonds as part of a diversified fixed income portfolio. Short-term bonds are less sensitive to interest rate changes and can help mitigate price sensitivity in a portfolio should interest rates continue to rise.

- Real assets. This category typically benefits from a persistently elevated inflationary environment. Opportunities to consider center on global infrastructure assets which include utilities, transportation, communications, midstream energy and pipelines.

- Equity markets. The environment for stocks may remain volatile in the near term. Investors may reset earnings expectations if the Fed’s monetary tightening contributes to slow economic growth, with recession risks still a consideration. There are concerns about how higher costs, rising interest rates, less available capital and a potential decline in consumer spending will affect the bottom lines for many corporations. “Investors who have assets to deploy in the equity market should consider dollar-cost averaging over a period of time (consistently investing over at least a six-month period),” says Haworth. This systematic investment approach has the potential to lessen the risk during volatile market periods, while still allowing investors to put money to work in equities to meet long-term goals.

Be sure to consult with your financial professional to review your current portfolio positioning and determine if changes might be appropriate given your goals, time horizon and feelings toward risk.

Tags:

Related articles

How do rising interest rates affect the stock market?

With interest rates going up this year, what’s the likely ripple effect across capital markets?

How rising interest rates are impacting the bond market

With the Federal Reserve increasing interest rates to get inflation under control, what opportunities does this create for bond investors?