Additionally, despite declines in prices for oil and food, inflation concerns persist. After peaking at a rate of 9.1% in June 2022 (based on the Consumer Price Index or CPI, measured over the previous 12-month period), inflation has since retreated. The CPI for the 12-month period ending in March 2023 stood at 5.0%, its lowest level since May 2021.2 “Inflation is still coming down from a high point, but the Fed wants inflation at the 2% level,” says Freedman. To combat inflation, the Fed has raised its target federal funds rate from near 0% to almost 5.00%. While the Fed’s own projections indicate they are near a peak in rates, additional, modest rate hikes may ensue.

Assessing recession risks

While the Fed hopes to avoid a recession even as it maintains higher interest rates, tempering inflation’s rapid rise remains its primary concern. As a result, the fed funds target rate is likely to stay elevated for some time.

Higher interest rates mean higher borrowing costs for consumers and businesses. That may dissuade some from adding debt to their balance sheets or make it much more expensive for those who choose to borrow, particularly compared to conditions that existed prior to 2022. “If you envision that consumers are on a treadmill, it was set at a lower resistance level up until early 2022, and spending remained strong. Now, higher borrowing costs and reduced savings act as a higher resistance level for consumer activity,” says Freedman. “The steeper the ramp for consumers, the more likely that slower spending results.”

Freedman says businesses are trying to make their own spending plans based on consumer spending projections. “Are companies looking to beef up operations? Are leisure and hospitality firms planning to expand their physical presence because they think more people will come to visit?” Freedman suggests these specific developments are important. “If you have large companies willing to expand because they think increased consumer spending is more realistic, that could be a telling sign that the economy will weather today’s challenges, reducing the recession risk.”

Freedman also notes the inter-dependent relationship between consumers and businesses. “Businesses are confronting higher costs for energy, wages and borrowing. That can have a cascading effect on business expenditures. If business spending slows, that can ultimately impact consumer spending, and the interdependence persists.”

The extent to which consumers and businesses maintain current spending levels may also impact inflation’s path in 2023. “Labor costs are a critical consideration,” says Freedman. “Job openings exceed available workers, which can push elevated wage gains even higher.” That could partially offset the Fed’s inflation-reduction strategy. Factors such as wage gains merit scrutiny in the Fed’s ongoing interest rate strategy.

“It’s far from certain that the U.S. will experience a recession in 2023. The U.S. Bank economics group, in fact, thinks we will narrowly avoid a recession,” says Freedman, “but if one occurs, our expectation is that it will be shallow. The bigger question is how long a recession endures if it occurs.”

Equities are increasingly earnings-dependent

With the Fed appearing close to their peak interest rate in the current cycle, equity investors are likely to place increasing focus on fundamental factors, specifically corporate earnings (profits). “Over time, earnings are what really drive stock prices,” says Freedman. “In 2023, corporate earnings announcements may take on greater visibility.”

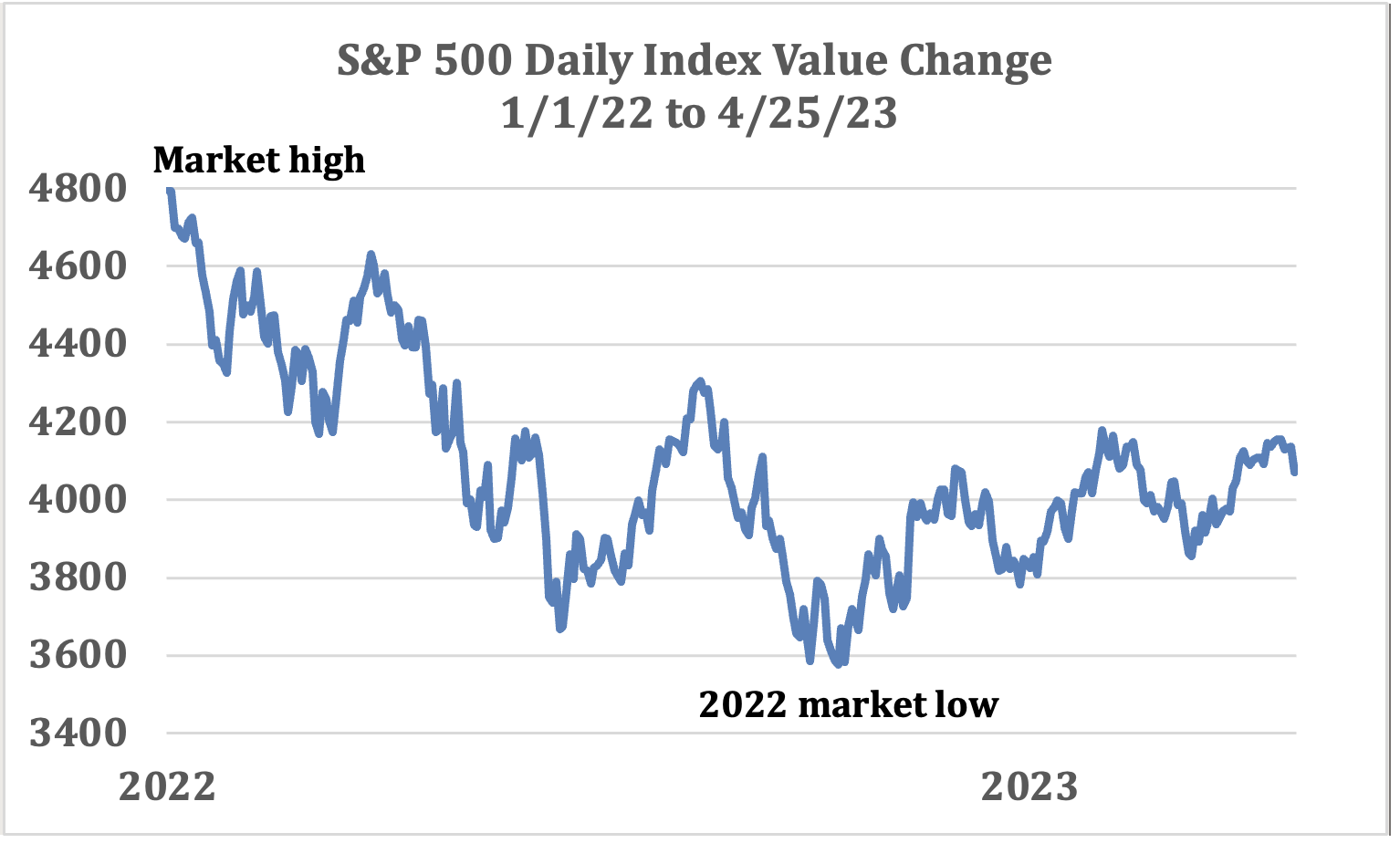

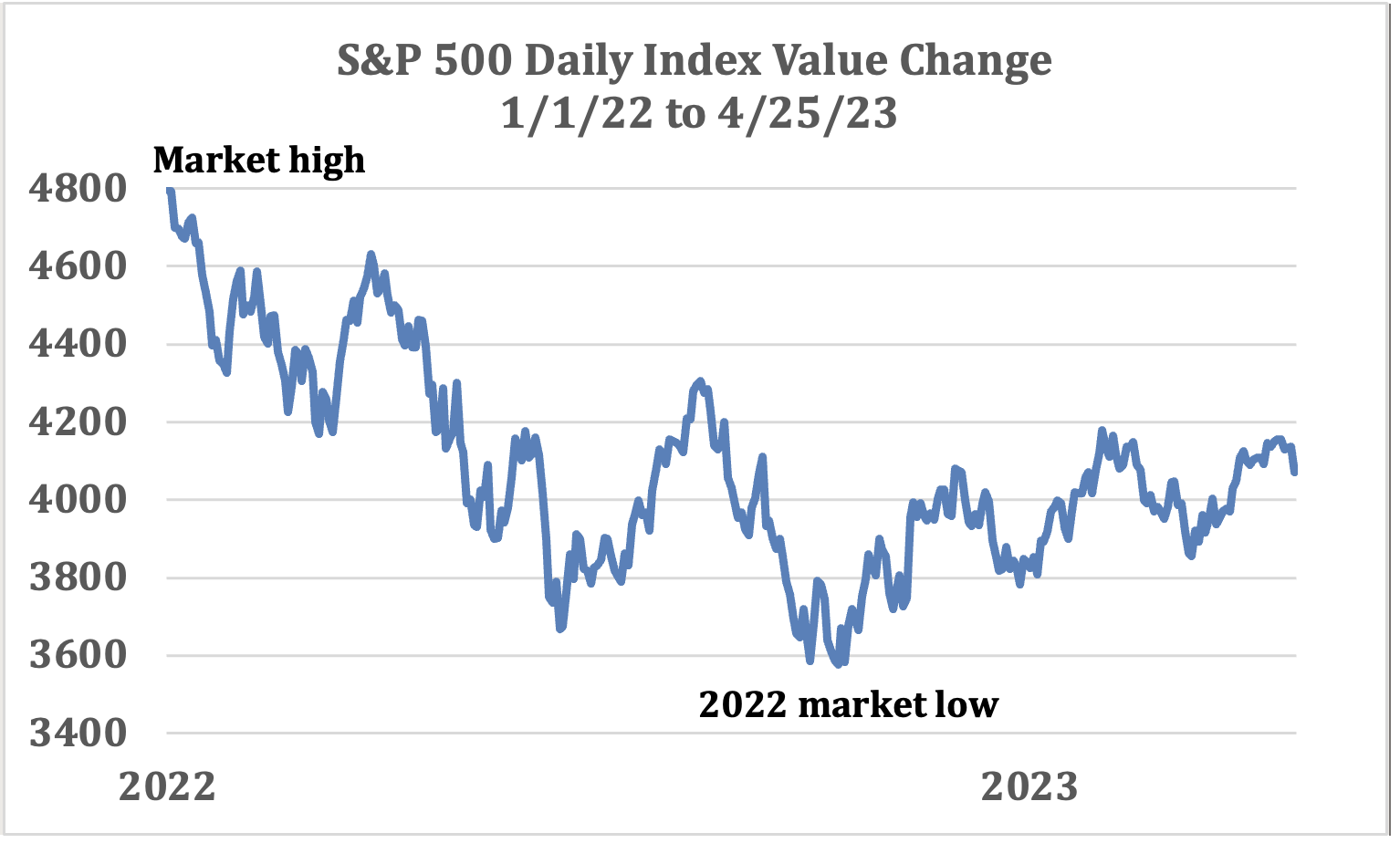

While stocks recovered some of the ground lost in 2022, markets have demonstrated an inability to generate sustained, upward momentum. For example, the benchmark Standard & Poor’s 500 peaked at just under 4800 on January 3, 2022. It dropped to a low of 3577 (a 25% decline) on October 10, 2022. Since mid-November, the index has stayed above 3800, but below 4200, well off its earlier peak. Several key variables that could affect corporate earnings and ultimately, result in more definitive movement in stock prices, may not come into clear focus until later in the year.

Source: WSJ.com. Chart depicts daily changing values of the Standard & Poor’s 500 Index, an unmanaged index of stocks. It is not possible to invest directly in the index. Past performance is no guarantee of future results.

Freedman notes that three industry sectors drove the U.S. stock market’s positive results in early 2023. “We’ve seen very narrow leadership from technology, communication services and consumer discretionary stocks. Those three categories generated double-digit gains through the first four months of the year, with the rest of the S&P 500 lagging behind.” Broader participation among other sectors is required to sustain an upward trend for stocks, Freedman says. “When leadership is narrow, it’s less healthy than a more balanced type of rally.”

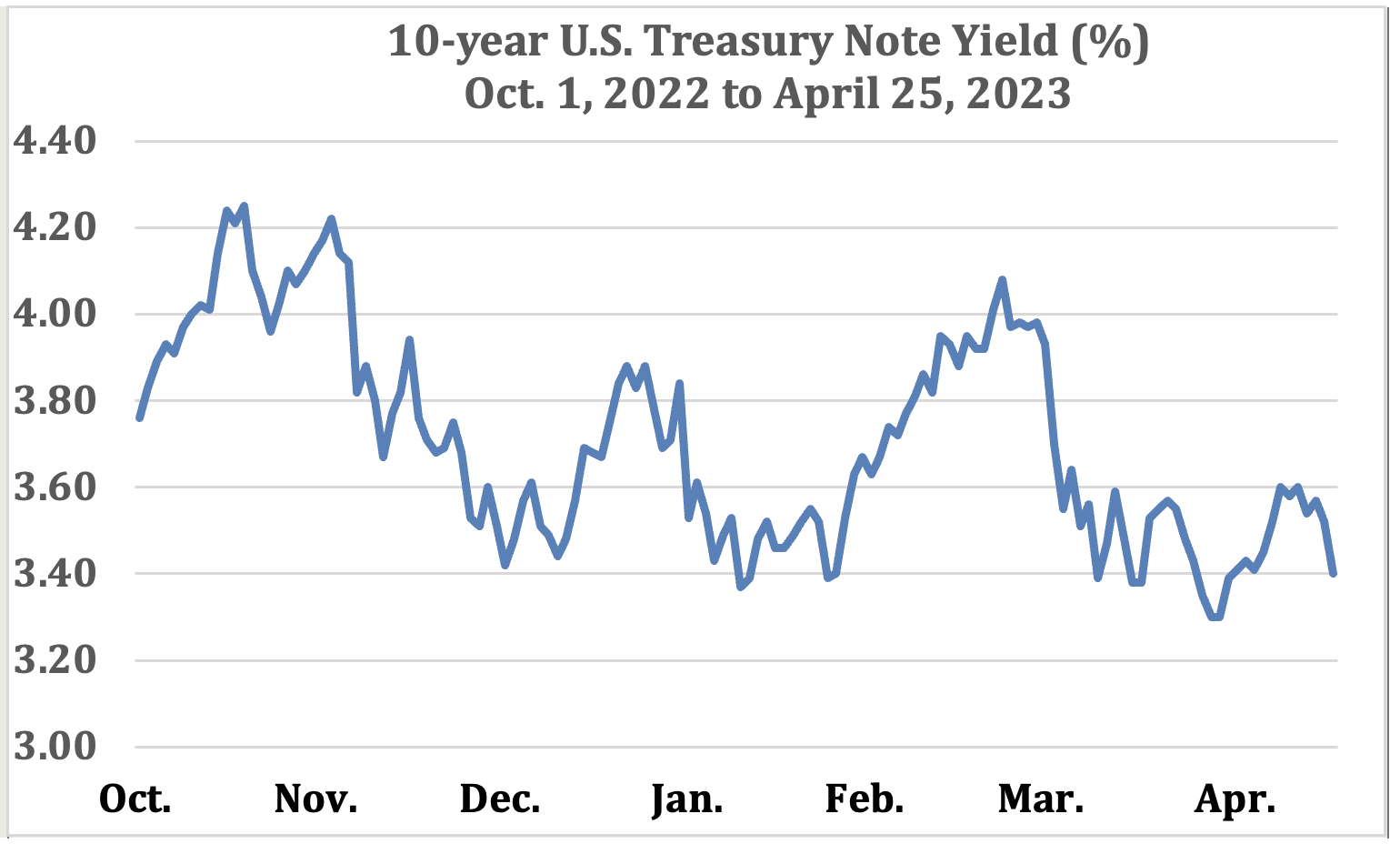

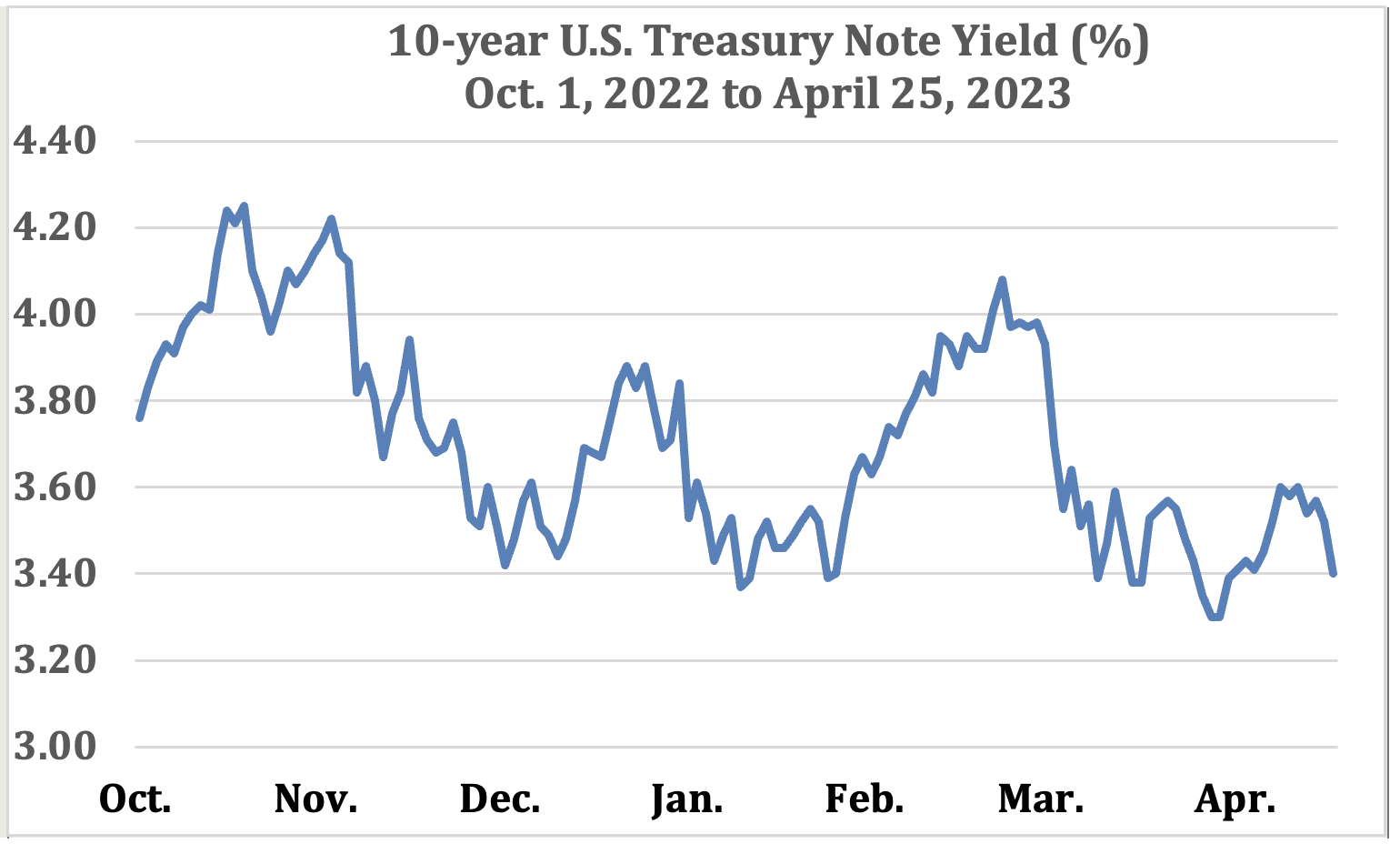

Many parts of the bond market are also trading consistently in a narrow range. Yields on the benchmark 10-year U.S. Treasury note have varied from 3.30% to 4.25% since October 2022. “It is likely that bonds will remain in a similar range for a period of time,” says Freedman.

Source: U.S. Department of the Treasury, Daily Treasury Part Yield Curve Rates.

What to invest in now

Freedman says that while uncertainty persists, investors need to be prepared for possible additional asset repricing. If consumers and businesses cut back on spending, it would likely result in reduced corporate profit growth, and consequently, lower stock prices. Freedman says the extent to which this scenario plays out is not clear but deserves investor consideration.

“It’s critical, first of all, to have a plan that’s tied to the specific goals you hope to achieve,” says Freedman. “Next, be prepared to take what the capital markets offer given the current environment’s realities.” Freedman notes that in the fixed-income market, shorter-term securities are paying competitive rates. In April 2023, the yield on the 2-year Treasury note exceeded 4%, its highest level since 2007, and higher than rates offered on Treasury securities of any duration as recently as early 2022.3

With respect to equities, Freedman says stocks that generate attractive dividends, such as utilities, offer opportunity. Infrastructure stocks related to energy and shipping ports also merit consideration. Freedman emphasizes, however, that these immediate opportunities only represent modest, tactical positions to incorporate in a longer-term investment portfolio.

Now is a good time to review your financial plan with your U.S. Bank wealth professional. If you don’t have a plan, take the time to establish one. Determine whether there are opportunities to rebalance your portfolio in ways that more appropriately reflect your investment objectives, time horizon, risk appetite and the current market environment.

Have questions about the economy, markets or your finances? Your U.S. Bank Wealth Management team is here to help.

Note: The Standard & Poor’s 500 Index (S&P 500) consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The S&P 500 is an unmanaged index of stocks. It is not possible to invest directly in the index. Past performance is no guarantee of future results.