Key takeaways

U.S. economic growth lost momentum to start 2023.

While persistently higher inflation continues to create headwinds for the economy, the pace of rising prices is slowing.

Economic resilience in the form of solid consumer spending and a strong job market have so far helped avoid a recession even as economic growth slows in the U.S.

Capital markets continue to weigh the risk of recession in 2023. Despite slower first quarter growth, the economy has avoided recession so far. Economists attribute this slowdown, in large part, to concerted efforts by the Federal Reserve (Fed) to temper inflation with 10 consecutive interest rate hikes by the Federal Open Market Committee (FOMC) at its regularly scheduled meetings dating back to 2022. While it is slowing, the U.S. economy continues to exhibit resilience despite recessionary pressures.

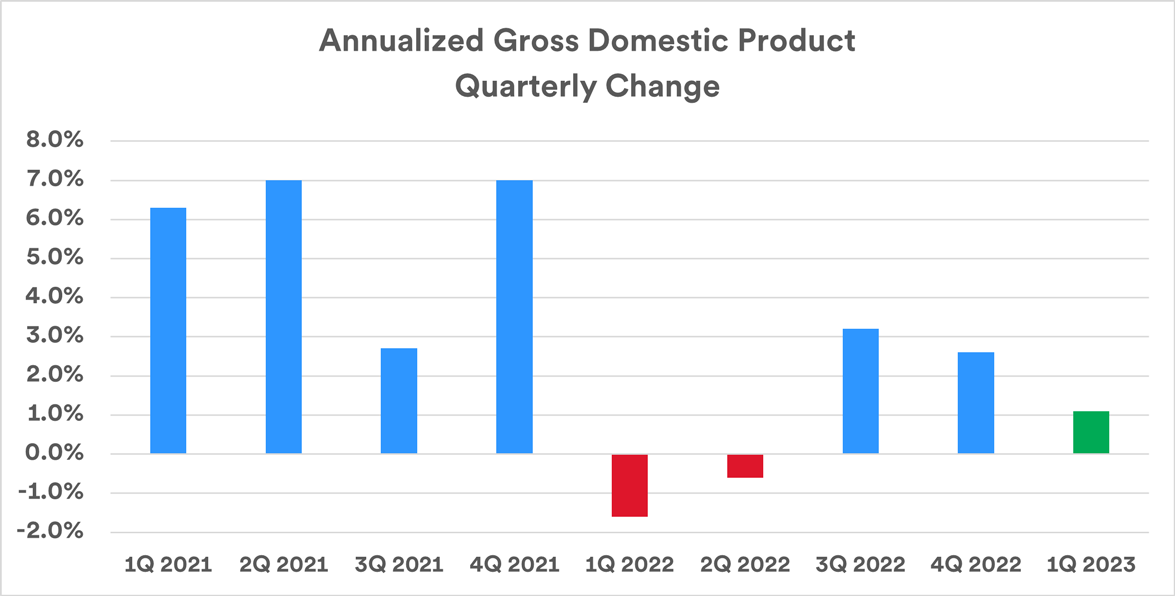

As measured by Gross Domestic Product (GDP) growth, the economy in 2021 expanded at an annualized rate of 5.9%, the fastest rate of growth in a calendar year since 1984. The pace of slowed significantly in 2022, with GDP increasing at a rate of just 2.1%.1 In the first quarter of 2023 (reflected in the green bar on the chart below), GDP growth slowed to a 1.1% annualized rate.2 The first quarter’s numbers confirm that recession risks remain.

Source: U.S. Bureau of Economic Analysis, “Real Gross Domestic Product and Related Measures: Percent Change from Preceding Period,” April 27, 2023.

As indicated by the chart, the underlying economy experienced a notable change as 2022 began. The economy slowed dramatically in the first half of the year (with negative GDP growth), followed by two quarters of modest growth. Recent growth trends raise more questions about the direction of the economy going forward. “The economy, at this point, could tip in either direction with regard to whether we see a recession in 2023,” says Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management. Haworth says despite the downward trend in GDP growth, “There’s good news in recent reports in that consumer spending is holding up. In addition, inflation is coming down. Still, there may be other challenges ahead.” U.S. Bank’s economic forecast for the year shows the U.S. economy narrowly avoiding recession.

If, however, the economy does slide into a recession in 2023, economist expectations are that it won’t be severe. “Our view is that we’re less concerned with how deep a potential recession is,” says Eric Freedman, chief investment officer at U.S. Bank. “Our bigger concern, if it does occur, is how long it lasts. It’s possible that we see a relatively stagnant economy in the U.S. and Europe in 2023.”

One contrary indication of an imminent recession is the job market, which continues to feature a very low unemployment rate (3.4% in April) and solid job growth.3 In addition, there are significantly more job openings than there are available workers.4

How should investors assess the state of the economy today and what should they expect going forward?

The impact of inflation’s re-emergence

Beginning in early 2021 and continuing through 2022, the re-emergence of inflation became the biggest economic story. The inflation rate, as measured by the Consumer Price Index (CPI), peaked in June 2022 at more than 9% over the previous 12-month period.5 This was the highest level in more than four decades and exceeds by a wide margin the inflation target established by the Fed. In the closing months of 2022, the inflation rate slowed, and as of April 2023, stood at 4.9% over the previous 12-month period.5 The Fed targets an inflation rate that averages close to 2% over time.

“The Fed has made clear its first target is to soften inflation.”

Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management

In response, the Fed pivoted its strategy. In March 2022, it raised the primary interest rate it controls, the fed funds rate, for the first time since 2018. By May 2023, the Fed hiked the target fed funds rate to a range of 5.00% - 5.25%, up from near zero percent before rate hikes began. The Fed also ended its bond buying program and began reducing its bond holdings. They leveraged these strategies to push interest rates higher in the broader bond market and raise borrowing costs to temper the pace of economic growth. “The Fed has made clear its first target is to soften inflation,” says Haworth. He believes the Fed’s 2% inflation target may not be reachable before 2024 – noting the lagging effect of Fed rate hikes, often requiring 12 months or more for the full impact to circulate throughout the economy.

Today’s higher interest rate environment

The Fed’s aggressive interest rate hikes have had an immediate impact as well. Yields on many types of fixed income vehicles (certificates of deposit, money market funds, bonds) rose in conjunction with Fed rate hikes. Mortgage rates and interest charged on other types of loans moved up as well.

Higher rates had their greatest impact on areas of the economy that interest rates most directly affect. For example, housing activity has slowed due to increasing mortgage rates. “The housing market has seen a significant change due to higher mortgage rates,” notes Haworth, “yet underlying fundamentals of consumer finances and the housing market both remain favorable, even as higher mortgage rates affect home affordability.” Haworth says major factors to watch are consumer and business borrowing given rising loan costs attributable to rising interest rates.

Despite the Fed tightening monetary policy since March 2022, job growth exceeded projections, averaging close to 400,000 per month for all of 2022.5 Job growth reports were also solid in the first four months of 2023, though new job creation slowed over that time. “What the Fed is most focused on is wage growth and its impact on the overall inflation rate,” says Haworth. Average hourly earnings rose modestly in 2022 but did not keep pace with the elevated inflation rate. The pace of wage gains tapered off in the first three months of 2023, before April’s wage gains ticked slightly upward.

In March 2023, reports surfaced detailing the failures of a few regional banks. While it led to concerns about financial sector stability, fears of a wider contagion among other financial institutions appear to be receding.

Can the economy hold its ground?

A key question is whether the Fed’s aggressive posture allows it to successfully tackle the inflation threat while steering the economy toward a “soft landing” and avoiding a recession.

“It seems likely the economy may stay out of a recession, but we expect that real GDP growth will be relatively flat in the near term,” says Matt Schoeppner, senior economist at U.S. Bank. “It might qualify as what we call a ‘growth recession,’ where we see a slow economy, but with few ramifications for the job market.” Schoeppner says to this point, the economy has demonstrated surprising strength despite the Fed’s efforts to temper growth. “Growth in consumer spending was relatively steady throughout 2022 and ticked up in the first quarter of 2023 when compared to the closing quarter of 2022,” says Schoeppner.

The delayed impact of Fed rate hikes could also create challenges later in the year. “We may see the impact occur in different ways,” suggests Haworth. “Consumers dealing with higher interest rates may be most directly affected.” Individuals may be less likely to pursue major purchases that require financing, such as homes and cars. “We’ve already seen a decline in corporate bond issuance,” says Haworth.

Implications for investors

Both stock and bond markets experienced negative returns in 2022. As the Fed laid out its planned policy shift in early 2022 (raising interest rates and ending its sizable bond purchasing activity), investors became more cautious. “When the Fed says they’re going to raise rates, generally other asset classes will reprice lower in response,” says Freedman.

Interest rates across the board in the bond market moved up rapidly in 2022. While bond yields leveled off after financial sector questions emerged, interest rates remain elevated from where they started in early 2022. Persistently higher rates may continue to put pressure on equity markets. “If investors can earn higher yields now than they did prior to the Fed’s policy shift, it makes stocks less attractive,” says Haworth. “Investors may be less willing to bid up stock prices in that kind of environment.” The result, says Haworth, is that stock market volatility may persist for some time.

Nevertheless, stocks started 2023 on a positive note. The Standard & Poor’s 500 Index of large-cap stocks showed a gain of more than 9% in the first four months of 2023.

Haworth believe there is potential for corporate earnings to retreat relative to previous projections, reflecting the impact of slower economic activity and higher borrowing costs for companies. He notes that earnings are now stock investors’ primary focus, with less apparent concern about issues like Fed rate hikes and ongoing inflation. The subdued earnings forecast is one reason for a cautious, near-term outlook for stocks. In addition, Haworth says the job market may be a bellwether for the direction of the economy. “If that starts to weaken, it may mean the economy is about to face more headwinds.”

Consider reviewing your current portfolio with your wealth management professional to determine if it’s consistent with your long-term goals and positioned to meet the challenges of what continues to be an uncertain market and economic environment.

Have questions about the economy, the markets and your finances? Your U.S. Bank Wealth Management team is here to help.

Note: Diversification and asset allocation do not guarantee returns or protect against losses. The Standard & Poor’s 500 Index (S&P 500) consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The S&P 500 is an unmanaged index of stocks. It is not possible to invest directly in the index. Past performance is no guarantee of future results.

Tags:

Related articles

The impact of rising interest rates on the housing market

The Federal Reserve’s aggressive war on inflation is slowing the housing market and curbing investor appetite for real estate. Learn how this could impact the broader economy and investors.

How far will the market correction go?

With stocks slipping in and out of bear market territory, learn how the market correction and ongoing volatility could impact your investments.